Top 50 Altcoins Performance Review vs. BTC

Written By: Eric Oke & Real Rose

Edited by: Dominic Victor

Many retail investors, including newbies, have a mixed perception of bitcoin. They understand the leading role it plays during the boom and bust cycles of the halvings every four years. Yet, they rarely see it as a good investment because of its high market capitalization. Many retail investors do not associate bitcoin’s intrinsic value with making profits. Some say, “It’s too late to make any money from bitcoin. If I had gotten in ten years ago, I would have made significant profits. But not now. It’s only for the rich. This is why I trade altcoins. There is so much more upside. I can earn 5 to 100 times my money.”

However, investing in altcoins carries higher risks. Their market is less liquid and more subject to volatility. Additionally, many altcoins do not have the same name recognition or level of adoption as bitcoin, with its market dominance and historical performance. This makes altcoins more susceptible to market fluctuations and loss of value over time. To see if this is true, this essay will examine the top altcoins’ market performance against bitcoin over the past year.

The Risk Factors Of Altcoins

Here are the top reasons why our study focused on the top 50 altcoins.

- Volatility: newer altcoins can experience extreme price fluctuations within short periods. This volatility makes it challenging to predict price movements and increases the potential for significant financial losses.

- Scams: Many new altcoin projects operate to exploit users. This can lead to risks associated with fraud, scams, and rugpulls.

- Low Liquidity: Some altcoins may have low trading volumes, making it difficult to buy or sell without affecting the price significantly. This can lead to challenges when trying to exit a position.

- Market Sentiment: The value of altcoins can be heavily influenced by market trends, social media, and investor sentiment. This can lead to erratic price spikes or drops based on speculation rather than fundamentals.

- Project Viability: Not all altcoins have strong development teams or use cases. Some projects may lack a clear path to viability, making them riskier investments.

- Limited Information: New coins have little to no history.

- Technological Issues: Newer altcoins may face technological challenges or bugs that can impact their functionality and, subsequently, their price.

Bitcoin VS Altcoins Performance

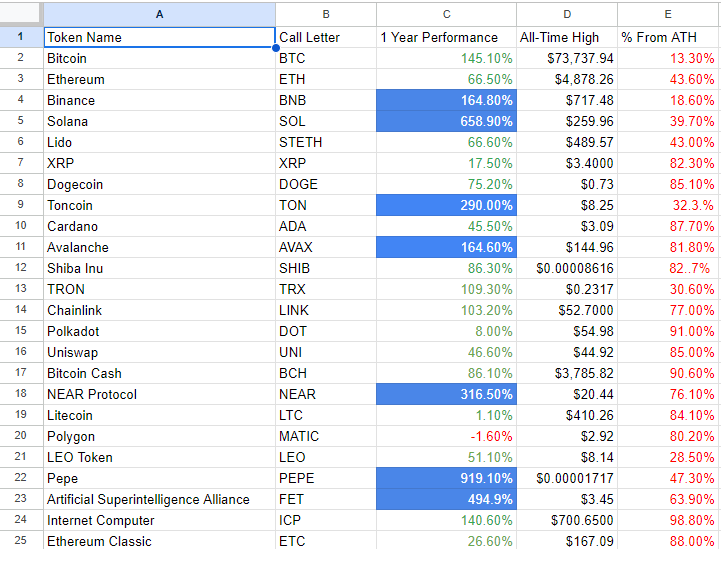

To see if many pro-altcoin investors’ perceptions about bitcoin are true, we examined the performance of the top 50 altcoins that have a history of one year or more. The data shows that only 19 altcoins outperformed bitcoin, and 31 altcoins underperformed bitcoin over the past 12 months.

The evidence points to a majority of altcoins underperforming bitcoin during this bull run. From the low price point of $15,600 in November 2022 to bitcoin’s all-time high in March 2024 of $73,737, bitcoin has grown 4.7 times. It is up 147% in the past year, while the top 50 alts are in between 24% to 92% from their all-time highs. However, the overwhelming majority of alts are still 50% to 90% from their all time highs.

Why Are Altcoins Underperforming?

A major fundamental flaw in crypto is starting to emerge and it is one of the main reasons why altcoins are underperforming this cycle.

OVERSUPPLY:

Oversupply in the context of altcoins refers to the phenomenon where there are too many cryptocurrencies and tokens available in the market relative to the demand for them. This can lead to underperformance in several ways:

Market Saturation:

With over 2 million altcoins available, investors and traders have a vast array of options. Crypto analyst Miles Deutscher points out that over “1 million new crypto tokens have been launched since April 2024. Current estimates suggest there is around $150m-$200m of new supply pressure per day.” This saturation dilutes interest and capital causing many altcoins to struggle to gain traction or achieve significant growth. Plus the constant sell pressure takes a huge toll on the market.

Lack of Differentiation:

As new altcoins are constantly being launched, many of them might not offer unique value propositions or technological advancements compared to existing ones. This lack of differentiation can make it hard for new projects to stand out and attract investment.

Investor Fatigue:

Investors may become fatigued or skeptical about new altcoin projects if they see too many failing to deliver on their promises. This skepticism can reduce their willingness to invest in or support new projects.

UNLOCKS:

Token unlocks can be a significant factor in the underperformance of altcoins in several ways, especially in a cycle where these unlocks are substantial or poorly timed. Here’s a breakdown of how token unlocks can lead to underperformance:

Increased Token Supply:

When tokens are unlocked, they become available for trading or selling. This increase in the circulating supply can lead to a dilution of value, as the market now has more tokens to absorb. If the demand does not match the increased supply, it can lead to downward pressure on the token’s price.

Sell Pressure from Early Investors:

Tokens unlocked from early rounds of investment, such as seed rounds or private sales, are often held by early investors who bought in at lower prices. When these tokens are unlocked, these early investors may choose to sell their holdings to realize profits or exit their positions. This increased sell pressure can negatively impact the token’s price.

Dilution of Value:

Each unlocked token can dilute the value of existing tokens. If a project’s total supply increases significantly due to unlocks, it can reduce the value per token, affecting overall market performance. Investors may perceive this dilution as a sign of potential devaluation, leading to reduced interest and investment.

Ezra Reguerra of Cointelegraph magazine explains that whopping $755m in unlocks took place in July 2024 alone.

Quantitative Tightening

Quantitative tightening can lead to the underperformance of altcoins by reducing liquidity, increasing borrowing costs, prompting a shift to safer assets, impacting market sentiment, and decreasing investment in innovative projects. These factors collectively contribute to a less favorable environment for riskier assets like altcoins, leading to their underperformance in such economic cycles.

Reduction in Liquidity:

QT involves central banks reducing the amount of money circulating in the economy, often by selling off assets from their balance sheets or allowing them to mature without reinvestment. This reduction in liquidity can lead to a decrease in the amount of capital available for investment in riskier assets, including altcoins. With less money in the system, investors may be less willing or able to allocate funds to altcoins.

Increased Borrowing Costs:

As central banks tighten monetary policy, interest rates typically rise. Higher borrowing costs can make it more expensive for both individuals and businesses to take on debt. This can lead to reduced investment in high-risk assets, including altcoins, as investors and companies may prefer safer investments or face higher costs for leveraging their positions.

Shift to Safer Assets:

During periods of QT, investors often shift their portfolios towards safer, more stable assets. This risk aversion can result in a reduced demand for altcoins, which are generally considered higher risk compared to scarce commodities like gold and bitcoin. Investors also opt for traditional investments such as government bonds and blue-chip stocks.

Bitcoin Dominance

As bitcoin dominance increases, it typically means that capital is flowing into bitcoin and away from altcoins. Investors tend to rotate into bitcoin in a risk-on environment like when the US Federal Reserve Bank implements a policy of Quantitative Tightening by raising interest rates. In this situation investors perceive bitcoin as a safer investment compared to altcoins. This shift in capital can lead to decreased investment and lower prices for altcoins which causes them to underperform.

The chart below shows bitcoin dominance rose from 43% to 52% after the US Fed raised the interest rates between March 17, 2022 and July 26, 2023.

Bitcoin dominance continues to rise despite many promises by the US Federal Reserve Chairman Powell to cut rates throughout 2024. By August 24, 2024, bitcoin’s market dominance had climbed to 57.34% marking its highest share of the total cryptocurrency market cap since April 2021.

US Spot Bitcoin ETFs

Another reason why alts are underperforming this cycle is due to the launch of the US Bitcoin ETFs. Prior to the BTC launch, ethereum’s highest market capitalization was $571.67b on November 9, 2021 and that was 2.3 times less than bitcoin’s at the time.

As of August 24, 2024, bitcoin dominance is 57.34% with a market capitalization of 3.8 times that of Ethereum’s. This is also attributed to the bitcoin ETFs. Since its debut, the US Bitcoin ETFs have taken in $17.88 billion from investors.

Conclusion

Our study shows that contrary to popular belief, a lot of money can be made from buying and selling bitcoin. In fact, only 38% of the top 50 altcoins outperformed bitcoin in the past year. This means that 62% of the top 50 alts underperformed bitcoin. There are many reasons for such mediocre performances such as oversupply, unlocks, high interest rates, and high demand for the bitcoin ETFs which all led bitcoin to dominate a larger share of the crypto market cap.

In sum, the belief that no money can be made with bitcoin has proven to be a baseless narrative. The research shows that if a person invested in bitcoin one year ago they will have made far more money than if they invested in most of the top 50 alts.

Sources:

https://www.cnn.com/2024/05/01/investing/premarket-stocks-trading/index.html

https://www.theblock.co/data/crypto-markets/bitcoin-etf

https://x.com/milesdeutscher/status/1803071315257254211?s=46

https://www.theblock.co/learn/286335/what-is-bitcoin-dominance