Non Fungible tokens (NFTs) remained a vital component of the Web3 ecosystem in 2023. Many community members persistently explored new frontiers and looked to resolve various challenges in the industry throughout the year.

While detractors frequently pen eulogies for NFTs, users trading the asset class demonstrate that the space is very much thriving. In the last 30 days alone, the top 10 NFT blockchains have shown strong demand by registering a collective sales volume of over $1.5 billion.

Numerous events transpired within the NFT space in 2023, some alterations stood out more conspicuously than others. These encompass historical advancements for the industry, such as the creation of Bitcoin Ordinals, the first United States Securities and Exchange Commission against NFTs, and the rift regarding creator royalties.

IN OTHER NEWS

Bitcoin Ordinals

You know what this ordinals thing just might work – Casey Rodarmor, Ordinals Creator

Software engineer Casey Rodarmor devised Bitcoin Ordinals in 2023. Following a blog post on Jan. 21, the developer deployed the program on the Bitcoin mainnet. The protocol created Bitcoin’s version of NFTs, termed as “digital artifacts” in the Bitcoin network.

Conventional NFTs often only hold metadata that points to off-chain storage containing NFTs. This approach has sometimes led to issues such as NFTs displaying blank images or, worse, porn. In December 2022, the collapse of the crypto exchange FTX affected NFTs hosted on its platform. As the company restructured, the NFTs disintegrated, displaying blank images instead of the original artworks.

On January 4, 2024, the third-party hosting service employed by NFT marketplace Magic Eden was compromised. At the time, users reported seeing some pornographic images on the NFT thumbnails instead of the NFTs’ artworks. With Bitcoin Ordinals, the assets’ contents are stored on the blockchain. While this protects the Bitcoin NFTs from being susceptible to having their data erased and transformed into blank images, it doesn’t shield the platform from people minting distasteful images onto the Bitcoin network. In addition to people arguing that Ordinals congest Bitcoin’s block space, the decentralized nature of Ordinals enabled a rogue actor to engrave a picture of a man fondling his genitals shortly after its launch.

The image was removed from the Ordinals promptly, but the engraving will remain on the Bitcoin blockchain forever. Despite the negatives, many still praise the emergence of a new use case for Bitcoin as beneficial for the network. Throughout the year, there were debates among Bitcoiners on whether Ordinals belong in the ecosystem. However, it was evident that the protocol’s adoption had already soared. In May, the Bitcoin network surpassed Solana in monthly sales volume as a direct consequence of Ordinals transactions. In December, the network achieved the highest spot for most sales in 30 days, raking in over $744 million, while the Ethereum network earned $391 million.

NFT Market Value in 2023

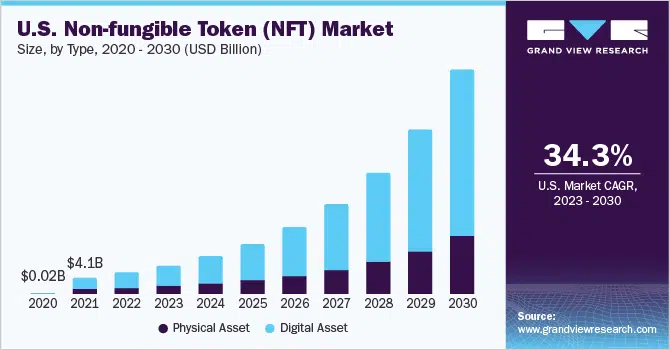

Expert forecasts had the U.S. NFT market, valued at about $22 billion at once, growing at a compound annual growth rate (CAGR) of more than 34% between 2023 and 2030. However, as previously mentioned, the NFT marketplace growth in 2023 saw a considerable decline, with transaction volumes plunging to $4.7 billion, sharply contrasting the $12.6 billion volume recorded in the same period in 2022.

With the public losing interest in NFTs, leading marketplaces such as OpenSea experienced significant drops in deal values between December 2021 and December 2022, and this trend was reflected across several other platforms as well.

OpenSea’s monthly active user base stood at around 250,000, with the platform witnessing a remarkable 450% increase in unique NFT buyers between 2020 and 2021. This spike saw the monthly buyer volume rise from 10,000 to 40,000. However, Q1 2023 marked a low number of NFT holders, possibly linked to the royalty dispute between Blur and OpenSea. Interestingly, up until 2022, there were more buyers than sellers in the NFT market, with a ratio of 1.3 to 1.

By 2023, however, there was a shift in the market graph, with sellers outnumbering buyers, indicating a potential change in market behavior and possibly marking the start of the NFT market’s second major cycle.

November’s Market Revival: Positive Indicators Amidst Ambiguity

November ushered in a fresh breeze to the NFT market, signaling a revival that echoed through key market data and dynamics. Positive indicators lit up the way forward, instilling renewed faith among traders and enthusiasts. The month observed a recovery in trader profitability, spikes in floor prices for top collections, and shortened holding periods for NFTs, depicting a picture of a market finding equilibrium amidst fluctuating values. Yet, amidst these peaks, fluctuations in average prices added layers of intricacy to the evolving narrative, demanding a closer examination of factors influencing NFT valuations.

The thriving NFT market in November experienced remarkable sales, including the record-breaking Cryptopunk sale, along with other noteworthy transactions like the Jack Butcher Trademark collection and Herbert W. Franke’s Zentrum collection. These sales illustrated the appeal and challenges within the market, displaying triumphs alongside rapid price variations on the secondary market.

The month also witnessed the Blur project’s second airdrop and worries over wash trading, serving as alerts of the need for caution and prudence within the NFT landscape.

NFT Regulatory Problems

NFTs also faced the first unregistered securities sales allegation with U.S. regulators in 2023. On August 28, the SEC accused Los Angeles-based entertainment company Impact Theory of allegedly selling unregistered securities in the guise of its NFT collection, Founder’s Keys. The SEC claimed that the company enticed investors to buy the NFTs as an investment in its business. The SEC alleged that the NFTs were investment contracts, and therefore, they were securities. The regulator’s actions implied that the company broke the law by selling the NFTs without registration. The securities regulator also issued a cease-and-desist order, which the firm complied with.

After accusing Impact Theory, the SEC sued another company for selling NFTs. On September 13, the SEC accused Stoner Cats 2 (SC2), the creators of the Stoner Cats animated series, of conducting an unregistered offering of crypto asset securities. As with the first case, the SEC issued a cease-and-desist order for SC2, and the company agreed.

Hollywood actress Mila Kunis led the Stoner Cats project and collaborated with several NFT creators to produce the animated series. The cast in the series included big names such as Kunis, Ashton Kutcher, Chris Rock, Gary Vaynerchuk, and Ethereum co-founder Vitalik Buterin.

The SEC stated that the company marketed the NFTs as having the potential for secondary sales. The SEC also observed that the ads implied that the credentials of the people involved in the project would cause the NFTs to rise in value.

Many opposed the SEC’s crackdown on NFTs. On August 28, SEC Commissioners Hester Peirce and Mark Uyeda published a dissenting statement against the SEC. The duo argued against the SEC’s assertion that the company and purchaser statements cited by the SEC are not the type of promises that form an investment contract.

DECEMBER NFT STATISTICS

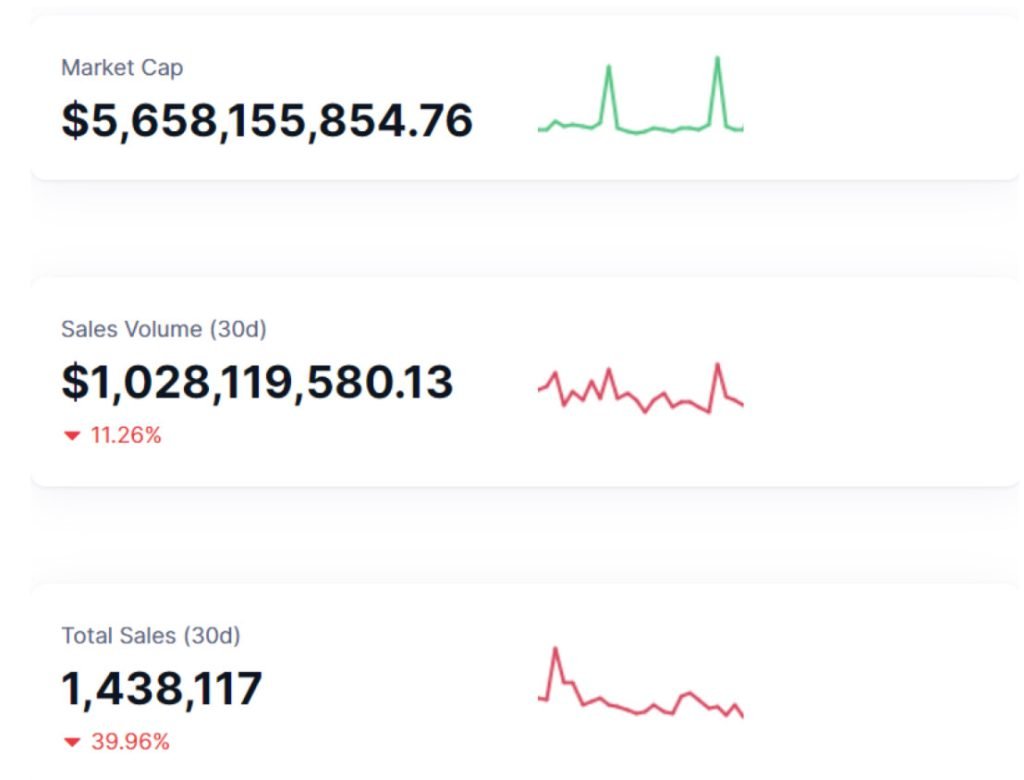

In December, the NFT market sustained its robust performance, continuing the positive momentum observed in November. The market cap increased to an impressive $5.66 billion, representing a 1.0% growth from November’s figure of $5.59 billion. Miniscule, but a positive sign nonetheless.

The sales volume, on the other hand, experienced substantial growth, reaching $1.03 billion for December. This is a significant 28.4% increase from the previous month’s figure of $801.86 million, highlighting the sustained trading activity and increased liquidity within the NFT market.

Total sales of NFTs in December reached an impressive 1,438,117. A 4.5% month-over-month growth from November’s 1,373,997. This growth in the total number of NFT transactions indicates a sustained and expanding interest in the market.

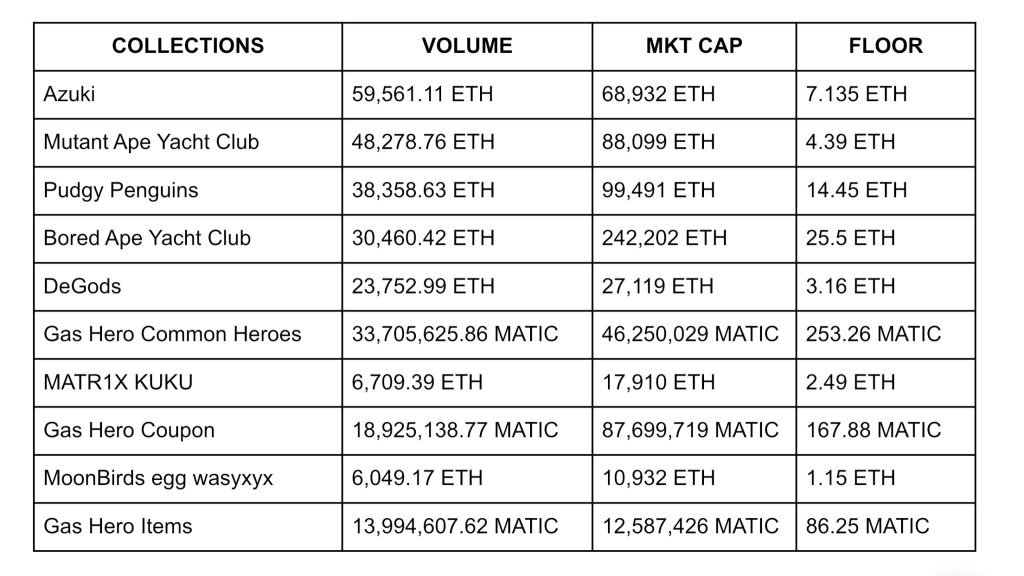

The dominance of the top 10 NFT collections in terms of sales continued in December, underlining their significant impact on the overall market. Ethereum maintained its leading position as the primary blockchain for NFT sales, contributing to a substantial 54% of all sales during the month, consistent with the trend observed in October and November.

Overall, December’s NFT statistics depict a market that not only maintained its positive trajectory but also saw notable growth in key metrics, affirming the continued interest and investment in the NFT space.

Top NFT Bluechips

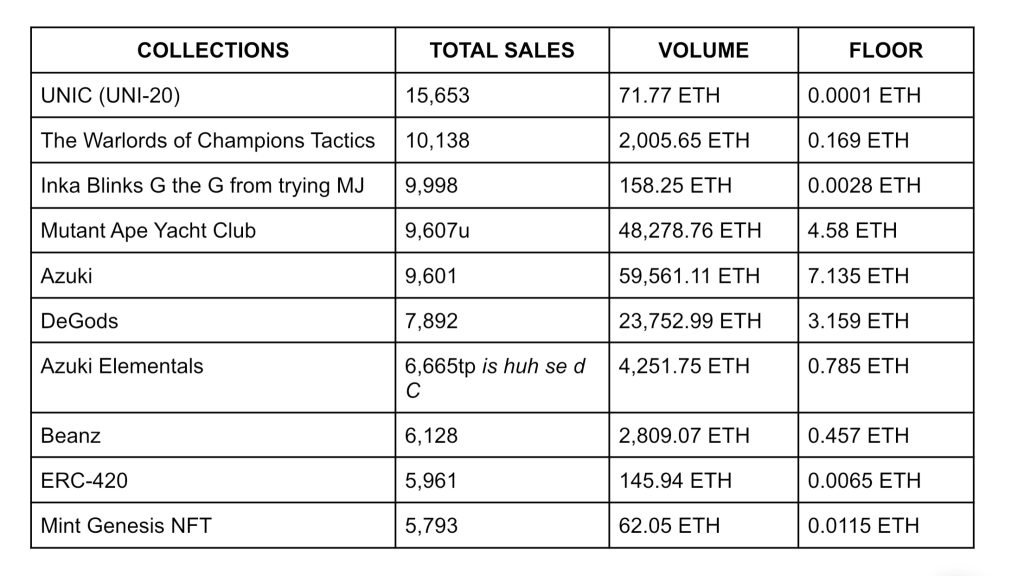

Trending NFT Collection by Sale

Upcoming NFT Mints

This is a list of upcoming projects that appear to have potential. Please note that this is NOT FINANCIAL ADVICE.

The list is based on a variety of factors, including the project’s team, technology, and use case. However, it is important to do your research before investing in any project.

Jack Butcher: Checks on Bitcoin- @g XR the RV RVvff VCf VC you hiyy DDDyyg jackbutcher

The Citadel- @0xCitadel

Lost Realms King’s Oath- @LostRealmsXYZ

Stakeland- @stakeland

PFP.com- @pfpdotcom

KICKZ- @kickz

DigiDaigaku Chibi Ordinals- @DigiDaigaku

Awake- @awakebtc

Cool Pets Upgrade- @coolcats

Today- @todaythegame

OVERWORLD- @OverworldPlay

Play Somo- @playsomo

Tiny Blazers- @tinyblazers

Orivium- @Orivium

Kantoria- @kantorianft