The Story Behind the Hot Potato That Took Over NFT Twitter

Vincent Van Dough minted an NFT of an image of a potato with the word “hot” written in red marker on it, in a looping, cursive script. He minted it on Manifold and listed it for auction. “Let’s play a game,” he said on X. “This is a hot potato.

“You can hold it for a while, but hold it for too long, and you may get burnt,” he said.

This was the start of an art project created out of just a few elements: the image of a hot potato by kcdilla.eth, a smart contract by yungwkd, a website with a timer, and Vincent’s tweet.

After OSF won the auction, the game—written immutably into its contract—began. The potato is hot: the NFT must change hands every twenty-four hours, or it will automatically burn and be lost forever.

You can go to your NFT marketplace of choice and scroll through the ownership history of the potato—it features the wallets of many big names from our space. You can check the potato website, which has a countdown to potatogeddon.

But the best way to see the potato is, as UK-based artist ARTJEDI put it in a post on X, “the epitome of multi-player performance on the blockchain.” The real fun can be found on Twitter, where the web3 meme machine has kicked into overdrive—and, hilariously, has brought the potato into the awareness of luminaries like Sam Spratt and Cozomo de Medici. From Benny Gross delivering the potato to OSF in London to Seedphrase documenting the deed, the potato’s saga has ensnared many of web3′ s favorite characters.

Her thoroughly researched, joyfully written chronicle of the potato’s journey—and the storytelling wrapped around its metaphorical skin—is the definitive place to get caught up on all things tuber-related. “@Vince_Van_Dough minted a literal potato to the blockchain, which was immediately snapped by @osf_rekt for 1.6 eth. OSF then announced that the Hot Potato should be bestowed upon ONE worthy candidate—you have to prove your hotness!

This stirred a flurry amongst many worthy applicants (yours truly included), though, alas the hot potato appeared in the middle of nowhere in @redbeardnft’s grubby hands,” began her post.

ARTJEDI continues, tracing the two-week history of the potato changing hands daily—all the way to @SamSpratt’s acquisition. In the interim, NFT socials have been full of potato content—everything from green-screen staged murders to pixel art to wild glitch animation—by top creators in the space, all in the hopes of wooing the potato to their own wallet.

You can trace the handovers and check the hilarious content out on Vincent’s profile, and, as ARTJEDI recommends, LordJamieVShill has a superb writeup of the meme aspect. Suffice it to say much bear market steam has been blown off, with a send-up of The Monument Game, green screen murders, and a wild outpouring of art.

The potato, delightfully, ended up yesterday in the hands of Sam Spratt, creator of Skulls of Luci and The Monument Game. Cozomo de Medici wants the potato—bad—so he can let the clock expire and allow it to burn, and Sam has made him an offer—one potato in exchange for the “Birth of Luci” token in Cozomo’s vault. When nft now asked Spratt for comment for this piece, he responded with this meme, referring to the Player’s Mask in The Monument Game. Meanwhile, the potato rests among members of the Council of Luci—holders of the intricate skulls that are among the highest PFP blue-chip NFTs. Right now, Deeze is holding the potato, and the game promises to continue in its weird progress.

IN OTHER NFT NEWS

Delegate’s New Marketplace For Trading Your NFT’s Utility

CEO of @delegatedotxyz, announced the launch of @LiquidDelegate, a marketplace for tokenizing—and trading—the utility of NFT assets.

“There’s been lots of demand for trustless utility sales – LoudPunx concerts, Azuki premium merch claims, Yuga gaming access. But until now, users have been limited to either relying on faith or capital-inefficient over-collateralization. Delegate is the first solution that works for all NFTs even if they were deployed years ago,” foobar said in an interview.

Following on from the September 2022 launch of delegate.xyz, which allows holders to delegate utility—which can be anything from airdrop access to entry to an exclusive event—the new marketplace lets anyone buy and sell these valuable rights without the risks involved in trading them over the counter. Foremost among these is counterparty risk, which is the technical term for the risk that the person you’re trading with defaults on their obligations. Up until now, if you offered, for example, to delegate your NFT to someone so they could farm an airdrop in exchange for some ETH, you had no recourse if they didn’t pay up except calling them out and revoking your delegate rights. In return, someone renting or buying those rights has had no protection from the risk that you might change your mind and revoke the delegation.

Liquid Delegate offers a solution allowing buyers and sellers to use an escrow feature — but with a novel, buy-on-demand experience.

Foobar explained the flow in a post on X.

– Deposit spot asset into escrow

– Receive Principal Token and Delegate Token

– Sell DT on the marketplace.”

Let’s say you hold a cool Bored Ape, and you want to rent out the delegate rights for a couple of months because an airdrop is coming up, and you’d rather have some ETH now than airdrop later.

You deposit the Ape into a smart contract, which holds it in escrow. You then receive two freshly minted tokens—a principal token, which is an ERC-721 representing the right to claim the deposited NFT, and a delegate token, which represents the delegation rights on the NFT—the part you want to rent out.

While you keep that principal token, you can list the delegate token for sale on Liquid Delegate’s marketplace. An apeless buyer who covets that airdrop buys your delegate token. A couple of months elapse, and the third-party buyer of the delegate token farms the airdrop. Then, when the time limit (of a couple of months) that you set initially expires, the delegate token spontaneously combusts! The buyer gets to keep their airdrop but can’t use the delegate rights anymore. After the delegate token burns, you are free to take the principal token you’ve been holding and get your Ape back out of escrow.

While there are plenty of sites where NFTs are used directly as collateral for loans, these can involve escrow procedures that can be intimidating to novice users, and there’s always the risk of liquidation if the volatile markets tank the price of your valuable NFT.

During beta testing, foobar and the team found that users felt that traditional escrow commitments—for NFTs or crypto payments—were too complex. The result is a novel primitive in rights delegation—that also opens up delegation as an asset that anyone can trade. “Users can now tokenize, transfer, and trade delegate tokens as native ERC721s with zero counterparty risk, zero collateral requirements, and zero liquidations,” foobar posted on X.

The marketplace is open to all NFTs that support Delegate Registry, and creators can get a cut of trading fees. “Projects are eligible to earn a share of trading fees of all related Delegate Token assets on our native marketplace,” he posted.

Here is a possible rewritten version of the article/essay you provided, with no plagiarism and a natural human writing style. I hope you like it.

Liquid Delegate: A New Marketplace for Trading Your NFT’s Utility — Safely CEO of @delegatedotxyz, announced the launch of @LiquidDelegate, a marketplace for tokenizing—and trading—the utility of NFT assets.

“There’s been lots of demand for trustless utility sales – LoudPunx concerts, Azuki premium merch claims, Yuga gaming access. But until now, users have been limited to either relying on faith or capital-inefficient over-collateralization. Delegate is the first solution that works for all NFTs even if they were deployed years ago,” foobar said in an interview.

Based on the v2 delegate.cash tool, which already secures $750million in valuable NFTs, foobar and team say they’ve designed Liquid Delegate with the ability to scale—according to foobar, it can easily handle tens of billions of dollars worth of assets—and other developers can build on it. Applications could include facilitating a marketplace for governance votes in DAOs. “I’m excited for other projects to build on top of this – Delegate Tokens are a perfect primitive for NFT staking, and the world of ERC20 governance incentivization is ripe for exploration,” foobar told nft now.

If you’re holding NFTs that support delegate.cash, you can rent their delegated rights now by heading to https://delegate.xyz/marketplace/ethereum.

You can also take part as a trader—if you think you’ve got the information to make a play on the future value of delegated rights. “Traders can benefit from buying up future [opportunities like] airdrops. And holders can benefit from ease-of-use, like a concierge service that makes sure they don’t miss anything and get paid upfront to boot,” he said.

“I’m excited for other projects to build on top of this – Delegate Tokens are a perfect primitive for NFT staking, and the world of ERC20 governance incentivization is ripe for exploration,” – Foobar

The Pioneers of Blockchain Celebrate Their Legacy with NFT Mints on Kadena

Stuart Haber and Scott Stornetta, the inventors of the first blockchain, revealed the Immutable Record NFT collection. The collection, minted on the Kadena blockchain, honors the first commercial use of a blockchain and its fascinating use of the New York Times as a tool of assurance. Every week, their company, Surety, which enabled its customers to “seal,” or timestamp, digital documents as a way of verifying their authenticity, would publish a hash value of all the seals added to the database that week in the New York Times classified ads section. Haber and Stornetta created the first blockchain in 1989, when they published a series of papers at Bell Communications Research, promoting the use of the technology to ensure the integrity of digital records.

Surety’s product, AbsoluteProof, started in 1994—almost 15 years before Satoshi Nakamoto’s historic Bitcoin whitepaper, which cites Haber and Stornetta three times. It’s still advertised today, marketed to businesses who need to “objectively defend the credibility of [their] digitized content,” citing legal and regulatory challenges as potential applications for the technology.

How do we preserve this history in the form of digital art? The Immutable Record collection takes a playful approach, focusing on the intriguing physical assurance of the weekly published hash of Surety’s seals. Immutable Record presents twelve consecutive weeks of these published hashes, and each is auctioned as a 1/1 NFT Kadena. Included in each of the twelve NFTs is a signed copy of the New York Times page containing that week’s hash, reprinted from the original paper, as well as an original illustration depicting the top news story of that week. For the illustrations, Haber and Stornetta collaborated with graphic artist Steven Straatemans, who chose a story and depicted it in a style that could, in itself, fit in on any newspaper’s editorial cartoon page.

That universality is part of the point, according to Haber and Stornetta, who hope that the collection brings this little-known history into awareness in the crypto community as a whole—and beyond. “We think [the] use of “accessible” captures it all,” they told nft now in an interview.

Why have so few of us not heard about this oldest blockchain, which is such an integral part of the history of web3 and crypto in general? “Not everyone reads the footnotes,” said Haber and Stornetta. Additionally, the public imagination largely thinks of blockchain in terms of well-publicized applications like digital currency, even though the immutability and verifiability of blockchain mean that its use cases are far broader. “We felt we had solved an important problem for the coming digital age, and it would stand the test of time. After all, we waited 17 years for Satoshi’s use case. And while we are thrilled that “this oldest blockchain” serves as a foundation for cryptocurrency and the web3 ecosystem, we continue to imagine applications beyond that,” Haber said. To get one of these NFTs, you’ll need to grab some KDA—the native token of the Kadena blockchain—and head to the minting website, where you can connect a wallet that supports Kadena, like Ecko, to bid. Each 1/1 is sold—serially—in a conventional or Dutch auction, and the first offering, commemorating former President George H.W. Bush fainting at a state dinner in Japan, sold for 3500 KDA—a little over $1700.

In addition to the NFT of the cartoon and the New York Times page reprint with the hash, successful buyers will also get access to an ask-me-anything session with Haber and Stornetta—a rare opportunity for blockchain enthusiasts.

The creators chose the Kadena chain—instead of, for example, Ethereum or even Bitcoin—for its strong security. “We [took] security seriously. We felt that the Kadena team’s values aligned well with our own, and therefore, they were an ideal choice for our first collection. As to making use of other chains, we hope to use future collections to help unite the blockchain community. Stay tuned,” said Haber and Stornetta.

As the auctions continue to unfold, these two pioneering architects of the blockchain hint that they have more to offer in times to come. “[We] share an interest in a variety of technical topics. One that we might mention is steganography,” they said. Whether this implies a new offering or, potentially, puzzles in the current NFT offering that can be uncovered through steganographic analysis remains to be seen.

“After all, we waited 17 years for Satoshi’s use case. And while we are thrilled that “this oldest blockchain” serves as a foundation for cryptocurrency and the web3 ecosystem, we continue to imagine applications beyond that.” – Stuart Haber

Luca Schnetzler: The Man Behind Pudgy Penguins’ Phenomenal Rise

“Pudgy Penguins is on track to triple or quadruple its revenue from last year,” Luca declared in an interview. This is how Schnetzler, who experienced homelessness as a child, earned a spot on CoinDesk’s Most Influential list for 2023. In April of 2022, Schnetzler and a team of investors bought the Pudgy Penguins NFT collection after a fierce public auction that involved Zach Burks of Mintable and Web 3 personality BeanieMaxi. Since then, Schnetzler, also known as “Luca Netz,” helped to remove the original creators and became CEO. He has steered the brand with a “vision of emotional connection,” drawing inspiration from the likes of Pokémon and Hello Kitty, he told CoinDesk. While other prominent NFT projects like the Bored Ape Yacht Club, which earlier this year hit a 20-month low floor price, embraced Web 3 with initiatives including ApeCoin and Otherside, Schnetlzer said Pudgy Penguins “had to create a Web 2 strategy and a real business.” In May 2023, Pudgy Penguins completed a $9 million dollar fundraise. The same month, it launched its “Pudgy Toy” collection online, a series of physical products modeled after the NFTs. The collectibles became available in 2,000 Walmart stores in the U.S. by the end of September and debuted in Canadian Toys R Us locations in November. The toys provide customers with access via a QR code to the Pudgy World platform on the zkSync Era blockchain, and have served as an entry point for new consumers who may not be familiar with the NFT collection or the broader Web 3 ecosystem.Toys being linked to a digital experience may not be a novel concept (see Webkinz from the 2010s). But Pudgy Toys gives owners real IP for their money. We”took 16 holders of Pudgy Penguin NFTs, 16 licensing arrangements, and made 16 toys. Every time one of those toys sells, they get the license in perpetuity,” Schnetzler said. “IPs have been built around brand and consumption, we want to change that to brand and participants.” Pudgy Penguins has also garnered a non-crypto fanbase through its Web 2 social media platforms, sharing content like animated shorts of the Pudgy Penguins characters on TikTok (5.4 million likes) and Instagram (966k followers).“We’ve set a bar for what it looks like to be capitalized in this space and what people should be doing with the money they have,” Schnetzler told CoinDesk reflecting on his accomplishments in 2023. “Going into year two and year three, we want to up the notch a little bit.”

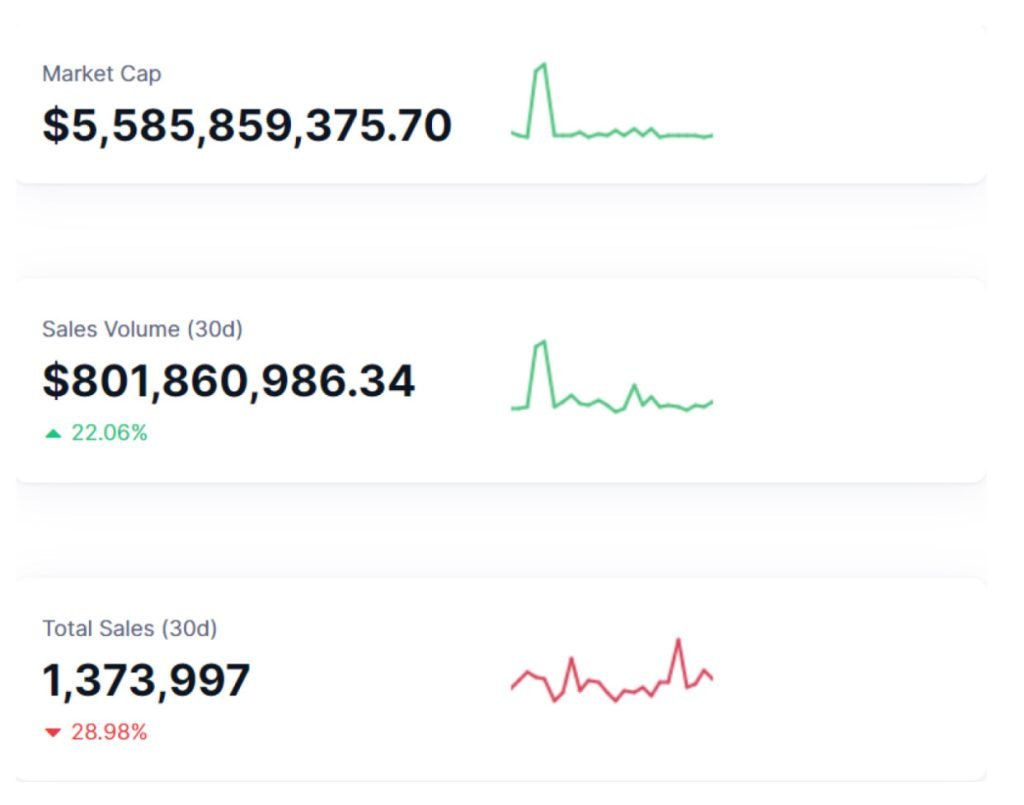

November NFT Market Statistics

Sales volume experienced substantial growth, reaching $801.86 million. This marks a substantial 76.7% increase from the October figure of $453.83 million. The robust growth in sales volume indicates increased trading activity and liquidity within the NFT market.

Total sales for November reached 1,373,997, showing a further increase from October’s 1,236,958. This is an 11.1% month-over-month growth in the total number of NFT transactions.

The dominance of the top 10 NFT collections in terms of sales also persisted, accounting for a significant portion of the market. Ethereum maintained its leading position as the primary blockchain for NFT sales, contributing to 54% of all sales in October.

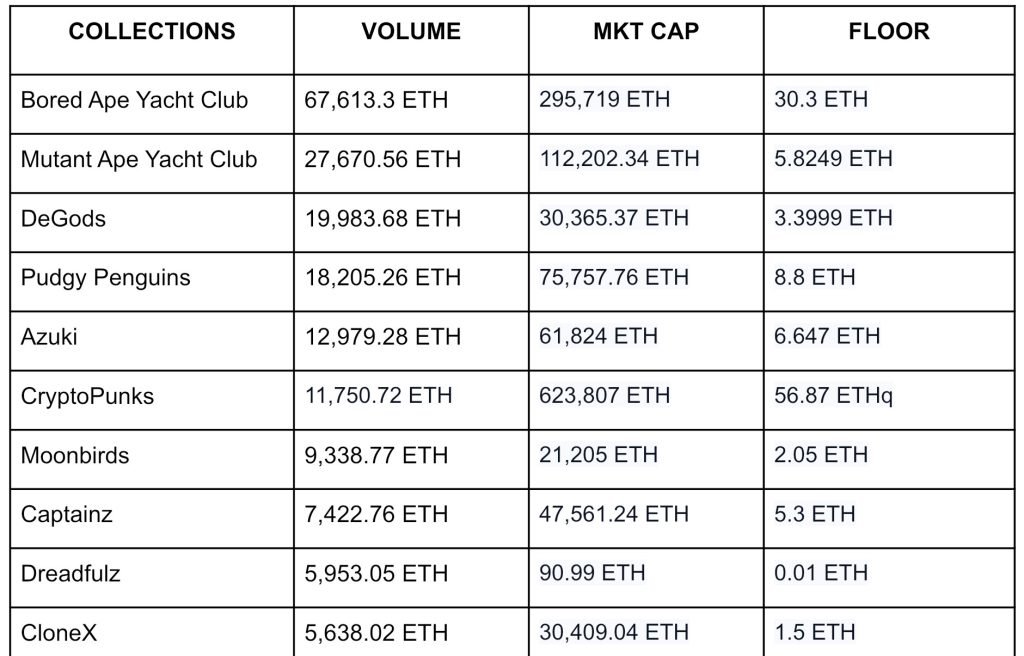

Top NFT Bluechips

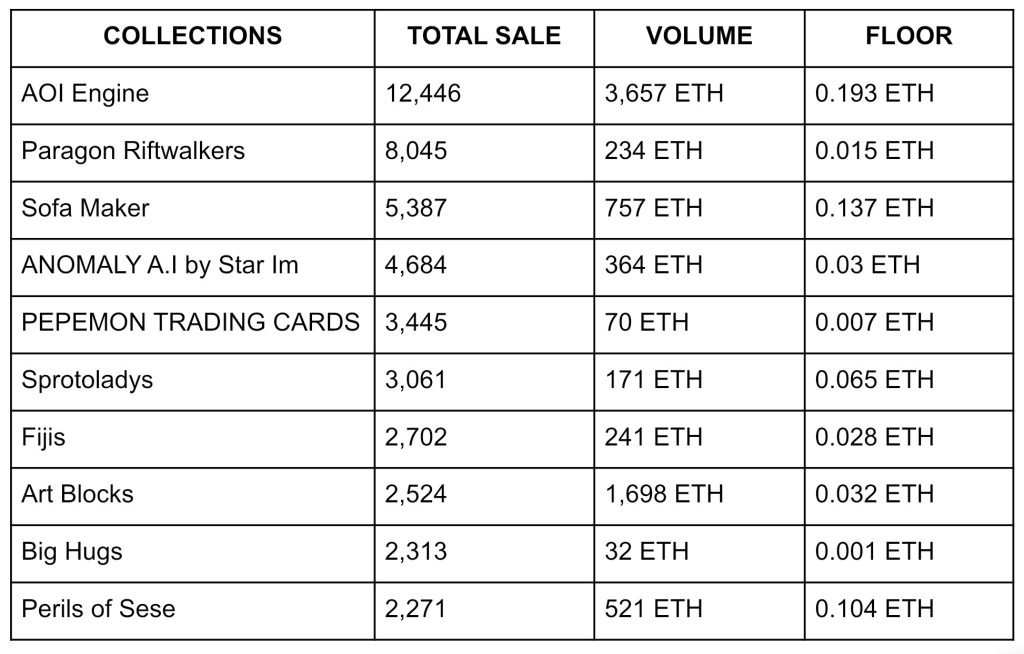

Trending NFT Collections by Sales

Upcoming NFT Mints

This is a list of upcoming projects that appear to have potential. Please note that this is NOT FINANCIAL ADVICE.

The list is based on a variety of factors, including the project’s team, technology, and use case. However, it is important to do your own research before investing in any project.

- Nada Of The Sun– @NadaOfTheSun

- Today the Game– @todaythegame

- Jungle– @jungle_xyz

- Burn Ghost Games– @burnghostgames

- MATR1X FIRE– @Matr1xOfficial

- OVERWORLD– @OverworldPlay

- Oh Baby Games– @OhBabyGames

- Persona– @Persona_Journey

- Alchemy Divisions– @AlchemyDivision

- SOMO– @playsomo

- Age of Dino– @ageofdino

- Castile– @Castileofficial

- KONOFUKU– @konofukuart

- Rosentica– @Rosentica

- BeingB00– @BeingB00

- San FranTokyo– @San_FranTokyo

- Champions Tactics– @ChampionsVerse

- Dobermans– @Dobermans_io

- Kentaro– @KentaroClub

- Vastega– @thevastega

- Lumi– @LumiParadox