What are Decentralized Applications (DApps)?

Decentralized applications, or DApps, are programs that operate independently through the use of smart contracts. They run on a decentralized computing blockchain or other distributed ledger systems. Just like traditional applications, DApps provide some function or utility to their users. They operate without human intervention and are not owned by any single entity. Instead, DApps distribute tokens that represent ownership.

DApps serve diverse purposes and have a range of applications. Some are tailored for financial transactions, such as in decentralized finance (DeFi) or payment systems, enabling direct transfers without intermediaries like banks. Others may be used for gaming, supply chain management, voting systems, or even the creation and trade of digital art and collectibles.

What is Decentralization

Decentralization is a concept where power, control, and decision-making are spread across a network or system, rather than being concentrated in one organization or individual. This approach eliminates the need for a central entity to make all decisions. Technologies like blockchain can support decentralization by enabling multiple computers (nodes) to maintain a shared database and verify transactions, ensuring that no single entity has total control over the system.

In contrast, centralized systems are governed by a single authority or organization that maintains complete control. This central authority is responsible for making all significant decisions and has the power to enforce rules and regulations.

Decentralization is increasingly being adopted in various sectors. For example, cryptocurrencies and decentralized finance (DeFi) seek to create financial systems independent of traditional banks. Additionally, decentralized governance models, such as decentralized autonomous organizations (DAOs), allow communities to make collective decisions without being dominated by a central authority.

How Do DApps Work?

DApps are distributed across a network and collectively controlled by their users. Users pay cryptocurrency to enable a smart contract—a self-executing contract triggered once specific conditions are met. The blockchain database operates in such a way that it allows every action to be executed and recorded on a distributed ledger, decentralizing the entire process and removing centralized oversight.

In addition, DApps are often open-source, allowing anyone to review the underlying code and even contribute to its development. According to Eric Chen, CEO and Co-founder of Injective Labs, “Whether a user is creating an account, purchasing a digital item, placing a trade, or transferring assets, they only need to trust the open-sourced smart contract code and the underlying decentralized network.”

Difference Between a Centralized and Decentralized App

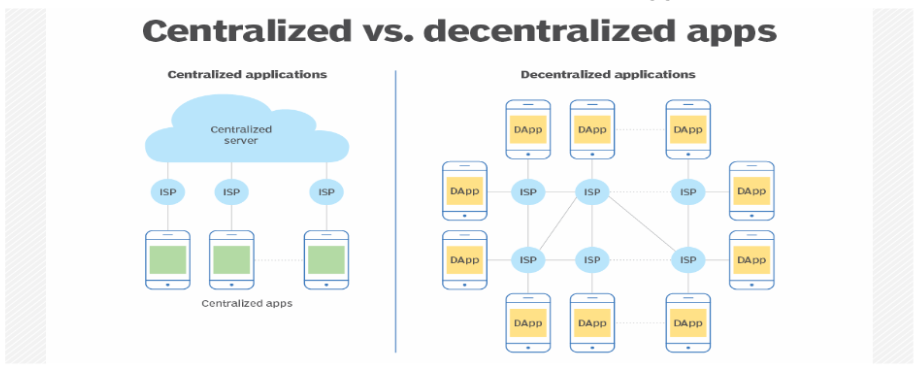

A centralized app operates on servers controlled by a single entity, meaning the software is owned and managed by a company or organization. In contrast, DApps use blockchain and peer-to-peer (P2P) networks that work without a central authority.

Therefore, with centralized apps, users communicate with one another through a company’s server. With DApps, users communicate directly with one another. This communication includes financial transactions executed without intermediaries and cross-chain bridge communications.

What Are Smart Contracts?

Smart contracts play a major role in DApps. They enforce rules, automate processes, and remove the need for intermediaries. This provides the foundation for DApps to function in a trustless and secure manner. Understanding smart contracts and their role in DApps is an important pillar of DeFi marketing and essential if you want to build a solid understanding of blockchain technology.

The Importance of DApps

DApps have so many benefits that they are important to every user participating in the blockchain network. These include security, transparency, and immutability of blockchain to provide organizations with increased privacy, ownership, and control over their data and digital assets.

With the growing popularity of blockchain, DApps have emerged as a revolutionary concept. It offers various advantages such as enhanced security, reduced costs, and the elimination of all third parties.

Uses Of DApps

DApps have a wide range of applications across various domains due to their unique characteristics of operating on blockchain or distributed ledger technology. They can be utilized in finance, payments, digital identity, privacy, supply chain management, content creation, distribution, gaming, digital collectibles as well as voting and governance.

Each of these applications benefits from the decentralized nature of DApps, which reduces reliance on intermediaries, enhances security, and increases transparency.

Scams Involving DApps

There are a lot of scams involving decentralized applications (DApps) which can take various forms. The relatively new and often complex nature of blockchain technology makes it easy to exploit. Here are some common types of scams:

– Phishing scams

– Smart contract exploits

– Pump-and-dump schemes

– Impersonation scams

– Fake initial coin offerings (ICOs)

– Deceptive yield farming

– Clone DApps

Therefore, to protect yourself from these scams, always conduct thorough research, verify the legitimacy of DApps and their developers, and exercise caution while sharing private information or making investments.

Conclusion

DApps represent a significant evolution in the way software operates, moving away from centralized control to a more distributed, peer-to-peer model enabled by blockchain technology. In leveraging smart contracts.

DApps automate processes and enhance transparency, security, and user control. Unlike traditional centralized applications, which depend on a single entity for management and operation, DApps distribute control across a network, thereby eliminating intermediaries and reducing costs.

While the benefits of DApps are numerous—including enhanced privacy and security—they also come with risks, such as susceptibility to various scams. As the technology and its applications continue to grow, it is crucial for users to remain vigilant, conduct thorough research, and exercise caution to avoid potential pitfalls.

Overall, DApps are shaping the future of digital interactions and transactions, offering innovative solutions across diverse domains while highlighting the need for informed and cautious engagement.