Introduction

Lido DAO is a decentralized autonomous organization that provides liquid staking solutions for various blockchain networks, such as Ethereum and Polygon. Liquid staking allows users to stake their tokens and receive equivalent tokens that represent their staked amount and rewards. These tokens are liquid, meaning they can be used in other decentralized applications (DeFi) to earn more yield.

Overview

In the burgeoning DeFi landscape, Lido DAO stands out as a pioneer, reimagining staking with its innovative liquid solutions. Gone are the days of illiquid, locked-up tokens; Lido empowers users across diverse networks like Ethereum and Polygon to seamlessly stake their assets and reap the rewards, all while retaining absolute flexibility.

Lido’s magic lies in its liquid staking derivatives. Stake your ETH, for instance, and receive stETH, a synthetic token representing your staked amount and accruing rewards. This stETH isn’t just a passive placeholder; it acts as a passport to the vibrant DeFi ecosystem, allowing you to participate in lending, liquidity pools, and other yield-generating strategies without sacrificing your staking gains.

Lido DAO isn’t tied to a single blockchain; it orchestrates liquid staking across a symphony of networks like Ethereum, Polygon, Solana, and Polkadot. Users seamlessly stake their tokens on their preferred chain, receiving liquid derivatives that unlock DeFi opportunities while their original assets quietly earn staking rewards. This blockchain-agnostic approach empowers users with unprecedented flexibility and Lido’s DAO governance ensures the conductor’s baton rests in the community’s hands.

Background

In 2020, a visionary trio – Konstantin Lomashuk, Vasiliy Shapovalov, and Jordan Fish – brought Lido DAO to life, backed by a diverse coalition of financial giants and astute angel investors.

Born in the nascent days of Ethereum’s Proof-of-Stake (PoS) transition (December 2020), Lido DAO emerged as a revolutionary force. Frustrated by the limitations of traditional staking – illiquidity and high minimums – Lido’s founders dared to dream of a more accessible and flexible solution.

Enter liquid staking: a groundbreaking concept where users stake their assets (initially ETH) and receive equivalent liquid tokens (stETH) that freely flow through the DeFi ecosystem. This innovation unlocked a treasure trove of possibilities: users could earn staking rewards while simultaneously participating in lending, liquidity pools, and other yield-generating strategies.

The impact was immediate. Lido exploded in popularity, becoming the go-to destination for crypto enthusiasts seeking to maximize their PoS potential. stETH, the digital embodiment of Lido’s magic, rocketed into the DeFi spotlight, fueling a wave of creative protocols and strategies.

But Lido’s ambition transcended Ethereum. Recognizing the diverse landscape of PoS blockchains, it embarked on a multi-chain odyssey, adding support for Polygon, Solana, and Polkadot, offering its revolutionary liquidity to a wider audience. This expansion wasn’t just about numbers; it solidified Lido’s position as a decentralized maestro, orchestrating staking across the blockchain symphony.

Tokenomics

Lido DAO revolves around two key tokens:

- Lido Staked Ether (stETH): Your gateway to earning staking rewards on your Ether. Deposit ETH, receive stETH that tracks its value plus accrued rewards, and redeem for ETH once withdrawals are enabled on Ethereum 2.0.

- Lido DAO Token (LDO): Your voice and stake in the DAO. LDO grants voting rights on crucial decisions like fees, supported assets, and treasury management, while sharing a slice of the protocol’s fees.

Lido DAO’s Key Metrics at a Glance (as of Dec 18, 2023):

- Market Cap: $1.86 Billion

- 24h Trading Vol: $55.7 Million

- FDV: $2.09 Billion (Fully Diluted Valuation)

- TVL: $19.87 Billion (Total Value Locked)

- FDV/TVL Ratio: 0.11

- Circulating Supply: 889.6 MillionLDO

- Total Supply: 1 Billion LDO

- Max Supply: 1 Billion LDO

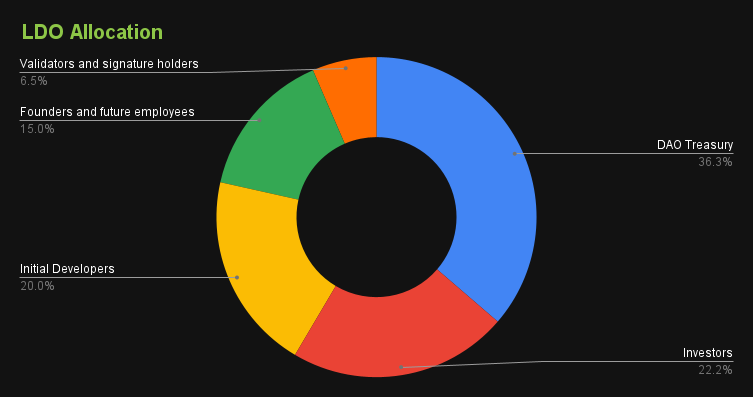

The distribution of LDO allocates a total of 36.3% to the DAO treasury, 22.2% to investors with 19.8% unlocked and 2.38% locked, 15% to the founders with 15% unlocked, 10% to initial developers, 10% to Venture Round with 10% unlocked and 6.5% to Validators with 6.5% Unlocked.

Beyond ETH: Lido’s reach extends to other cryptocurrencies like Solana, Polygon, and Polkadot. Stake your SOL, MATIC, or DOT, and receive corresponding tokenized versions like stSOL, stMATIC, and stDOT that function similarly to sstETH.

LDO Token use cases

- Governance: LDO is the core governance token of Lido DAO, granting holders voting rights on crucial decisions like fee structures, protocol upgrades, and strategic partnerships. By participating in proposals, LDO holders directly influence the future of Lido and potentially impact their investment.

- Fee Sharing: A portion of Lido’s generated fees are distributed proportionally to LDO stakers. This incentivizes active token participation and aligns community interests with the protocol’s success.

- Staking Incentives: LDO can be staked within the Lido protocol to earn additional rewards on top of regular staking yield. This encourages long-term commitment and fosters a dedicated LDO holder base.

- Decentralized Finance (DeFi) Integration: LDO’s compatibility with DeFi opens doors for advanced yield-generating strategies. Users can leverage LDO in liquidity pools, lending protocols, and other DeFi applications to maximize their returns.

- Speculation: Like any other cryptocurrency, LDO’s price fluctuates based on market demand and sentiment. Investors can speculate on the future value of LDO, expecting its price to appreciate as Lido’s adoption and influence grow.

stEth Use Cases

- Liquid Staking: stETH represents staked ETH held within the Lido protocol. Unlike directly staking on the Ethereum 2.0 deposit contract, stETH provides immediate liquidity, allowing users to trade, transfer, and utilize it in DeFi applications without waiting for withdrawals to be enabled.

- Lending and Borrowing: stETH can be used as collateral for borrowing other crypto assets on DeFi platforms. This allows users to access additional capital while still earning staking rewards on their ETH.

- Yield Farming: stETH’s integration with DeFi opens the door for advanced yield farming strategies. Users can deposit stETH in liquidity pools, lending protocols, and other DeFi applications to earn compounded returns on both staking rewards and DeFi activities.

- Derivatives and Options: The existence of stETH facilitates the creation of various derivatives and options contracts. This allows users to take speculative positions on Ethereum’s future price or hedge their existing ETH holdings.

- Access to Ethereum 2.0: Once withdrawals are enabled on Ethereum 2.0, stETH can be redeemed for regular ETH. This provides a convenient entry point for those who want to participate in Ethereum’s staking ecosystem without committing their ETH for an extended period.

Features and Functionalities

Within the burgeoning landscape of Ethereum liquid staking, Lido emerges with two key building blocks: LDO and stETH. Each token plays a distinct, yet interconnected role in shaping Lido’s ecosystem.

LDO, the lifeblood of governance, empowers its holders to actively guide Lido’s trajectory. Through proposals and voting rights, LDO champions decentralized and inclusive decision-making, ensuring Lido’s path forward reflects the collective voice of its stakeholders.

stETH, the embodiment of staked ETH, represents a user’s contribution to the protocol and unlocks the rewards generated by the Ethereum network. Beyond simply accruing yield, stETH opens doors to diverse DeFi opportunities. Integration with platforms like Yearn, Curve, Maker, and Aave allows stETH holders to leverage rebasable token functionalities and amplify their gains.

Aligning the aspirations of the Lido DAO with the interests of stETH holders is paramount. Lido achieves this through a meticulously crafted dual governance framework, featuring several key pillars:

– Timelocked execution: A deliberate pause between LDO vote passage and implementation creates space for thoughtful review and refinement.

– Veto power: stETH holders act as vigilant watchdogs, wielding the power to veto potentially harmful proposals through a dedicated mechanism.

– Rogue token mitigation: To deter malicious proposals, the framework allows for burning or expropriation of LDO tokens following successful vetoes.

– Veto abuse prevention: Stringent safeguards like extended timelocks or substantial stETH requirements prevent frivolous or manipulative vetoes.

Furthermore, LDO and stETH diverge in their supply dynamics, influencing their price behavior. LDO boasts a fixed 1 billion token supply distributed strategically, considering variables like stake size, node operator fees, and treasury management. In contrast, stETH’s initial supply mirrors deposited ETH, dynamically adjusting daily based on Ethereum network rewards.

Through their distinctive, yet synergistic roles, LDO and stETH empower users to become active participants in Ethereum’s evolution, while unlocking innovative yield-generating opportunities.

Advantages of Lido DAO

– Democratizing Staking: Lido empowers anyone, regardless of technical expertise or capital requirements, to participate in Ethereum staking. This breaks down traditional barriers and opens up lucrative staking rewards to a wider audience.

– Liquidity through stETH: Unlike traditional staking, Lido offers “stETH,” a liquid derivative token representing your staked ETH. You can trade, lend, or earn additional yield on stETH in DeFi platforms while your ETH continues to accrue staking rewards.

– Decentralized Powerhouse: Lido DAO thrives on a community-driven governance model. LDO token holders actively shape the protocol’s future through proposals and voting, fostering transparency and accountability.

– Innovation Engine: Lido actively researches and implements cutting-edge solutions within the staking space. This commitment to innovation ensures users benefit from the latest advancements and optimizes rewards.

– Security as a Priority: Lido employs rigorous security measures, including multi-signature wallets, distributed node operators, and regular audits, to safeguard user funds and ensure protocol integrity.

– Diversification Avenue: Lido DAO opens doors to various DeFi integrations, allowing users to diversify their portfolios and explore yield-generating strategies beyond simple staking.

– Future-Proof Ecosystem: Lido actively adapts to the evolving Ethereum landscape, integrating with Layer 2 scaling solutions and other cutting-edge technologies to remain relevant and secure.

– Community Focus: Lido fosters a vibrant and supportive community where users can learn, share knowledge, and contribute to the protocol’s growth. This collaborative spirit strengthens Lido’s foundation and fuels its development.

Risks and Challenges of Lido DAO

- Smart Contract Vulnerability: One critical bug in Lido’s smart contracts could lead to the loss of millions of dollars worth of users’ funds. This is a constant threat in the fast-paced world of DeFi, and even thorough audits can’t guarantee perfect security.

- Centralization Creep: While Lido champions decentralized governance, the concentration of LDO tokens in the hands of a few whales could undermine the DAO’s democratic principles. This could lead to proposals favoring the interests of large holders over the broader community.

- stETH Price Volatility: While stETH offers liquidity, its price may not perfectly track the underlying ETH due to withdrawal limitations and market fluctuations. This volatility can discourage some users and introduce an element of uncertainty in their returns.

- Regulatory Uncertainty: The crypto landscape is still evolving, and regulatory scrutiny is increasing. Lido could face potential legal challenges and restrictions depending on how regulators classify its operations and stETH’s nature.

- Network Disruption: If the Ethereum network suffers major disruptions, staking rewards could be halted, and stETH withdrawals might be temporarily suspended.

How Lido DAO Addresses Challenges

- Security Focus: Lido prioritizes security by employing rigorous audits, bug bounty programs, and multi-signature wallets to minimize vulnerabilities. Additionally, continuous monitoring and proactive updates further strengthen the infrastructure.

- Decentralization Efforts: To counter centralization, Lido incentivizes staking across diverse validator nodes and encourages broader LDO distribution through DAO initiatives. This empowers a wider range of users to participate in governance and reduces the influence of large token holders.

- Liquidity Enhancements: Lido actively integrates with DeFi platforms like Curve and Aave, enabling stETH borrowing and lending functionalities. This improves liquidity, reduces price volatility, and offers users additional yield opportunities.

- Regulatory Engagement: Lido proactively engages with regulatory bodies and implements compliance measures to ensure legal clarity and mitigate potential risks. This proactive approach aims to avoid regulatory hurdles and fosters a healthy relationship with authorities.

- Diversification & Contingency Plans: Lido distributes its stake across multiple validator nodes to lessen the impact of node-specific technical issues or downtime. Additionally, contingency plans outline procedures for managing network disruptions and minimizing user losses in such scenarios.

How is Lido DAO Secured

Lido DAO’s security, rather than residing in a singular framework, resembles a woven tapestry. Instead of one dominant thread, multiple elements intertwine to form a robust security posture. Let’s explore these interwoven layers:

Smart Contract Fortification:

- Open-source and audited: Lido’s code is publicly available, allowing constant scrutiny by the security community. Renowned auditors like Trail of Bits and ConsenSys Diligence regularly scrutinize the code, minimizing vulnerabilities.

- Bug bounty program: A proactive approach incentivizes ethical hackers to find and report potential bugs, further bolstering the code’s resilience.

Decentralized Validator Network:

- Multiple node operators: Lido spreads its ETH across diverse, professional, and geographically distributed node operators. This mitigates the risk of a single operator getting compromised or experiencing technical issues.

- Slashing risk mitigation: Insurance covers a portion of potential slashing penalties, protecting users from severe losses while incentivizing node operators to maintain proper uptime and performance.

Community-driven Governance:

- DAO structure: Lido DAO’s decentralized governance empowers token holders to vote on critical decisions, fostering transparency and community ownership of the platform’s security measures.

- Continuous improvement: The DAO’s active and engaged community fosters ongoing research and development, ensuring Lido evolves and adapts to emerging threats.

Transparency and Risk Awareness:

- Regular security updates: Lido proactively communicates potential vulnerabilities and mitigation efforts through official channels, keeping users informed and building trust.

- Risk analysis and education: Lido provides clear documentation and resources outlining potential risks associated with staking and the platform itself, empowering users to make informed decisions.

Conclusion

Lido DAO emerges as a unique hybrid in the crypto landscape. It’s a Decentralized Autonomous Organization (DAO) offering liquid staking, essentially removing technical hurdles for those seeking passive income from their digital assets. Imagine a community-run bank built on blockchain, dedicated to simplifying staking rewards.

Lido DAO empowers regular users with accessible staking, fosters community governance through its token (LDO), and carves its niche in the ever-evolving DeFi ecosystem. Whether it reigns supreme in the long run remains to be seen, but its innovative approach certainly deserves a closer look.

References

https://lido.fi/

https://docs.lido.fi/lido-dao/

https://coinmarketcap.com/currencies/lido-dao/

Investing In Lido DAO (LDO) – Everything You Need to Know

Lido DAO