Introduction

Raydium is an automated market maker (AMM) and decentralized exchange (DEX) that leverages the speed, scalability and low fees of Solana, as well as the liquidity and order flow of Serum, the first decentralized exchange built on Solana. Raydium offers users and projects a suite of features and benefits, such as light-speed swaps, next-level liquidity, friction-less yield, and a launchpad for new Solana projects. In this article, we will explore the project overview, background, tokenomics, features and functionality, roadmap and future developments, risks and challenges, and conclusion of Raydium.

Overview

Raydium is an AMM and DEX built on the Solana blockchain for the Serum DEX. Unlike any other AMMs, Raydium provides on-chain liquidity to a central limit order book, meaning that funds deposited into Raydium are converted into limit orders which sit on Serum’s order books. This way, Raydium’s liquidity providers (LPs) have access to the order flow and liquidity of the Serum ecosystem, and vice versa. Raydium also determines the best swap route among all pools in order to provide the best price for users, and executes accordingly. Raydium enables the permissionless creation of liquidity pools and farms so projects can launch and bootstrap liquidity in a decentralized manner. Raydium also hosts a launchpad called AcceleRaytor, where users can participate in initial DEX offerings (IDOs) of new Solana projects and drive initial liquidity.

Raydium is built on Solana, a high-performance blockchain that can process over 50,000 transactions per second (TPS) with sub-second finality and minimal fees. Solana uses a novel consensus mechanism called Proof of History (PoH), which encodes the passage of time into the blockchain, creating a verifiable and trustless source of time for the network. Solana also uses a leader-based Proof of Stake (PoS) consensus, where validators stake tokens to secure the network and earn rewards. Solana supports smart contracts and decentralized applications (DApps) through its own programming language called Sealevel, which is designed to optimize parallel processing and scalability.

Raydium is integrated with Serum, the first DEX built on Solana. Serum is a fully decentralized and non-custodial exchange that operates on a central limit order book, where users can place and execute orders directly on the blockchain. Serum also supports cross-chain swaps, allowing users to trade assets from different blockchains, such as Bitcoin and Ethereum, through the use of interoperable protocols and bridges. Serum is governed by a decentralized autonomous organization (DAO), where token holders can vote on proposals and changes to the protocol.

Background

Raydium was founded by a team of anonymous developers who go by the pseudonyms of AlphaRay, BetaRay, GammaRay, and DeltaRay. The team has extensive experience in blockchain development, trading, and finance, and is passionate about creating the next generation of DeFi on Solana. The team is also supported by a group of advisors, including Sam Bankman-Fried, the founder and CEO of FTX and Alameda Research, and Anatoly Yakovenko, the founder and CEO of Solana.

Raydium was launched on February 21, 2021, with the initial liquidity mining program and the first AMM pool for the RAY/SRM pair. Since then, Raydium has achieved several milestones, such as:

Launching the Raydium platform and website on February 22, 2021.

Launching the first Fusion pool for the RAY/USDC pair on February 23, 2021.

Launching the first AcceleRaytor IDO for the COPE project on March 30, 2021.

Launching the Raydium governance and staking portal on April 15, 2021.

Launching the Raydium mobile app on May 10, 2021.

Launching the Raydium NFT marketplace on June 15, 2021.

Launching the Raydium DAO on July 15, 2021.

Tokenomics

RAY is the native utility token of Raydium, and it is used for the following functions:

Staking: Users can stake RAY to earn staking rewards (in RAY) and a portion of the trading fees from the Raydium platform. RAY stakers can also participate in the governance of the platform, by voting on proposals and changes.

Liquidity Mining: Users can contribute to the liquidity pools to earn liquidity mining rewards and a share of the DEX transaction fees. Users can deposit tokens into liquidity pools and earn a share of the DEX transaction fees. Users can further stake the LP tokens in the Raydium farms or Fusion farms to earn liquidity incentives, which may be paid in RAY or other project tokens.

Launchpad: Users can stake RAY for additional allocation in IDOs of new Solana projects on the AcceleRaytor launchpad. In previous IDO rounds, users that do not stake RAY may also participate in smaller amounts.

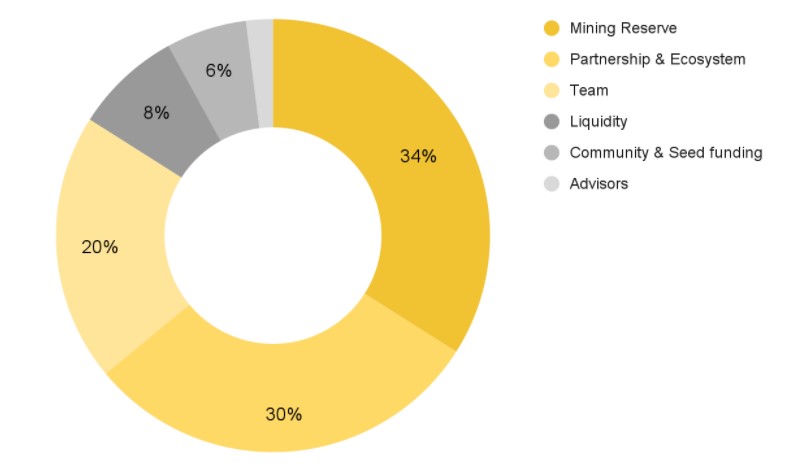

The total supply of RAY is 555,000,000 and the current circulating supply is 58,143,673 (~10.58% of the total token supply) as of November 12, 2023. The token distribution of RAY is as follows:

Team: 10% (55,500,000 RAY), vested over 2 years with a 6-month cliff.

Advisors: 5% (27,750,000 RAY), vested over 2 years with a 6-month cliff.

Ecosystem: 35% (194,250,000 RAY), allocated for partnerships, grants, airdrops, and community initiatives.

Liquidity Mining: 40% (222,000,000 RAY), allocated for liquidity incentives and rewards for LPs and stakers.

Treasury: 10% (55,500,000 RAY), reserved for future development and operations.

Users can buy, store, and trade RAY on various platforms, such as:

Raydium: Users can swap or trade RAY with other tokens on the Raydium platform, using either the AMM or the order book interface.

Serum: Users can trade RAY with other tokens on the Serum DEX, using the central limit order book and the cross-chain swaps.

FTX: Users can trade RAY with other tokens on the FTX exchange, a centralized exchange that supports Solana and Serum projects.

Binance: Users can trade RAY with other tokens on the Binance exchange, a centralized exchange that supports Solana and Serum projects.

Sollet: Users can store and manage RAY and other Solana-based tokens on Sollet, a web-based wallet that supports Solana and Serum projects.

Phantom: Users can store and manage RAY and other Solana-based tokens on Phantom, a browser extension wallet that supports Solana and Serum projects.

$RAY Market Stats

Market Cap: $85,956,483

Circulating Supply: 241,882,816 RAY

Supply Cap: 550,000,000 RAY

All-time High: $16.93 -97.9% September 12, 2021

All-time Low: $0.1343 +1343% December 29, 2022

Features and Functionality

Raydium offers a suite of features and functionality that power the evolution of DeFi on Solana, such as:

Trade: Users can swap or trade quickly and cheaply on the Raydium platform, using either the AMM or the order book interface. Raydium provides the best price for users by routing the swaps among all pools and accessing the liquidity and order flow of the Serum ecosystem.

Yield: Users can earn yield through fees and yield farms on the Raydium platform. Users can provide liquidity for any SPL token and earn a share of the DEX transaction fees. Users can also stake the LP tokens in the Raydium farms or Fusion farms and earn liquidity incentives, which may be paid in RAY or other project tokens.

Pool: Users can create liquidity pools and farms for any SPL token on the Raydium platform, without the need for permission or approval. Users can also join existing pools and farms and contribute to the liquidity of the network.

AcceleRaytor: Users can participate in IDOs of new Solana projects on the Raydium launchpad, and drive initial liquidity for the projects. Users can also stake RAY for additional allocation in the IDOs, and access exclusive projects and opportunities.

NFT: Users can create, buy, sell, and trade non-fungible tokens (NFTs) on the Raydium NFT marketplace, and access a variety of digital art and collectibles. Users can also stake RAY to earn NFT rewards and participate in NFT auctions and drops.

Some of the unique selling points and advantages of Raydium are:

Speed and Scalability: Raydium leverages the speed and scalability of Solana, which can process over 50,000 TPS with sub-second finality and minimal fees. This enables Raydium to offer a fast and smooth user experience, and support high-throughput and low-latency applications.

Ecosystem-Wide Liquidity: Raydium leverages the liquidity and order flow of Serum, which operates on a central limit order book and supports cross-chain swaps. This enables Raydium to offer the best price and execution for users, and access a larger market and network effect for the projects.

Modular and Composable Design: Raydium leverages the modular and composable design of the Cosmos SDK, which allows developers to build custom blockchains with their own features and functionalities. This enables Raydium to offer a variety of features and functionality for users and projects and developers, and foster innovation and experimentation in the DeFi space.

Roadmap and Future Developments

- Launching more liquidity pools and farms for various SPL tokens and projects on Solana.

- Launching more IDOs and partnerships on the AcceleRaytor launchpad, and supporting the growth and adoption of new Solana projects.

- Launching more NFT collections and collaborations on the Raydium NFT marketplace, and creating a vibrant and diverse NFT community.

- Launching more features and functionality on the Raydium platform, such as limit orders, margin trading, lending and borrowing, synthetic assets, and more.

- Launching more cross-chain bridges and integrations with other blockchain networks, such as Ethereum, Binance Smart Chain, Polkadot, and more.

- Launching more governance and community initiatives, such as proposals, voting, grants, airdrops, and more.

Risks, Challenges and Mitigations

Raydium faces some potential risks and challenges that may affect the project and the ecosystem, such as:

Competition: Raydium competes with other AMMs and DEXs on Solana, such as Orca, Mango, Bonfida, and more. Raydium also competes with other AMMs and DEXs on other blockchain networks, such as Uniswap, SushiSwap, PancakeSwap, and more. Raydium needs to maintain its competitive edge and differentiation by offering superior features and functionality, and attracting more users and projects to its platform.

Regulation: Raydium operates in a highly uncertain and evolving regulatory environment, where different jurisdictions may have different rules and requirements for DeFi projects and services. Raydium needs to comply with the relevant laws and regulations, and avoid any legal or regulatory issues that may affect its operations and reputation.

Security: Raydium relies on the security and reliability of the Solana blockchain and the Serum DEX, which may be subject to technical glitches, bugs, hacks, or attacks. Raydium also needs to ensure the security and safety of its own smart contracts, platform, and tokens, and prevent any loss or theft of funds or data.

Raydium addresses these challenges by:

Innovation: Raydium strives to innovate and improve its features and functionality, and offer the best user experience and value proposition for its users and projects. Raydium also leverages the innovation and collaboration of the Solana and Serum ecosystems, and integrates with the latest technologies and developments in the DeFi space.

Compliance: Raydium adheres to the best practices and standards of the DeFi industry, and follows the guidance and advice of its advisors and partners, who have extensive experience and expertise in the crypto and finance sectors. Raydium also respects the sovereignty and preferences of its users and projects, and does not impose any unnecessary restrictions or limitations on its platform.

Security: Raydium utilizes the security and robustness of the Solana blockchain and the Serum DEX, which are designed to be fast, scalable, and secure. Raydium also conducts regular audits and reviews of its smart contracts, platform, and tokens, and implements the necessary measures and safeguards to protect its funds and data.

Conclusion

Raydium is a hybrid order book AMM and DEX on Solana that aims to create the “evolution of DeFi” on Solana. Raydium offers users and projects a suite of features and benefits, such as light-speed swaps, next-level liquidity, friction-less yield, and a launchpad for new Solana projects. Raydium leverages the speed, scalability, and low fees of Solana, as well as the liquidity and order flow of Serum, to offer a fast and smooth user experience, and support high-throughput and low-latency applications. Raydium also enables the permissionless creation of liquidity pools and farms, and hosts a launchpad and a NFT marketplace for new Solana projects. Raydium has an ambitious roadmap and vision for the future development of the project and the ecosystem, and faces some potential risks and challenges that it addresses by innovation, compliance, and security. Raydium is a project that is worth following and supporting, as it contributes to the growth and adoption of DeFi on Solana.

Sources

https://raydium.io/

https://raydium.gitbook.io/raydium/

https://www.binance.com/en/research/projects/raydium

https://coinmarketcap.com/currencies/raydium/

https://coinmarketcap.com/pt-br/currencies/raydium/

https://medium.com/raydium/

https://solana.com/

https://medium.com/solana-labs

https://projectserum.com/

https://docs.projectserum.com/

https://projectserum.medium.com/