Introduction

Synthetix is a cryptocurrency minting programme that enables users to create new crypto assets similar to real world assets like the US dollar and crypto assets like Bitcoin.

Overview

Synthetix is a decentralized liquidity provisioning protocol that aims to broaden the cryptocurrency space by introducing non blockchain assets. It is built on Optimism and Ethereum mainnet and is collateralized by SNX, ETH, and LUSD. This collateralization enables the issuance of synthetic assets (Synths) that track and provide returns on the underlying asset without requiring one to directly hold the asset. SNX tokens are used as collateral for the synthetic assets that are minted, meaning that whenever synths are issued, SNX tokens are locked up in a smart contract.

Synthetix operates by allowing users to stake their SNX tokens in a staking pool. These staked tokens serve as collateral for the issuance of synthetic assets (Synths). Synths track the value of real-world assets, providing users with exposure to these assets without the need to hold them directly. The platform tracks the underlying assets using smart contract price delivery protocols called oracles. This allows users to trade synths seamlessly, without liquidity or slippage issues. The protocol has transitioned to the Optimistic Ethereum mainnet to help reduce the gas fees on the network and lower oracle latency.

Background

The network was launched in September 2017 by Kain Warwick under the name Havven (HAV). About a year later the company rebranded to Synthetix. Kain Warwick is the founder of Synthetix and a non executive director at the blueshyft retail network.

Synthetix has over 25 employees working at the original Synthetix Foundation and nearly 12 regular contributors to the Synthetix Github. The headquarters is in Sydney, New South Wales, and was founded in 2017. Key team members include Kain Warwick (Founder), Justin Moses (CTO), and Jordan Momtazi (COO). Kain has spearheaded the organization since December 2016 but has previous experience as a Non Exec Director for Blueshyft, a software platform that adds physical retail presence to digital businesses. Justin Moses, another Blueshyft team member, worked as a Tech Advisor at Synthetix originally but soon moved to CTO. Before Justin’s time at Blueshyft. He spent several years working for MongoDB and Lab49 managing Cloud SaaS and financial software as a principal engineer. Jordan Momtazi, another addition to the team transferring from Blueshyft, has been with the foundation since August 2017, originally as VP of Business Development and then as COO. Jordan is also a Co Founder in a crypto payment network at RelayPay, a delayed crypto payment application.

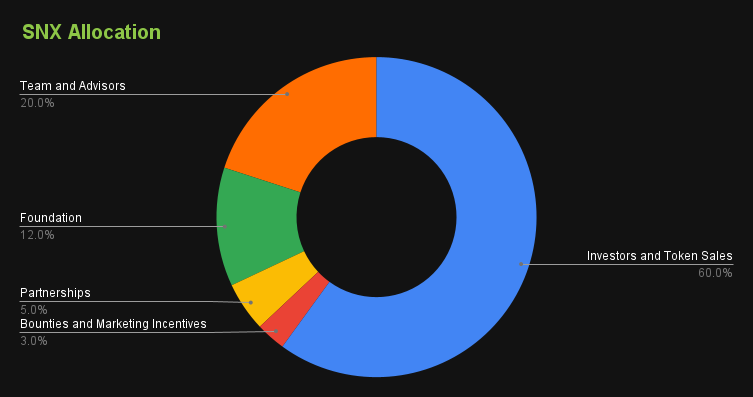

Tokenomics

SNX is an inflationary token with an initial total supply of 100,000,000. It had an initial annual inflation of 75% APR starting from Mar 13, 2019 that decreases at a rate of 1.25% per week, with a final 2.5% APR annual inflation fixed on Sep 6, 2023.

How Synthetix works

- Synthetix operates by allowing users to stake their SNX tokens in a staking pool. These staked tokens serve as collateral for the issuance of synthetic assets (Synths). Synths track the value of real-world assets, providing users with exposure to these assets without the need to hold them directly. The platform tracks the underlying assets using smart contract price delivery protocols called oracles. This allows users to trade synths seamlessly, without liquidity or slippage issues. The protocol has transitioned to the Optimistic Ethereum mainnet to help reduce the gas fees on the network and lower oracle latency.

Total Supply and Distribution

- SNX is -8.21% in the last 24 hours, with a circulating supply of 327.77M SNX coins and a maximum supply of 328.19M SNX coins. SNX ranks 56 by market cap. It has a 24H high of $3.95 recorded on Dec 17, 2023, and its 24H low so far is $3.43, recorded on Dec 17, 2023.

Use cases

- SNX is used for staking rewards and decentralized governance through community voting. In addition to collateralizing synths, Synthetix also supports crypto derivatives markets like futures and options trading.

Where to Buy Synthetix

- SNX tokens can be purchased at top exchanges, such as:

- Binance.

- OKEx.

- Coinbase Pro.

- Uniswap (V2)

How to Store Synthetix

- Download and install the Ledger Live app in a couple of clicks on desktop and mobile. Coupled with a Ledger, it makes the most secured wallet for your Synthetix Network.

How do you store SNX on a ledger

- You will need to create a Synthetix-Network Token account on Ledger Live, to connect your Ledger hardware wallet and to verify your identity. Once you buy your Synthetix-Network-Token using your payment card or a bank transfer, it will be automatically sent to your hardware wallet, and thus secured.

Features and Functionality

- It’s a blockchain based asset insurance protocol.

- Synthetix (SNX) is an Ethereum based project that allows users to create and exchange synthetic decentralised assets.

- The Synthetix ecosystem can even reward traders by supplying funds to other Synthetix ecosystem components.

- Easy to navigate user interface.

- Stake to earn portion of exchange fees.

- Trading on exchange does not require SNX.

Risks and Challenges

- Potential regulatory changes could affect future.

- High gas fees because it is built on Ethereum.

- The field of crypto projects is competitive and there are many new projects

Conclusion

Synthetix is at the forefront of the DeFi movement and offers synthetic assets to users across the entire world, providing access to specialized trading strategies as a result of this. When taking into consideration the size of traditional financial markets, it has the potential to truly create a massive tokenized market of digitized real world assets on the Ethereum Blockchain.

References

https://coinmarketcap.com/community/articles/657c7dda87279170ec207bbb/

https://www.coinbase.com/price/synthetix-network-token

https://www.bybit.com/en/coin-price/havven/