Introduction

The purpose of this article is to introduce and explain Centrifuge, a decentralized finance (DeFi) lending protocol that connects real-world assets (RWA) with DeFi liquidity. The article will cover the project overview, background, tokenomics, features, functionality, roadmap, risks, and challenges of Centrifuge. The article is intended for readers who are interested in learning more about Centrifuge and its potential impact on the DeFi ecosystem and the traditional finance sector.

Overview

Centrifuge is a decentralized asset financing protocol that aims to make credit more accessible to small and medium-sized enterprises (SMEs), while also providing a stable yield for investors by opening pooled liquidity to the world of traditional finance. The main goal of the project is to generate profits that are not tied to volatile crypto assets; the developers are pursuing the task of transferring real monetary value from fiat to cryptocurrencies.

Centrifuge allows users to tokenize real assets, such as invoices, real estate, and royalties, and use them as collateral to access financing through Tinlake, a decentralized application (DApp) lending protocol. Tinlake pools the tokenized assets and issues two types of tokens: DROP and TIN. DROP tokens represent the senior tranche of the pool and have a fixed interest rate and a lower risk profile. TIN tokens represent the junior tranche of the pool and have a variable interest rate and a higher risk-reward ratio. Investors can choose to invest in either DROP or TIN tokens depending on their risk appetite and return expectations.

Centrifuge runs on its own blockchain, which is built on Substrate, a framework for creating interoperable blockchains. Centrifuge leverages the Polkadot network for security, scalability, and cross-chain communication. Centrifuge also integrates with Ethereum, the leading platform for DeFi applications, through bridges and oracles. This allows Centrifuge to access the liquidity and innovation that Ethereum has to offer, while also benefiting from the speed and low fees of Polkadot.

Background

Centrifuge was founded in 2017 by Lucas Vogelsang and Martin Quensel, who are also the co-founders of Taulia, a supply chain finance company. Vogelsang and Quensel have extensive experience in the fintech industry and have witnessed the challenges and inefficiencies that SMEs face when accessing credit from traditional financial institutions. They decided to create Centrifuge as a way to democratize access to finance and enable SMEs to tap into the DeFi market.

Centrifuge has achieved several milestones since its inception, such as:

– Launching Tinlake, the first DApp built on Centrifuge, in 2019.

– Raising $3.8 million in a seed round led by BlueYard Capital in 2019.

– Launching the Centrifuge Chain mainnet in 2020.

– Raising $4.3 million in a strategic round led by Mosaic Ventures and Naval Ravikant in 2020.

– Launching the CFG token and the Centrifuge governance system in 2021.

– Integrating with MakerDAO, Aave, and Compound, some of the leading DeFi protocols on Ethereum, in 2021.

– Raising $4 million in a funding round led by Galaxy Digital and IOSG Ventures in 2021.

Tokenomics

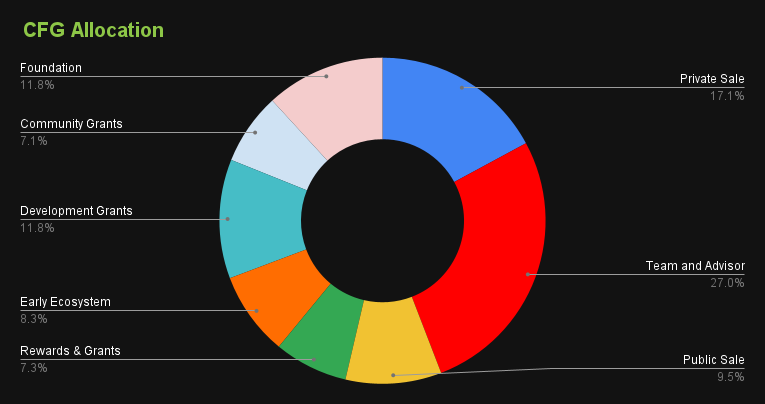

The native token of Centrifuge is CFG, which is used for network operations and governance. CFG has a fixed supply of 425 million tokens, of which:

– 36% were allocated to the Centrifuge team and investors.

– 32% were allocated to the Centrifuge Foundation and ecosystem development.

– 20% were allocated to the Tinlake community and liquidity mining.

– 12% were allocated to the public sale and distribution.

CFG has several use cases, such as:

– Staking: Users can stake CFG to become validators or nominators of the Centrifuge Chain and earn rewards for securing the network.

– Governance: Users can stake CFG to participate in the governance of the Centrifuge protocol and vote on proposals and upgrades.

– Fees: Users can pay CFG as fees for transactions and smart contracts on the Centrifuge Chain.

– Rewards: Users can earn CFG as rewards for providing liquidity and investing in Tinlake pools.

CFG is available on several platforms, such as:

– Kraken: A leading cryptocurrency exchange that supports CFG trading and staking.

– CoinList: A platform that hosted the CFG public sale and distribution in 2021.

– Uniswap: A decentralized exchange that allows users to swap CFG with other ERC-20 tokens on Ethereum.

– Moonbeam: A smart contract platform that bridges CFG to Ethereum and other blockchains.

Features and Functionality

Centrifuge has several features and functionalities that make it a unique and innovative DeFi protocol, such as:

– Tokenization: Centrifuge enables users to tokenize real assets and create non-fungible tokens (NFTs) that represent the ownership and cash flows of the assets. These NFTs can be used as collateral to access financing on Tinlake and other DeFi platforms.

– Pooling: Centrifuge allows users to create and join asset pools on Tinlake, where they can borrow or lend funds based on the tokenized assets. Tinlake issues two types of tokens for each pool: DROP and TIN, which have different risk-return profiles and cater to different types of investors.

– Interoperability: Centrifuge connects the Centrifuge Chain with other blockchains, such as Ethereum and Polkadot, through bridges and oracles. This allows Centrifuge to access the liquidity and innovation that other DeFi protocols have to offer, while also enabling cross-chain asset transfers and verifications.

– Governance: Centrifuge empowers its users to have a say in the development and direction of the protocol through the CFG token. Users can stake CFG to vote on proposals and upgrades that affect the Centrifuge Chain, Tinlake, and other DApps built on Centrifuge.

Roadmap and Future Developments

- Expanding the number and variety of asset pools on Tinlake, such as music royalties, carbon credits, and art collections.

- Increasing the integration and collaboration with other DeFi protocols, such as Curve, SushiSwap, and Yearn Finance.

- Launching the Centrifuge parachain on Polkadot, which will enable Centrifuge to benefit from the shared security and scalability of the Polkadot network.

- Developing new DApps and features on Centrifuge, such as a decentralized identity system, a credit scoring system, and a decentralized exchange.

Risks and Challenges

Centrifuge faces some risks and challenges that could affect its growth and adoption, such as:

- Regulatory uncertainty and compliance issues, especially regarding the legal status and enforceability of the tokenized assets and the contracts involved.

- Technical complexity and security risks, especially regarding the interoperability and compatibility of the different blockchains and protocols that Centrifuge interacts with.

- Market competition and user adoption, especially regarding the awareness and education of the potential borrowers and investors who could benefit from Centrifuge.

Centrifuge addresses these challenges by:

- Working closely with legal experts and regulators to ensure that its protocol and DApps comply with the relevant laws and regulations in different jurisdictions.

- Conducting regular audits and tests to ensure that its code and smart contracts are secure and bug-free, and implementing best practices and standards for data privacy and protection.

- Building a strong and active community of users, developers, and partners, and providing incentives and rewards for participation and contribution.

Conclusion

Centrifuge is a DeFi protocol that connects real-world assets with DeFi liquidity, and aims to lower the cost of capital for SMEs and provide a stable source of income for investors. Centrifuge leverages the Polkadot network for speed and low fees, and integrates with Ethereum for liquidity and innovation. Centrifuge has a native token, CFG, that is used for network operations and governance. Centrifuge has several features and functionalities that make it a unique and innovative DeFi protocol, such as tokenization, pooling, interoperability, and governance. Centrifuge has a clear and ambitious roadmap for the future, and also faces some risks and challenges that it is working to overcome.

Sources:

https://centrifuge.io/

https://coinmarketcap.com/currencies/centrifuge/

Centrifuge: Makes Real World Assets Liquid on Blockchain

https://www.kraken.com/learn/what-is-centrifuge-cfg

https://en.cryptonomist.ch/2022/11/03/centrifuge-crypto-project-receives-4-million/