Introduction

The Injective Protocol and its surrounding ecosystem represent a pioneering force in the realm of decentralized finance, often abbreviated as DeFi. Born from the desire to revolutionize traditional financial markets and offer users a more decentralized, accessible, and flexible system, the Injective Protocol is an innovative solution.

Injective Protocol’s fundamental architecture hinges on its commitment to supporting decentralized trading and exchange of assets, whether they’re cryptocurrencies, derivatives, or other financial instruments. With the utilization of advanced blockchain technology, Injective Protocol facilitates peer-to-peer trading while ensuring transparency and security.

They can engage in trading diverse assets, customizing their strategies, and even launching their own markets. This fosters a rich, decentralized environment that empowers users to become market creators and innovators in the DeFi space.

The following discussion delves deeper into the unique features, use cases, and transformative potential of the Injective Protocol and its ecosystem.

Project Overview

Injective emerges as a blockchain tailored for financial innovation, serving as a foundational layer-one blockchain in the realm of decentralized finance (DeFi). It underpins a broad spectrum of next-generation DeFi applications, encompassing decentralized spot and derivatives exchanges, prediction markets, lending protocols, and more. Injective distinguishes itself by offering robust core financial infrastructure components for applications to harness. Among its notable features is a fully decentralized, MEV-resistant on-chain order book, and it hosts all financial market types such as spot, perpetual, futures, and options entirely on-chain. This blockchain’s interconnectivity extends to Ethereum, IBC-enabled blockchains, and non-EVM chains, like Solana.

Injective introduces a forward-thinking, highly interoperable smart contract platform based on CosmWasm, incorporating advanced interchain capabilities. Built using the Cosmos SDK and driven by a Tendermint-based Proof-of-Stake consensus mechanism, Injective provides prompt transaction finality while sustaining exceptional speed, achieving over 10,000 transactions per second (TPS). The expansive Injective ecosystem unites more than 100 projects and a global community of over 150,000 members, enjoying substantial backing from prominent investors like Binance, Pantera Capital, Jump Crypto, and Mark Cuban. The core exchange module within Injective delivers cutting-edge functionalities, including a sophisticated on-chain order book and matching engine catering to various markets, notably spot, perpetual, futures, and options. It effectively resists Miner-Extractable Value (MEV) via batch auction order matching while offering users zero gas fees. Injective is inherently interoperable through IBC, connecting it with multiple layer-one blockchains, including Polygon and Solana through an impending Wormhole integration.

Notably, it integrates seamlessly with Ethereum via its own decentralized ERC-20 token bridge, marking Injective as the first Cosmos ecosystem network natively accommodating Ethereum assets. Injective’s implementation of smart contracts relies on CosmWasm, fostering effortless multi-chain smart contract transactions. It stands out as the sole blockchain enabling automated smart contract execution, unlocking unprecedented possibilities for developers to forge novel use cases that remain unparalleled on any other blockchain.

Injective is currently ranked #39 on coinmarketcap and has a DEXT score of 99.

Background

Injective, along with its associated ecosystem, has its roots in the innovative efforts of Injective Labs. Injective Labs, as the research and development core, played a pivotal role in the conception of the Injective Protocol. At the helm of this venture are two prominent figures. Eric Chen, one of the co-founders, draws from his previous experience as a cryptographic researcher and trader at a major cryptocurrency fund. During this tenure, he spearheaded pioneering market-neutral trading initiatives within the blockchain sphere and took charge of investments in prominent companies like 0x, ChainLink, and Cosmos. This background equips him with extensive knowledge spanning both blockchain protocols and traditional finance, coupled with a nuanced understanding of both eastern and western blockchain-based ecosystems.

The Injective ecosystem also benefits from the technical prowess of Albert Chon, who serves as the CTO of Injective Labs. Chon’s academic credentials include Bachelor’s and Master’s degrees in computer science from Stanford University. His professional journey took him to Amazon, where he worked as a software development engineer. Importantly, he is recognized for his contribution to a groundbreaking Ethereum standard, now widely adopted by major projects. His co-founding role within Injective Labs, alongside Eric Chen, solidifies his influence on the development of the Injective Protocol and its encompassing ecosystem.

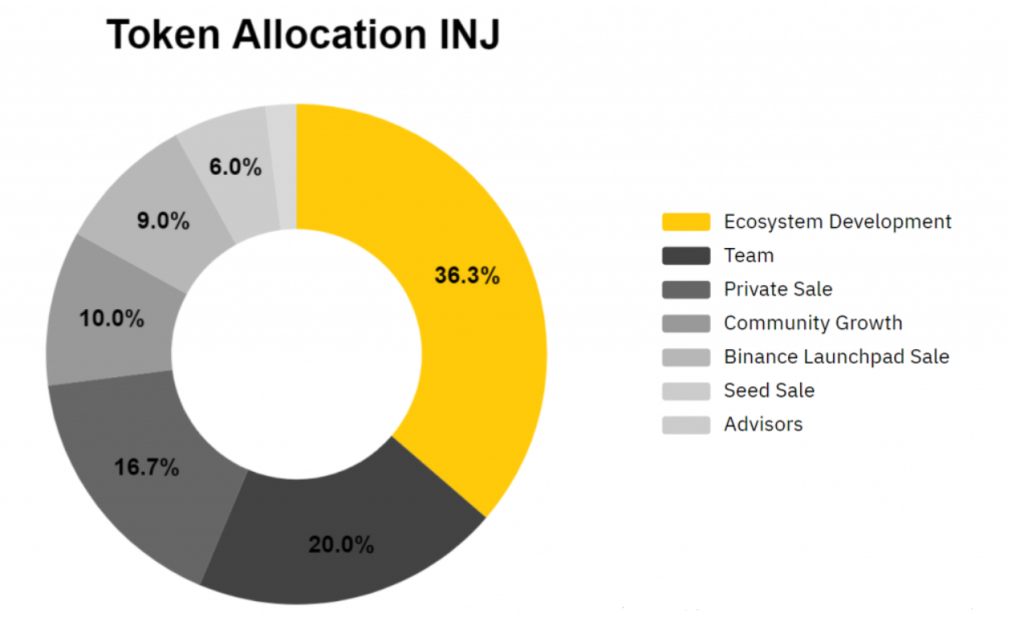

Tokenomics

Injective Protocol’s tokenomics are designed to foster various aspects of its ecosystem. The native token, INJ, plays a central role:

- Governance: INJ token holders have a say in the protocol’s governance. They can propose and vote on changes, ensuring a decentralized decision-making process.

- Staking: Users can stake INJ tokens to secure the network, participate in governance, and earn rewards. Staking incentivizes token holders to actively engage in protocol operations.

- Collateral: INJ is used as collateral within the Injective ecosystem, enabling users to create and trade synthetic assets.

- Rewards: Stakers and liquidity providers can earn rewards in the form of INJ tokens, encouraging active participation and contributions to the protocol.

- Fees: Transaction fees within the network are paid in INJ, which is burned, reducing the overall supply over time.

- Cross-Chain Functionality: INJ is used for cross-chain governance, enabling it to participate in governance across multiple blockchain networks.

These tokenomics are structured to create a thriving and decentralized ecosystem while providing utility and incentives for INJ token holders.

Market Stats:

Market Cap: $1,362,251,548

Circulating Supply: 83,755,556 INJ

Supply Cap: 100,000,000 INJ

All-time High: $25.01 -34.86% (April 30, 2021)

All-time Low: $0.6557 +2384.72% (November 03, 2020)

$INJ can be purchased on Binance, Huobi Global, Uniswap and Bilaxy.

Features and Functionality

- Layer-1 Smart Contract Blockchain: Injective operates as a Layer-1 smart contract blockchain, delivering high-speed transactions without gas fees.

- DeFi Application Development: It provides a robust foundation for building DeFi applications, including on-chain order books, enabling developers to create diverse financial applications.

- Cross-Chain Compatibility: Injective facilitates trading and yield generation across various layer-1 blockchains like Ethereum, Cosmos, and more, enhancing interoperability.

- Community-Driven Governance: The ecosystem is governed by a decentralized community structured around a Decentralized Autonomous Organization (DAO), ensuring community participation in decision-making.

- Interoperability: Injective is highly interoperable, boasting native connections to multiple blockchains, which fosters integration with various blockchain networks.

- Customizability: The ecosystem allows for full customization, enabling users to modify parameters to suit their specific use cases.

- Developer-Friendly Environment: With flexible development environments supported by Rust and Golang, developers find an intuitive and expressive platform for creating applications.

- Environmental Considerations: Injective’s Tendermint PoS consensus mechanism significantly reduces its carbon footprint, demonstrating an eco-friendly approach to blockchain technology.

Risks, Challenges and Countermeasures

Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies and DeFi can pose legal challenges.

Steps Taken: Injective has engaged with legal experts and compliance teams to ensure adherence to emerging regulations.

Security Vulnerabilities: Smart contract vulnerabilities or network attacks could compromise the ecosystem.

Steps Taken: Frequent security audits and rigorous testing to identify and fix vulnerabilities; community bug bounty programs for early detection.

Scalability: As DeFi and Injective’s popularity grow, scalability issues may arise, causing network congestion.

Steps Taken: Ongoing research and development to enhance network scalability, including layer-2 solutions.

User Adoption: Attracting and retaining users in a competitive DeFi space can be challenging.

Steps Taken: Initiatives to promote user adoption, including educational resources and incentives like liquidity mining.

Market Volatility: DeFi markets can experience high volatility, impacting trading outcomes.

Steps Taken: Risk management tools, such as stop-loss and take-profit orders, are integrated to mitigate market risks.

Challenges Unique to Injective:

Interoperability: Enabling seamless trading across different blockchains presents technical complexities.

Steps Taken: Ongoing research and development to improve cross-chain interoperability.

Liquidity: Building and maintaining liquidity in decentralized markets can be challenging.

Steps Taken: Incentive programs, partnerships, and liquidity mining to attract liquidity providers.

Ecosystem Growth: Expanding the Injective ecosystem while maintaining security and user trust is a continuous challenge.

Steps Taken: Ecosystem grants, partnerships, and community engagement initiatives to foster growth sustainably.

Community Governance: Ensuring the community has a say in protocol decisions while maintaining efficient governance.

Steps Taken: Mechanisms for community voting and governance proposals, alongside clear communication channels.

Cross-Chain Assets: Integrating and managing diverse assets across different blockchains requires ongoing effort.

Steps Taken: Strategic partnerships and developer support to enhance cross-chain asset support.

Roadmap and Future Development

Injective’s forward trajectory is intrinsically linked to its ambitious roadmap, which lays out a blueprint for expanding and enhancing its services. By maintaining a commitment to ceaseless innovation and introducing novel functionalities, Injective aspires to fortify its standing as a frontrunner in the DeFi realm. Among the pivotal milestones in Injective’s roadmap are the incorporation of a more extensive array of cross-chain assets, including the implementation of an NFT standard and an NFT marketplace, the augmentation of its derivative product portfolio, and the creation of advanced trading tools and features.

Injective is presently actively carrying out this roadmap with a strategic emphasis on evolving into a focal point for cross-chain blockchain-based derivatives, futures, and foreign exchange trading. This strategic direction is anticipated to draw a larger user base to the platform, thereby potentially enhancing liquidity and invigorating the DeFi ecosystem. Concurrently, Injective remains dedicated to the continual diversification of its product lineup and the integration of new assets and markets, ensuring it stays aligned with the previously mentioned strategic objectives.

A paramount facet of Injective’s strategy revolves around cultivating a robust and collaborative community that encompasses developers, traders, and enthusiasts. The platform is dedicated to nurturing meaningful engagement with its user community, actively encouraging the development of fresh tools, features, and applications. This community-centered approach is purposefully designed to stimulate a sense of participation among the user base, which is expected to fuel ongoing innovation and expansion. Injective’s emphasis on community-driven development is poised not only to reinforce the platform’s long-term prospects but also to contribute significantly to the wider evolution of the DeFi landscape.

Conclusion

Injective Protocol stands as a pioneering beacon within the intricate expanse of the DeFi metropolis, a blockchain designed specifically for this domain. It adeptly maneuvers the labyrinthine DeFi landscape, offering adaptability to address its unique challenges. Through its intricate multilayered architecture and various optimizations, Injective transcends the boundaries of traditional decentralized exchanges (DEXs), delivering a markedly efficient trading experience for users. While continuously unraveling DeFi’s complexities, Injective unwaveringly drives forward its mission for unrestricted trading, heralding and propelling the new age of boundless interchain finance.

Sources

https://docs.injective.network/learn/basic-concepts/inj_coin/

https://docs.injective.network/learn/introduction

https://zerocap.com/insights/research-lab/what-is-injective-defi-protocol/

https://coinmarketcap.com/currencies/injective

https://www.dextools.io/app/en/ether/pair-explorer/0x6c063a6e8cd45869b5eb75291e65a3de298f3aa8