Introduction

Orca is an automated market maker, running on the Solana blockchain, focusing mainly on user friendliness. It prides itself as the easiest place to exchange one’s cryptocurrency in the most affordable and convenient way in the Solana verse. Users can also earn token emissions and trading fees through its liquidity and concentrated liquidity pools.

Overview

Orca is a decentralized finance platform that aims to make DeFi accessible and user friendly. It provides liquidity pools for users to trade and swap cryptocurrencies. Orca also offers an SDK for game developers to create blockchain games. The platform is powered by the Solana blockchain and is focused on providing a user-friendly and inclusive DeFi experience.

Orca functions by offering participants a way to swap tokens and earn a share of trading fees via the platform’s trading pools, known as aquafarms. This approach to pooling asset liquidity which can then be used for trading was first popularized by decentralized exchanges on the Ethereum network such as Uniswap.

Background

Orca launched in February 2021 and was self-funded with a grant from the Solana Foundation. The initial tokens available for trading were SOL, BTC, ETH, USDC, USDT, and RAY, but in the meantime more tokens have been added. The project was launched without a token. Once there was sufficient organic trading activity, the ORCA governance token was issued on 9 August 2021. At this point the Orca protocol facilitated over $400 million in trades. The initial circulating supply of 5.25 million tokens was mostly distributed to existing liquidity providers.

The Orca Impact Fund was established to fight climate change and save the oceans. Concretely, a part of the trading fees go to the Orca Impact Fund, which in turn then is donated to support he cause. In August 2021, a vote was held on the allocation of a first donation to a nonprofit.

In September 2021, Orca raised $18 million in a series A round, which was led by Three Arrows Capital, Polychain Capital and Placeholder VC. The raised capital will be used to create more awareness, expand the team and further develop platform. The future plans include the integration of Wormhole, which is a cross-chain bridge between Solana and Ethereum.

Yutaro Mori, aka rawfalafel, is one of the Co founders of Orca. He is an industry trained software engineer who foresaw an opportunity in cryptocurrency during the 2017 bull market and quit his 9 to 5 software job. he earned his DeFi stripes as a contributor to the Eth 2.0 Golang client and an engineer at UMA

Grace Kwan, aka Ori, is Orca’s other Co founder and Head of Product. She has earned her B.S and M.S. in Computer Science at Stanford. She worked as a software engineer at Coursera and an interaction designer at IDEO Tokyo. She specializes in turning complex technical systems into simpler products which users love.

Michael Hwang, aka tmoc, is Orca’s first employee. His deep understanding of the crypto space lies in his degen DNA and he has experience at both small startups and software giants such as Google.

Milan Patel, aka milan, is Orca’s marketing mastermind. After graduating with a degree in Economics and International Development from Georgetown, he worked for the big banks at McKinsey.

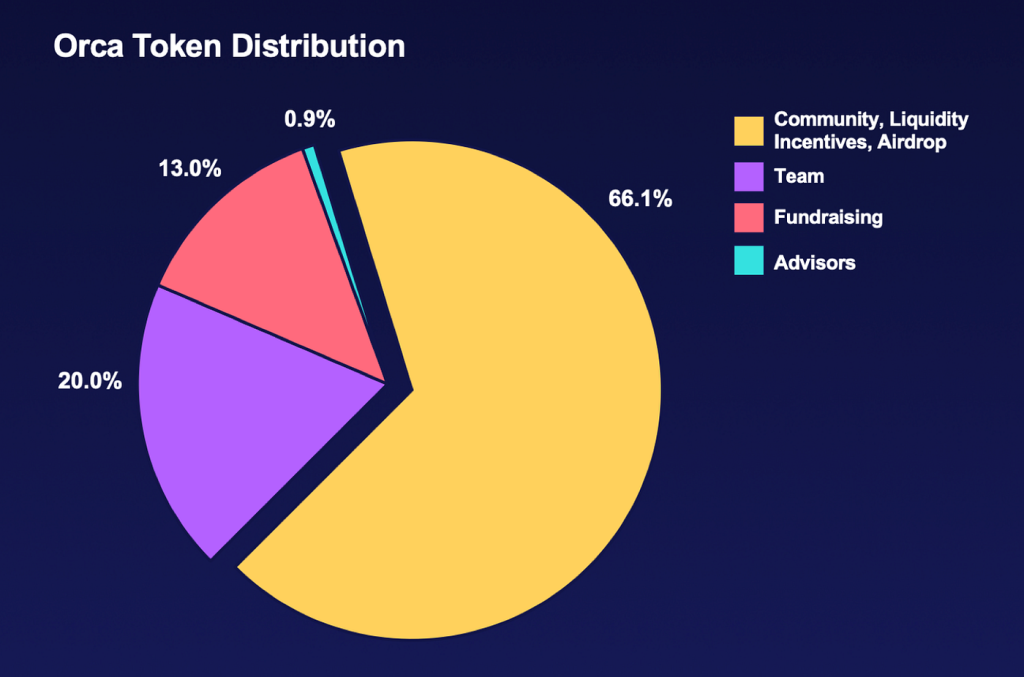

Tokenomics

ORCA rewards are earned by liquidity providers along with a share of trading fees. ORCA’s primary function is as a governance token that allows stakeholders to steer the project through voting rights.

Orca (ORCA) has a total supply of 100,000,000 ORCA coins. The top cryptocurrency exchanges for trading Orca stock are currently Gate.io, XT.COM, Coinbase Exchange, Crypto.com Exchange, and Kraken.

Use cases of ORCA

Utility: Liquidity providers earn a portion of fees in exchange for the opportunity cost of providing capital or impermanent loss.

Governance: Currently, 0.3% of all trades on product pools go to liquidity providers. Once the governance token is issued, the distribution will be adjusted as follows:

0.25% for Liquidity Providers.

0.04% for Orca Treasury.

0.01% for Impact Fund.

Features and Functionality

Orca is a decentralised exchange for swapping, farming, and building on Solana and is one of the first general purpose automated market makers launched on the blockchain. Through its user friendly interface, Orca hopes to make DeFi accessible to everyday traders. ORCA is the platform’s governance token.

Some afvantages of ORCA include:

Extremely low fees

Exceptional user interface

Lets liquidity providers choose a price range through whirlpools.

Risks and Challenges

- Solana’s exposure to FTX jeopardizes Orca’s future.

- Only supports Solana based assets.

- Many pools are severely lacking liquidity

Conclusion

Orca is an Automated Market maker based decentralized exchange (DEX) built on top of the Solana blockchain.

Taking full advantage of Solana’s quick transactions and low fees, Orca was among the first AMMs launched on the Proof of Stake (PoS) platform. With its intuitive interface, Orca offers a user-friendly place to exchange cryptocurrencies on Solana.

Orca uses an ongoing feedback loop to listen to the concerns of users and updates its protocol around this feedback. Orca has thus created an intuitive DEX that provides a simple yet powerful experience for novice and experienced traders alike.

The governance token, ORCA, is the native cryptocurrency of the Orca decentralized exchange and is linked to the trading activity of the DEX itself.