NFT Market Rebounds: October Witnesses 32% Surge Led by Ethereum

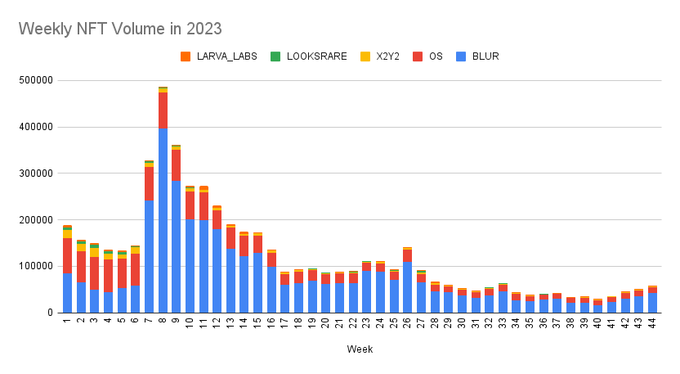

The NFT (Non-Fungible Token) market is staging a resurgence, despite recent layoffs at the prominent OpenSea marketplace. According to a report from crypto data firm DappRadar, NFT trading volume saw a notable increase of $99 million in October compared to the previous month.

DappRadar noted that the year long downtrend in NFT trading has been broken, with trading volume surging by 32%, rising from $306 million in September to $405 million in the last month. This represents sales levels not witnessed since August.

NFTs are distinct digital tokens that signify ownership of an item, often in the realm of digital art. While NFT markets experienced a period of exuberance in 2021 and early 2022, this year has been challenging for many profile picture (PFP) projects. Hype surrounding collections like Yuga Labs’ Bored Ape Yacht Club (BAYC) has waned amidst a prolonged crypto bear market.

Nevertheless, signs of life in the broader digital assets industry might be contributing to this rebound. The uptick in NFT trading coincided with Bitcoin’s price surpassing $35,000, marking its highest level in 16 months. Analysts suggest that this surge was driven by anticipation of the approval of a spot Bitcoin ETF in the United States.

DappRadar’s report also highlighted Solana as a notable network in terms of growth. NFT trading volume on the high-speed layer-1 blockchain increased by 15%, rising from $24 million to $27.6 million. In tandem with this growth, the price of Solana itself surged by 65% in October, climbing from $23 to approximately $38, according to CoinGecko.

The report covers NFT trading volumes across various blockchains that support this class of tokens. Across all networks, Ethereum, the second-largest cryptocurrency, experienced a significant 50% increase in NFT trading volume, solidifying its leading position.

As the NFT market heated up in October, the floor price (the lowest listed NFT price on a secondary marketplace) for some popular PFP projects also surged. For instance, the floor price for NFTs from the Bored Ape Yacht Club rose from $40,000 worth of Ethereum to approximately $55,000.

This resurgence in the prices of PFP projects was highlighted by Punk9059, director of research at NFT startup Proof, who commented on Twitter, “Uptober has arrived.”

However, it’s worth noting that, despite the optimism, the $405 million in NFT trading volume for October pales in comparison to the $2 billion in NFT sales that transpired in March. Furthermore, the total number of NFTs sold decreased by 5% in October, dropping from 3.58 million in September to 3.4 million. Although this decline is noticeable, it’s less severe than the 290,000 drop in NFT sales experienced in August.

IN OTHER NFT NEWS

The Head of Instagram Maintains Enthusiasm for NFTs

On October 4th, Instagram unveiled its inaugural Creator Innovation Summit. It is an arena dedicated to enlightening creators on brand amplification, optimizing Instagram’s arsenal, and the innovative utilization of cutting-edge technologies. In a captivating fireside chat, Adam Mosseri, the head of Instagram, engaged in a noteworthy dialogue with tech influencer Marques Brownlee, where Mosseri expressed his unwavering enthusiasm for NFTs.

This statement carries a notable resonance as in March 2023, Instagram had surprisingly announced the removal of its NFT-supporting features across the platform, a decision that caught many off guard. During the fireside chat, Mosseri elucidated the rationale behind his enduring bullish stance, despite Instagram’s prior withdrawal from NFT support. He cited the reason as being that NFTs, in his perspective, did not manifest as a substantial revenue driver for all creators. Hence, Instagram took a prudent step in curtailing their involvement, aligning with their broader fiscal restraint.

The Creator Innovation Summit featured a lineup of distinguished keynote speakers, including Adam Mosseri, Dave Krugman, and Larissa Gargaroz. They were accompanied by other luminary figures spanning diverse domains, encompassing photography, filmmaking, tech evolution, and artificial intelligence.

Further delving into the discourse, Mosseri explored the realm of artificial intelligence and its prospective applications through AI chatbots tailored for creators. In contemplating the quandary faced by creators in selecting the most fitting platforms and tools that resonate with their entrepreneurial pursuits, Mosseri presented an intriguing question—whether creators should ponder the creation of an AI doppelganger.

He remarked, “For some creators, it can be a logical choice, while for others, it may not align with their objectives.” Mosseri underscored the significance of harmonizing any AI chatbot with the creator’s core principles and virtues. The intricacy lies in ensuring that this AI representation genuinely mirrors the creator’s identity without inadvertently advancing their rivals. Mosseri also acknowledged the inundation of messages and requests that creators grapple with and suggested that a proficiently trained AI could proffer invaluable assistance in managing this influx.

He elucidated, “The AI incarnation of you must be intriguing, engaging in conversation with it should be captivating. It needs to resonate with your interests, comprehensively trained on your content, and acquainted with your unique tone. Simultaneously, it must refrain from endorsing your competitors or engaging in derogatory comments about you.” Mosseri voiced the multifaceted nature of the notion of AI chatbots or AI acting as an auxiliary representative for creators.

A few months ago, Meta disclosed its intentions to introduce AI-powered chatbots, each adorned with distinct personas, aimed at invigorating user engagement across its social media landscapes. These chatbots are designed to emulate various characters, spanning historical luminaries to everyday travelers, offering guidance and recommendations to users.

While this concept remains in its embryonic stage, Mosseri radiates optimism regarding the prospective advantages should they adeptly navigate the complexities intertwined with AI integration.

Open Metaverse Alliance Seeks Universal Standard for Creator Royalties

Industry leaders have finally had enough of the ongoing back-and-forth nonsense involving the integration of NFT creator royalties that continues to hinder the fundamental growth of our digital age through decentralization and fair compensation.

Traditionally, royalties have served as a mechanism for creators to fairly receive compensation for their intellectual property – copyrights, trademarks, and patents – long after the first sale.

However, conventional markets have also made it extremely difficult for artists to survive and thrive doing what they love to do most in this world.

For creators of digital art and NFTs, this mechanism is no different, except for bringing the secondary market into the picture as an entirely new avenue for these artists to continue producing their work without fear of losing out on secondary sales – or, at least that’s what has been touted as the heart and soul of true decentralization in our digital age.

Creator royalties, historically ranging in fees between 2.5% and 10%, were initially hailed as a revolutionary feature. However, the crypto bear market and greed have led newer NFT platforms to abolish such fees, using “other” appealing factors to try and divert users from dominant platforms like OpenSea and Blur.

Two years have passed since Beeple’s historic $69.3 million sale of his Everydays art piece showcased the potential and utility of digital art and NFTs. The direction we’ve been traveling in has completely sent the sector backward into the traditional Web2 creator economy infrastructure.

For those new to NFTs and Web3-infused digital art, these NFT marketplaces play a crucial role in the nascent stages of Web3, with the ability to dictate and set royalty percentages for NFTs sold on their respective platforms. This power heavily influences overall NFT trading volumes as one of many factors that go into showcasing key performance indicators (KPIs) that allow the industry and participants to analyze the health and future of these NFT collections and the platforms they live on.

Since as early as 2021, the creator royalty debate has been the hottest subject that, apparently, is so puzzling as to completely hinder the anticipated growth of a truly digital age. We’ve seen industry-leading marketplaces, such as OpenSea, Blur, Magic Eden, X2Y2, and others, continue to go back and forth on whether creator fees should be “mandatory,” “optional,” or flat-out “zero.”

From a Web3 lens, this is a no-brainer – Royalties. Always. Yet, marketplaces are clinging on to what they know, barring any true progress towards true decentralization.

Earlier this year, these marketplaces reduced royalty rates when tokens exchanged ownership in attempts to rejuvenate the NFT trading sector, which saw explosive growth during the COVID-19 pandemic but has since faced a sharp downturn.

Looking back to 2022, creator royalties plummeted from their peak of $269 million in January to just $2.4 million by September, according to Nansen data.

But when Blur entered the picture in 2023, its tactics to slash creator fees and gamify user experience seemed to have paid off. In February 2023, Blur surpassed OpenSea in trading volume.

Shortly after, even OpenSea, once a staunch defender of creator fees capitulated once again changing its royalty position in August 2023.

Yuga Labs recently blocked trading of its latest project, “Legends of Mara,” on both Blur and OpenSea. Yuga told Bloomberg that they would only allow those exchanges who “respect” royalties to list their portfolio of NFT collections. Considering Yuga’s monumental $9 billion trading volume in the NFT market, such decisions could reshape the landscape.

In August, Yuga Labs announced their decision to block NFT trades on OpenSea over the creator royalties controversy.

Open Metaverse Alliance (OMA3) currently aims to put an end to the royalty wars once and for all.

OMA3, a coalition encompassing a multitude of influential blockchain, NFT, and metaverse firms, announced its intention on October 17 to form a dedicated royalty-centric task force that will work to develop and strategize the standardization and preservation of creator royalties across NFT marketplaces.

From the OMA3’s perspective, this unwavering stubbornness and greed from marketplaces like OpenSea and Blur to deprive artists and creators of profits that are rightfully theirs only continues to endanger the very essence of what Web3 was supposed to be – a decentralized ecosystem that houses an “open metaverse,” or a unified online world that allows for users to finally be able to maintain ownership over our digital assets and bring them “off platforms.” In other words, these in-game digital items you spend hundreds of dollars on but technically don’t own and can’t use, but from within the platform, they can finally follow you wherever you go. For creators, this is a major transformation of digital ownership.

Consequently, these marketplaces are feeling the effects of these widely acclaimed creators leaving the platform as their returns and trading volume continue to dwindle.

OMA3’s royalty-centric task force intends to devise strategies to uphold creator royalties universally, proposing standards that its member entities would uphold. Industry leaders, including Animoca Brands, Yuga Labs, and Magic Eden, are just a few companies that will be joining the task force.

Chris Akhavan, Chief Gaming Officer at Magic Eden, told NFT Now that “[Magic Eden’s] commitment to creators is unwavering.” Partnering with OMA3 amplifies our efforts to create sustainable creator economies where every creator is recognized and rewarded fairly,” Akhavan added

In addition to Animoca, Yuga, and Magic Eden, OMA3 also shared that other industry leaders, including Decentraland, The Sandbox, Alien Worlds, and Upland will be joining the initiative.

“We at Yuga are committed to building a web3 world that’s interoperable and fair for all creators,” Mike Seavers, Chief Technology Officer at Yuga Labs, said. “And we’re pleased to be collaborating on the OMA and the standards we believe it will drive its success.” Sebastien Borget, CEO of The Sandbox and Co-founder of OMA3 shared more with NFT Now about OMA3’s mission to long-term positive impact on the NFT market and all the actors in this ecosystem.

“Partnering with OMA3 amplifies our efforts to create sustainable creator economies where every creator is recognized and rewarded fairly,” Chris Akhavan, Chief Gaming Officer at Magic Eden

Ryder Ripps Ordered to Pay $1.5 Million in Damages to Yuga Labs

New court documents, filed on October 25, 2023, have redefined the status of all RR/BAYC NFTs, now recognized as assets belonging to Yuga Labs. This pivotal development marks the conclusion of the protracted legal battle that transpired between Yuga Labs and Ryder Ripps, a dispute that had been a significant lawsuit in the NFT space. The lawsuit revolved around the alleged infringement of Yuga’s BAYC trademarks (“BAYC Marks”) by Ripps’ “satirical” RR/BAYC NFT collection and raised questions about Yuga’s use of “naked licensing.”

The legal battle had been marked by contentious accusations, with claims of antisemitism, Nazi racism, and Ripps justifying his actions as “satire” and “free speech” under the First Amendment to the U.S. Constitution. The case, Yuga Labs, Inc. v. Ryder Ripps, Jeremy Cahen, and DOES 1-10, has finally come to a conclusion, with some final adjustments made by both parties.

In the court’s Findings of Fact and Conclusions of Law, it was determined that the Defendants, including Ryder Ripps, acted “intentionally” and “in bad faith” with the expectation of profiting from the use of Yuga’s BAYC Marks. As a result, the court ordered the Defendants to pay Yuga Labs damages exceeding $1.5 million. Furthermore, Ryder Ripps was directed to transfer control of the RR/BAYC smart contract directly to Yuga Labs and disgorge all profits from the sale of RR/BAYC NFTs.

Key points from the court’s ruling include:

1. The BAYC Marks, despite being unregistered, were confirmed by the court as belonging to Yuga Labs, who had actively utilized them in various commercial activities, including online gaming, in-person events, merchandise marketing, product launches, and collaborations.

2. The claim that Yuga was using “naked licensing” was dismissed by the court, which affirmed that Yuga had not abandoned its trademark rights and had actively protected them.

3. The court agreed with Yuga’s assertion of “cybersquatting” regarding the domains in question – RRBAYC.com and APEMARKET.com – considering them either “identical or alarmingly similar” to Yuga’s original BAYC trademarks, which could lead to consumer confusion.

4. The court repeatedly emphasized the Defendants’ malicious intent to operate in bad faith, including registering website domains containing Yuga’s trademarks and selling RR/BAYC NFTs only after Yuga introduced its BAYC NFT collection.

The court’s decision was notable for rejecting the Defendants’ appeal to apply the U.S. Supreme Court’s ‘Rogers’ test, which assesses whether the use of a registered trademark qualifies as “fair use” under the First Amendment. The court clarified that the sale of RR/BAYC NFTs did not constitute “expressive artistic work” deserving of First Amendment protection. Instead, it compared the sale of these NFTs to that of counterfeit items due to the lack of constructive commentary or criticism.

With the primary issues resolved, the court is now focused on equitable remedies, including restitution, specific performance, and injunctions. Yuga is seeking to compel the Defendants to take certain actions or refrain from others, in addition to disgorging profits. The court also determined that Yuga was entitled to the disgorgement of the Defendants’ profits, with Lauren Kindler, Yuga’s economics and damages expert, testifying that the Defendants had generated over $1.5 million in profits.

In terms of statutory damages for cybersquatting, the court considered factors such as the egregiousness of the cybersquatting, the use of false contact information, misleading actions, and an attitude of contempt towards the court. Yuga was awarded the maximum statutory damages allowable in a cybersquatting case, totaling $200,000.

The court also granted a permanent injunction against the Defendants, and the case was deemed “exceptional,” entitling Yuga Labs to attorneys’ fees. The specific amount will be determined by the lower court, with Yuga required to provide billing records and documents to support their request for reasonable attorneys’ fees and costs. This information must be submitted by November 1, 2023.

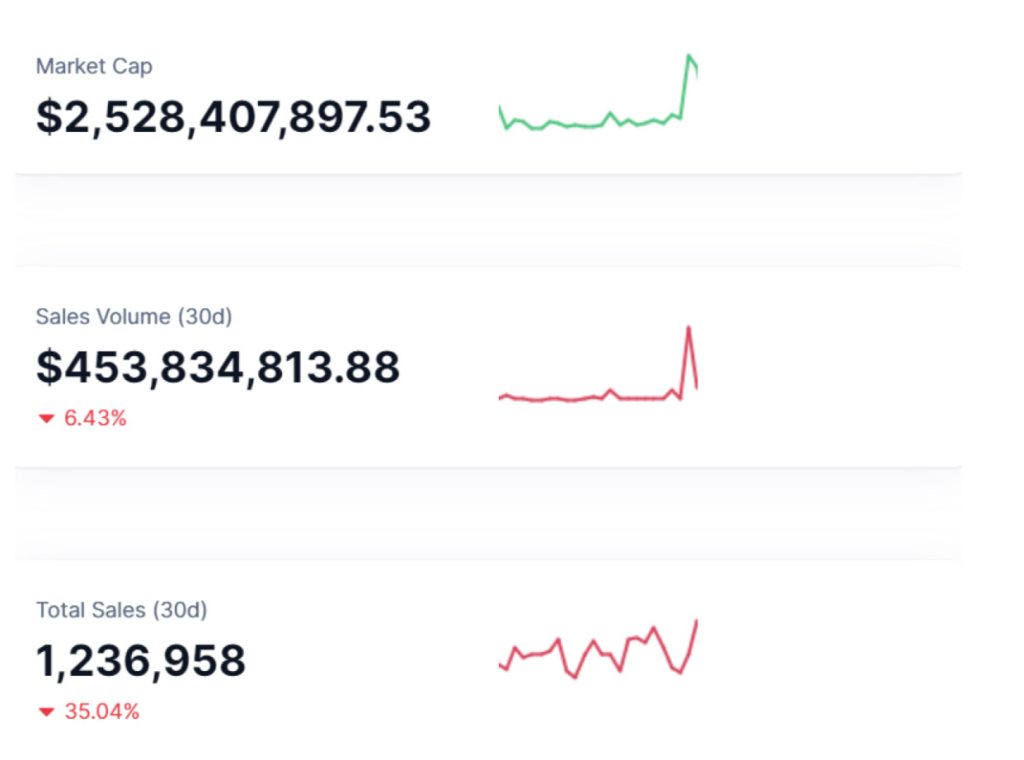

October NFT Market Statistics

In October, the NFT market experienced notable changes. Market cap surged by 11.5% from $2.25 billion in September to $2.52 billion in October, demonstrating a healthy uptick. Simultaneously, sales volume saw a robust 23.7% increase, rising from $366 million in September to $453 million in October. However, the overall picture wasn’t without nuances, as total sales dipped slightly by 0.3%, decreasing from 1,241,568 in September to 1,236,958 in October.

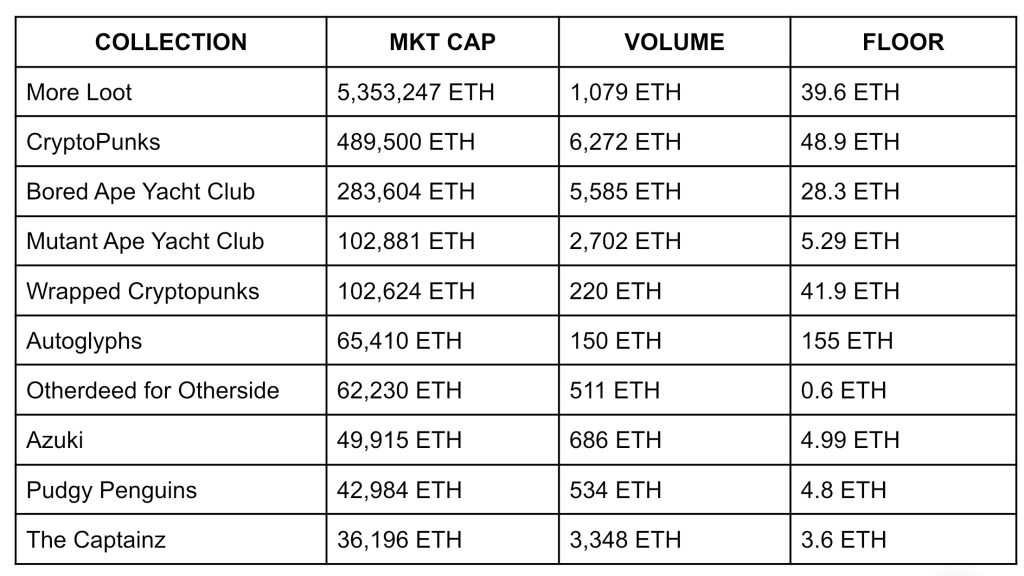

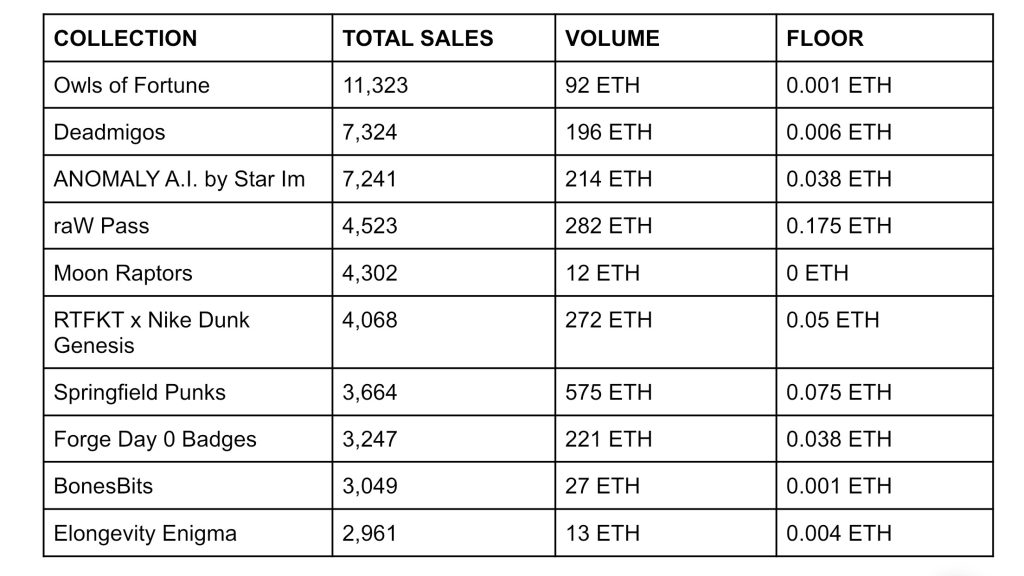

Additionally, the average NFT sale price in October climbed to $367, marking a notable rise from the previous month’s figure of $296. The top 10 NFT collections accounted for a significant 43% of all sales in October, underscoring their dominant presence in the market. Notably, Ethereum retained its stronghold as the dominant blockchain for NFT sales, contributing to 54% of all sales in October.

Furthermore, there was a noteworthy increase of 10% in the number of active NFT wallets in October, showcasing growing interest and participation in the NFT space.

All in all, October emerged as a positive month for the NFT market, with substantial increases in both sales volume and market cap. However, the slight decline in total sales may suggest some level of market saturation. It will be interesting to see how the market performs in the coming months and years.

Top NFT Bluechips

Trending NFT Collection by Sales

Upcoming NFT Mints

This is a list of upcoming projects that appear to have potential. Please note that this is NOT FINANCIAL ADVICE.

The list is based on a variety of factors, including the project’s team, technology, and use case. However, it is important to do your own research before investing in any project.

💠@NadaOfTheSun

💠@VendettaGamesHQ

💠@todaythegame

💠@jungle_xyz

💠@AOFverse

💠@AkogareOfficial

💠@ShadowWarGame

💠@burnghostgames

💠@Matr1xOfficial

💠@OverworldPlay

💠@L3E7_Official

💠@OhBabyGames

💠@JoinGrapeCoin

💠@digifineart

💠@Persona_Journey

💠@AlchemyDivision

💠@playsomo

💠@ageofdino

💠@Castileofficial

💠@konofukuart

💠@Rosentica

💠@BeingB00

💠@San_FranTokyo

💠@ChampionsVerse

💠@Seraph_global

💠@Bonigo_xyz

💠@playaneemate

💠@Dobermans_io

💠@KentaroClub

💠@TOKYOBEAST_EN

💠@Wavemint_io

💠@thevastega

💠@LumiParadox

💠@FreedomWrld

💠@oosagiNFT