Introduction

Maple Finance is a decentralized platform for institutional borrowing and lending in the crypto space. It aims to disrupt traditional financing by simplifying access to capital for established crypto businesses and offering stable yields for lenders. Maple Finance revolutionizes crypto financing by connecting established businesses with investors through a decentralized lending pool, offering flexible capital access and stable passive income in the dynamic blockchain arena.

Overview

Maple Finance is a decentralized platform that connects institutional borrowers and lenders in a transparent and efficient way. Borrowers can access undercollateralized loans from credit pools, which are managed by credit experts who perform due diligence and underwriting. Lenders can deposit their funds into credit pools and earn a yield on their deposits, while also benefiting from the credit expertise of the pool delegates. Maple Finance aims to create a global marketplace for institutional credit, leveraging blockchain technology and smart contracts. Maple Finance currently operates on Ethereum and Solana networks, and partners with regulated service providers and leading institutions to ensure compliance and security.

In the heart of the crypto world, Maple Finance disrupts traditional finance by connecting established institutions with a unique lending model. Borrowers shed the burden of collateral and access flexible funds through pools managed by expert “Pool Delegates.” These delegates conduct rigorous due diligence, ensuring lenders earn stable returns from diversified exposure to reputable borrowers. The entire process is transparent and on-chain, powered by the Maple Token, which grants governance rights, fee sharing potential, and personalized yield boosting options. More than just a lending platform, Maple fosters a collaborative ecosystem where innovation thrives, driving the digital economy forward.

Background

Founded in 2021 by Sid Powell and Joe Flanagan, Maple Finance emerged as a savior to the limitations of traditional lending markets within the burgeoning crypto space. Existing DeFi protocols largely relied on over collateralized loans, which could stifle the growth of crypto institutions seeking flexible financing.

Maple saw an opportunity to bridge the gap between established crypto players and yield-hungry investors. By introducing under collateralized loans and expert-managed liquidity pools, the protocol aimed to:

Empower borrowers: Secure quick and efficient financing based on their reputation, not just asset holdings.

Reward lenders: Offer diversified, sustainable yield opportunities with risk mitigation through Pool Delegate due diligence.

Boost transparency: Operate on-chain, ensuring open visibility into loan terms and transactions.

Enable governance: Employ the Maple Token (MPL) for community-driven decision-making, fee sharing, and personalized yield enhancements.

In essence, Maple aimed to revolutionize decentralized finance by creating a trust-based lending ecosystem that catered specifically to the needs of the evolving crypto market.

Milestones achieved so far by Maple Finance

– Launch and Adoption:

Launched on the Ethereum mainnet, Solana mainnet and Base

– Product Innovations:

Introduced dynamic interest rates based on supply and demand, aiming for fairer borrowing and lending costs.

Developed Pools for specific asset classes, simplifying investment and risk diversification for users.

– Governance and Community:

Established a Decentralized Autonomous Organization (DAO) for community-driven protocol development.

Successfully implemented multiple governance proposals voted on by token holders.

Actively fosters a growing community of users, developers, and investors through various channels.

– Partnerships and Integrations:

Partnered with leading DeFi protocols like Aave and Yearn Finance for cross-platform lending and borrowing opportunities.Integrated with several DeFi aggregators and wallets for seamless user experience.

Collaborates with institutions to bridge the gap between traditional finance and DeFi.

– Security and Transparency:

Underwent rigorous security audits by reputable firms.

Maintains transparency with regular on-chain data and reports published on the platform.

Actively engages with the security community to address potential vulnerabilities.

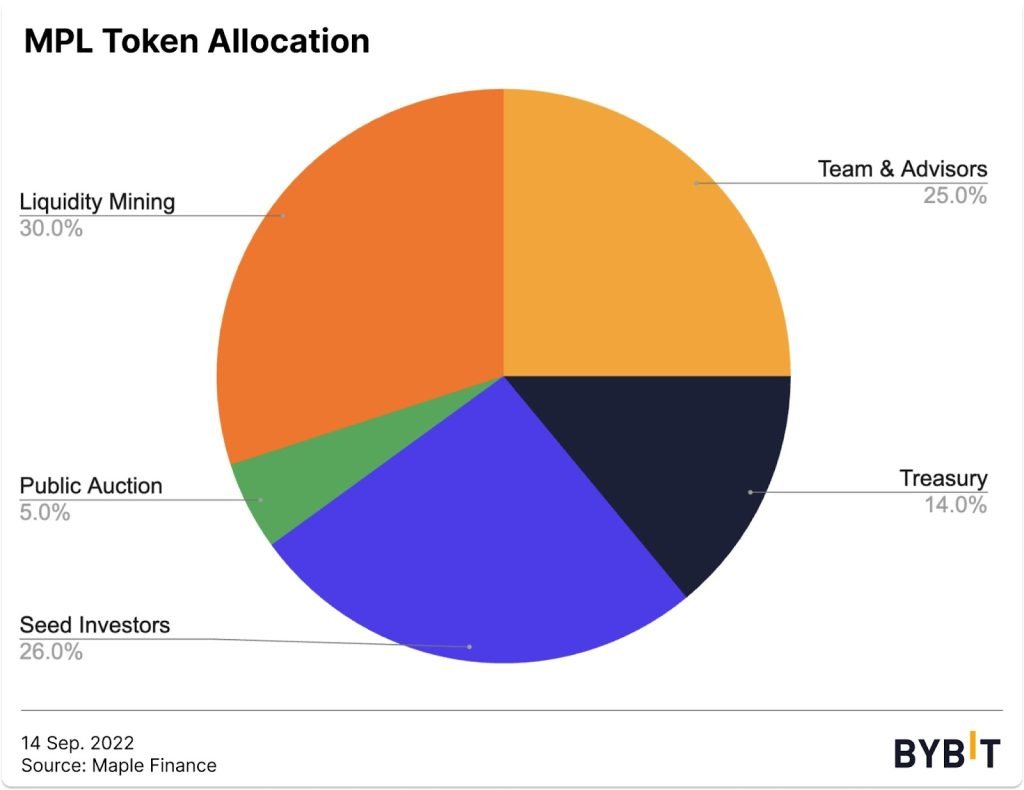

Tokenomics

Maple Finance introduced its native ERC-20 governance token, MPL, upon launch. The token empowers its holders in three ways: participating in protocol governance, contributing to Pool Cover insurance, and sharing in network fees generated by the Maple Treasury. Currently, 3,658,989 MPL are circulating out of a 10 million maximum supply. The initial distribution saw 30% allocated to liquidity mining, 25% for seed and advisor roles, 26% for additional seed funding, 5% for the public sale, and the remaining 14% held by the Maple Treasury.

Maple Finance’s innovative approach to launching on Solana involved a secondary token, SYRUP, which facilitates a secure and dilution-free rollout while streamlining fee management, Pool Cover, and liquidity mining efforts.

SYRUP Token Allocation:

Ethereum Treasury (40%): The largest chunk, this allocation represents the collective wealth of MPL holders on Ethereum. To share protocol fees, the Maple DAO will passively earn “SYRUP” tokens (initially unlisted), which are then used to buy back MPL and distribute it proportionately to xMPL stakers. This bypasses airdrops and directly rewards active engagement.

Solana Treasury (30%): Dedicated to fostering Solana-specific growth, this allocation fuels initiatives like liquidity mining, strategic token swaps with other Solana protocols, and OTC sales to key partners. This flexibility enables future funding and diversifies the treasury’s exposure.

Team, Advisors, and Acquisition (30%): This allocation supports team expansion, particularly with Solana-focused developers and advisors. It also fuels future acquisitions in line with Maple’s strategic vision.

Use Cases of MPL token

– Shape the Protocol: MPL holders wield voting power to influence critical decisions like pool parameters and fee structures, directly shaping Maple’s future.

– Earn from Engagement: Lock your MPL and reap rewards. Stakers receive a share of protocol fees, earning passive income while supporting Maple’s growth.

– Become the Safety Net: BPT tokens, backed by MPL, offer loan default insurance. Holders earn fees from borrowers and a share of recovered funds, protecting the Maple ecosystem.

– Empower Others: Delegate your voting rights to trusted users, letting them voice your opinions while you passively participate in governance.

Use Cases of SYRUP token

– Fees: SYRUP earns fees from Maple activity (borrowing, mining, Pool Cover). The DAO decides how to use these fees (treasury, development, rewards).

– Unlisted: SYRUP stays private, letting the DAO quietly build funds without impacting MPL price.

Security: Keeping SYRUP unlisted avoids potential trading risks that could harm the protocol.

– Future Liquidity: SYRUP may be listed later, offering additional options for MPL holders.

Features and Functionality

– Governance: Holders can vote on protocol proposals, shaping its direction and development.

– Pool Cover: It can be staked to provide a safety net for lenders against potential losses, earning cover staking rewards.

– Fee Sharing: A portion of the network fees generated is distributed to MPL holders, providing passive income.

– xMPL: Users can stake MPL to receive xMPL, which earns a share of the protocol’s revenue and governance rights.

Advantages

– For Lenders:

Higher Yields: Earn potentially high interest rates on crypto assets by lending to institutional borrowers with strong creditworthiness.

Under collateralized Loans: Get exposure to loans requiring less than 100% collateral, potentially amplifying returns.

Diversification: Access a variety of loan pools across different crypto assets and credit risks to spread your investments.

Transparency: On-chain governance and public loan terms ensure full visibility into protocol activities.

– For Borrowers:

Access to Capital: Secure loans from a diverse pool of lenders without stringent collateral requirements.

Flexible Loan Terms: Negotiate customized interest rates and repayment schedules based on creditworthiness and market conditions.

Fast Funding: Receive loan approvals and disbursements quickly through a streamlined and efficient process.

Institutional Focus: Connect with established crypto players within the DeFi ecosystem.

– For the Protocol:

Market Efficiency: Bridging the gap between traditional finance and DeFi by facilitating institutional participation.

Decentralized Governance: Community-driven decision-making fosters trust and transparency.

Innovation: Continuously developing new features and functionalities to expand the protocol’s capabilities.

Growing Ecosystem: Attracting more lenders and borrowers strengthens the network effect and overall liquidity.

Roadmap and Future Developments

Building a Sustainable Lending Future

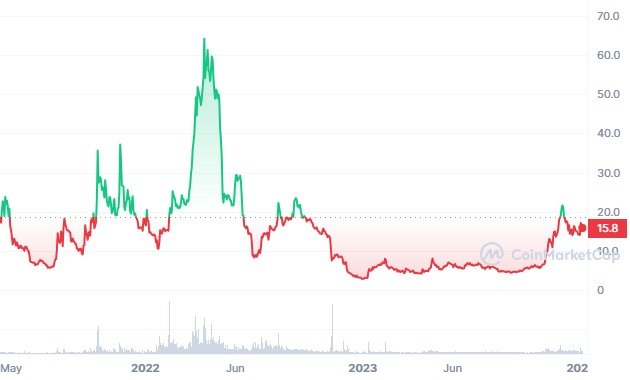

Maple Finance blazed through the first half of 2022, conquering multi-chain lending, unlocking over $1 billion in loan origination, and bolstering its team. Now, with these critical milestones under its belt, Maple charges headfirst into H2, setting its sights on becoming the undisputed leader in institutional capital networks within DeFi.

H1 22 ROADMAP: PLATFORM PERFORMANCE

Loan originations skyrocketed from $542 million across 4 pools at the year’s start to over $1.5 billion by June. Expanding to Maple Solana with two new pools contributed significantly to this growth. Currently, Maple Solana boasts $115 million in originations, while Maple Ethereum holds the majority at $1.4 billion. Existing pools also flourished, delivering value to lenders, borrowers, and pool delegates alike.

Internally, Maple achieved its first cash-flow positive quarter in Q1 2022. MPL secured listings on major exchanges like Coinbase, Gemini, and Huobi. They actively participated in conferences and podcasts like AVAX, Permissionless, Token Terminal, Solana, and Real Vision, earning coverage in prestigious publications like Blockworks, Business Insider, and The Block.

Their team grew from 20 to 35 dedicated individuals. We strategically filled key leadership positions to ensure Maple’s continued product excellence and operational efficiency.

PRODUCT DEVELOPMENT

– January: Loans V2 was released, offering increased flexibility and cost savings for protocol participants through new smart contracts.

– April: Maple expanded its reach by launching Maple Solana, a multi-chain offering now being actively developed towards feature parity with its Ethereum counterpart.

– May: xMPL was introduced, allowing MPL token holders to participate in Maple’s growth. This initiative proved successful, with 30% of circulating MPL staked within a week.

– June: Loan refinancing was implemented, empowering borrowers to roll over or update existing loans. This feature enhances both borrower experience and capital efficiency, while granting pool delegates greater flexibility in managing their pools.

H2 22 ROADMAP: BUILDING MAPLE 2.0

Platform Focus: Expanding User Base and Use Cases

Target new borrower verticals (crypto mining) and attract institutional lenders.

Explore launching pools for FinTech, SaaS, and other verticals.

Integrate with exchange, custodian, and yield aggregator applications.

Enable fiat deposits for broader institutional participation.

Product Focus: Maple 2.0 and Improved Features

Maple 2.0: A fundamental overhaul enabling scalable infrastructure and a wider range of features.

Iterative Development: A flexible architecture for adding new features, loan structures, and strategies.

Enhanced Flexibility: Greater pool delegate control, allowing for diverse pool strategies and borrower sets.

Pool Cover Redesign: Deposits as a single asset, eliminating Balancer dependency and impermanent loss concerns.

Interoperability: Pool tokens representing ownership shares become usable in secondary markets.

Compounding Interest: Automatic compounding eliminates manual reinvestment for lenders.

Improved Reporting: Industry-leading accounting and compliance tools for a one-stop-shop experience.

Building Out Maple Solana:

Explore new opportunities within the Solana ecosystem (infrastructure, node operators, startups).

Deploy unique features like open-term loans and active collateral management.

Introduce SYRUP, a second token for managing fees, security, Pool Cover, and liquidity mining.

Excited for Growth: The Maple team is energized and focused on building and scaling. Maple 2.0 marks a significant milestone for future growth, and their combined initiatives and technology position them for success in any market conditions.

Risks and Challenges

- Default Risk: As Maple focuses on uncollateralized loans, borrowers may default, leading to losses for lenders.

- Smart Contract Risk: Glitches or vulnerabilities in the code could compromise funds or manipulate the protocol.

- Risk of Loss: Engaging with digital assets, whether through holding, lending, or borrowing, carries significant risks, ranging from potential price devaluation to complete loss due to factors like hacking, platform insolvency, or market collapse.

- Market Fluctuations: Significant price movements in the crypto market can make it harder for borrowers to generate sufficient returns to service their debt, while simultaneously causing lenders to become more cautious and pull back their capital.

How Maple Finance Addresses Challenges

- Credit underwriting: Maple vets borrowers through a community of experienced credit analysts.

- Pool cover: Pools have dedicated funds to cover potential defaults.

- Risk diversification: Lenders can spread their capital across different pools with varying risk profiles.

- Security audits: Maple undergoes regular audits by renowned security firms.

- Bug bounty program: Incentives are offered for identifying and reporting vulnerabilities.

- Governance: The community can vote on proposed changes to the smart contracts.

- Floating interest rates: Rates adjust based on market conditions, incentivizing repayment during downturns.

- Diversification options: Pools offer exposure to various DeFi assets beyond just cryptocurrencies.

- Transparent data: Detailed on-chain data allows lenders to assess market conditions and adjust their strategies.

- On-chain data allows users to assess borrower performance, pool health, and broader market conditions to make informed decisions.

How Maple Finance is Secured

Maple Finance does not directly utilize a specific consensus mechanism as it operates on the Ethereum blockchain. Ethereum itself relies on the Proof-of-Stake (PoS) consensus mechanism, where validators secure the network by staking their Ether (ETH) tokens. Maple prioritizes security with audited contracts, bug bounties and on-chain checks.

Conclusion

Maple Finance is a decentralized lending platform on the Ethereum blockchain that connects borrowers with lenders in a credit marketplace. Unlike traditional DeFi lending, Maple primarily focuses on uncollateralized loans, meaning borrowers don’t have to put up additional assets as security.

Sources:

https://maplefinance.gitbook.io/maple/maple-for-token-holders/mpl-token#what-is-mpl

https://www.coingecko.com/en/coins/maple

https://maple.finance/news/maple-roadmap/

https://maple.finance/news/5-changes-to-tokenomics-for-improved-mpl-utility/