Introduction

Decentralized finance (DeFi) is reshaping the financial landscape, revolutionizing how individuals manage their assets. In this dynamic DeFi space, MELD stands out as a pioneering platform. MELD’s vision is to bridge the gap between traditional finance and DeFi, providing transparent and user-friendly lending and borrowing of both fiat and cryptocurrency assets. This article offers an in-depth exploration of MELD, delving into its origins, technology, tokenomics, features, security protocols, use cases, advantages, and potential risks.

What is MELD NETWORK

MELD Network emerges as a transformative force in the DeFi arena, offering a decentralized, non-custodial banking protocol. Its primary objective is to make lending and borrowing of fiat and crypto assets more accessible and transparent. MELD aims to extend the benefits of DeFi to a broader audience, including those currently underserved by traditional banking institutions.

MELD’s mission revolves around empowering individuals with essential financial tools and services, centered on cryptocurrency assets. This encompasses features such as cryptocurrency-backed loans, interest-earning fiat loans, and participation in reward-based incentive programs. MELD envisions a future where over 2 billion people lacking adequate access to banking services can benefit from its DeFi solutions.

Operating on the Cardano blockchain, known for its security, scalability, and sustainability, MELD ensures the integrity and safety of its financial operations. Security is paramount for MELD, as demonstrated by its robust measures, including smart contract audits and real-time data analysis, all aimed at safeguarding user assets and transactions.

At the core of the MELD ecosystem lies its native token, the MELD token. This versatile token serves multiple crucial functions within the network, including governance, covering transaction fees, providing incentives, and offering protocol insurance.

Project Background and Team

Founded in late 2020, MELD boasts a team of experts from diverse fields, including technology, finance, and blockchain. Some key figures within the MELD Network team include:

Ken Olling – Chief Astronaut: With over 20 years of experience in digital transformation, Ken Olling specializes in technology design and data handling. He has contributed his expertise to both startups and industry giants like GE, HP, Toyota, and Visa, focusing on enhancing consumer experiences through technology.

Daniel Kung – CEO: While specific details about Daniel Kung’s background are limited, as CEO, he plays a crucial role in guiding the project’s strategic decisions and ensuring its smooth operation.

Pepe Blasco – CTO: Pepe Blasco is a specialist in Blockchain and Big Data. As the Chief Technology Officer, he oversees the technical aspects of MELD’s platform, focusing on application and service development using these technologies.

Gediminas Kiveris – CIO: With more than a decade of experience in traditional banking and fintech, Gediminas Kiveris brings a wealth of expertise to MELD. He has worked in various roles, including quant, trader, and treasurer, and holds an MSc in Quantitative Finance from the London School of Economics. His experience includes expanding Revolut’s European business and obtaining its first banking license as the Head of Treasury.

Tokenomics

The MELD ecosystem revolves around the $MELD Token, which plays a pivotal role in traversing various blockchains, thanks to crypto bridges and MELD’s innovative capabilities. This cross-chain journey involves both the burning and minting of tokens.

The $MELD Token serves as the cornerstone of the MELD protocol, fulfilling vital functions such as covering transaction fees on the MELD blockchain, participating in protocol governance, providing incentives, and offering protocol insurance. Token holders are encouraged to maintain a minimum balance to maximize their potential earnings within the protocol.

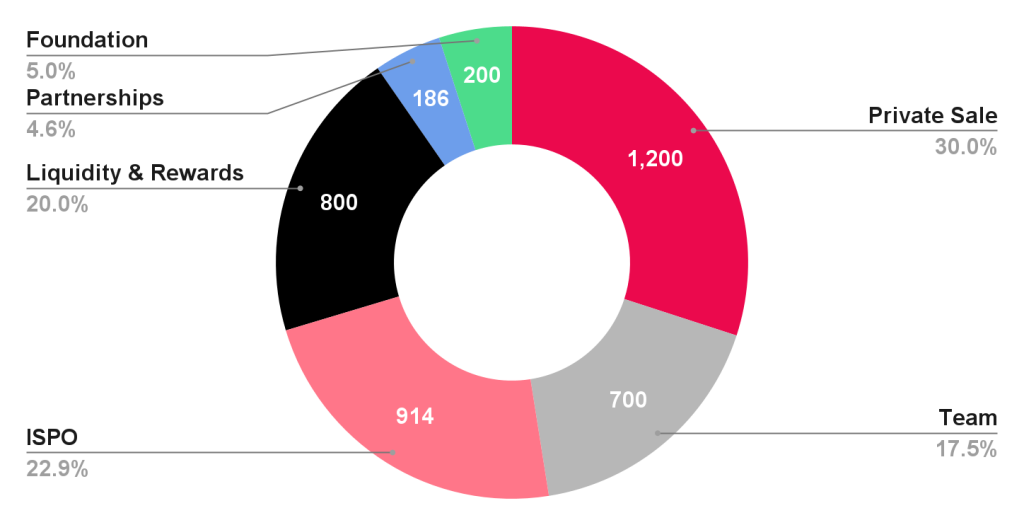

MELD’s total supply of $MELD tokens is fixed at 4 billion, and mechanisms are in place to gradually reduce this supply over time.

Use Cases of MELD

- Governance: MELD token holders are able to participate in the governance of the network. This includes voting on proposals and changes to the protocol and shaping the future direction of the project.

- Transaction Fee Payments: MELD tokens are used to pay transaction fees on the MELD Blockchain, facilitating the processing of transactions within the network.

- Incentivization: Token holders are incentivized to maintain a minimum balance of MELD tokens to maximize their earnings within the ecosystem, which may include staking rewards and fee reductions.

- Protocol Insurance: The tokens may play a role in providing insurance or security mechanisms within the protocol to protect users’ assets and interests.

- Participation in Staking: MELD token holders can stake their tokens to earn rewards, further incentivizing them to participate in the network’s activities.

MELD Ecosystem

- MELD Foundation: The MELD Foundation is the central organization responsible for overseeing and expanding the MELD protocol. It coordinates with other parties for technical development, community management, and business partnerships. Initially, it manages the MELD protocol until it becomes fully decentralized over time. The Foundation also takes care of the MELD treasury, which holds unissued MELD tokens and ADA block rewards from the ISPO (Initial Stake Pool Offering). It engages in various commercial activities and partnerships to support the ecosystem.

- MELD Neobank: MELD Neobank provides users with a convenient banking experience within the MELD ecosystem. It operates as a licensed Lithuanian electronic money institution and supports 15 different currencies, including both regular money and cryptocurrencies. Key features include crypto and regular accounts, a global debit card, payment processing, direct deposit, bill payment, and integration with the MELD blockchain and MELDapp. This Neobank allows users to easily manage their cryptocurrency and regular money, conduct transactions, and access traditional banking services.

- MELD X Exchange: MELD X is a regulated exchange located in Lithuania that plays a vital role in the MELD ecosystem. It operates in partnership with the MELD Foundation and facilitates the conversion of cryptocurrencies to regular money and vice versa. This exchange increases the liquidity and usefulness of the MELD token, making it more accessible for users to trade in broader financial markets.

- MELD Digital: MELD Digital serves as a Virtual Asset Service Provider within the MELD ecosystem. Its primary responsibilities include handling tokens and tokenized assets, enabling the creation and destruction of virtual assets, and ensuring compliance with regulations. One crucial function is bridging tokens across different blockchains, allowing users to move MELD tokens from one blockchain to another. This promotes compatibility between blockchains and maintains the integrity of the MELD token’s total supply.

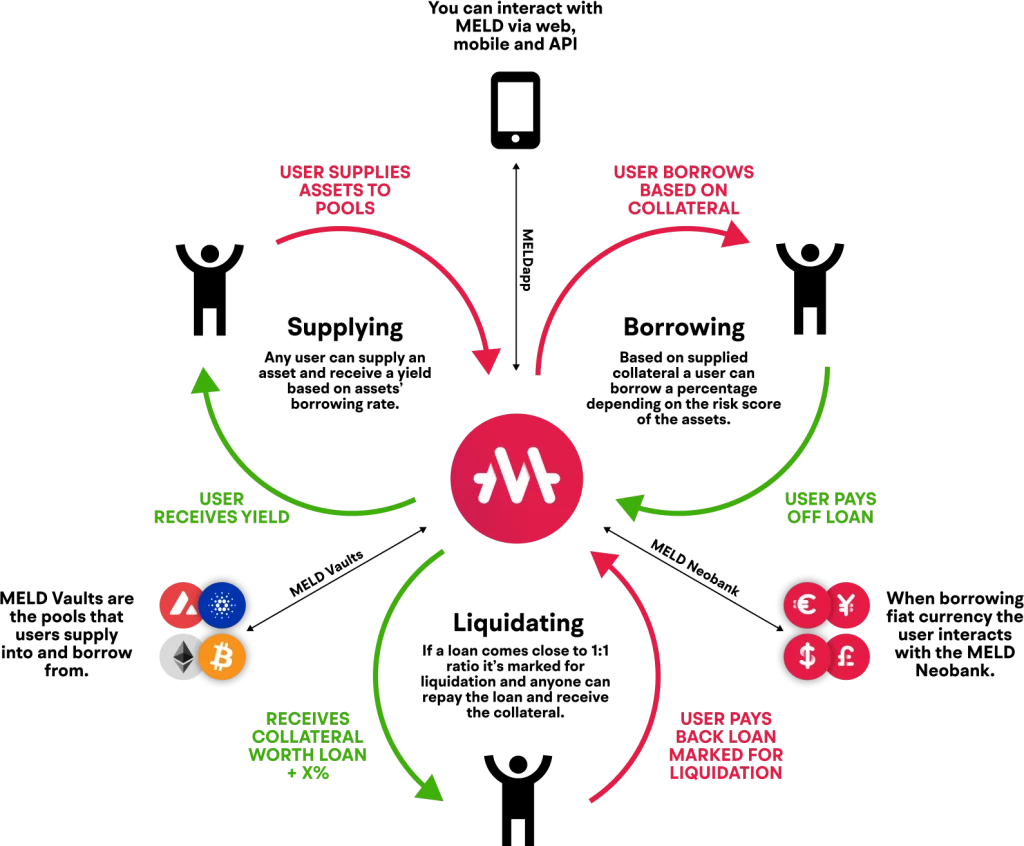

- MELD Protocol and MELDapp: The MELD Protocol sets the fundamental rules and structures for lending and borrowing assets in a decentralized liquidity market. MELDapp serves as the user-friendly interface that connects users to the MELD Protocol, making it simple for them to engage in lending, borrowing, staking, and other DeFi activities across various devices.

Core Features and Use Cases of Meld Network

- Cross-Chain Lending and Borrowing: MELD enables users to lend and borrow both fiat and cryptocurrency assets across multiple blockchains. Users can leverage their crypto assets to earn interest through lending or access liquidity by borrowing against their assets. This feature provides flexibility and utility for crypto holders.

- Staking and Governance: MELD token holders can stake their tokens within the ecosystem, participating in the network’s governance and earning rewards. Stakers earn rewards in the form of token incentives, making it an attractive option for those looking to maximize their holdings. Governance participation allows users to have a say in protocol changes and improvements.

- MELD Vaults: MELD Vaults are community-backed pools that safeguard individual assets while facilitating lending, borrowing, and generating returns. Users can deposit their assets into MELD Vaults to participate in lending and borrowing activities, earning rewards in the process. Vaults help optimize the utilization of crypto assets.

- Integrated Fiat Banking: MELD Neobank integrates seamlessly with the MELD ecosystem, providing users with access to fiat banking services. Users can manage both crypto and fiat currencies within the Neobank, conduct SWIFT and SEPA transfers, use a global debit card, process payments, and handle direct deposits and bill payments. This integration bridges the gap between traditional banking and DeFi.

- Liquidity Management and Swaps: MELD offers a streamlined approach to managing liquidity, allowing users to easily exchange between regular fiat and cryptocurrencies. This means you can swiftly convert your regular money into cryptocurrencies or the other way around, making transitions between different asset types seamless. This feature bolsters the flexibility and ease of access to assets.

- Bridging Across Blockchains: MELD Digital facilitates the bridging process, allowing users to move MELD tokens across different blockchains while maintaining the token’s total supply. This feature promotes interoperability between blockchains, making it easier for users to access and use MELD tokens on various blockchain networks.

- Yield-Generating Asset Supply: Users can supply assets within the MELD ecosystem to earn higher yields on their deposited crypto holdings. Asset suppliers can earn passive income by providing liquidity to the ecosystem, contributing to the network’s overall vitality.

- Borrowing in Crypto and Fiat: MELD allows users to borrow against their deposited assets, offering both crypto and fiat borrowing options. Borrowers can access immediate liquidity without selling their assets, while lenders can earn interest on their holdings.

- In-Wallet Staking: Users can stake their crypto assets directly within their MELD wallet, generating a yield on their holdings. Staking provides users with a passive income stream while participating in securing and supporting the network.

- Multichain Non-Custodial Wallet: MELD provides a feature-rich wallet that enables users to handle and move crypto assets across different blockchains. Users can efficiently manage their diverse crypto portfolios, engage in DeFi activities, and access cross-chain capabilities directly from their wallet.

Risks and Preventive Measures

- Market Volatility Risk: Dealing with cryptocurrencies involves exposure to price volatility. MELD actively manages this risk through an automated risk model. This model continuously assesses various market metrics, including crypto price volatility and asset prices. By backtesting historical data, it ensures that the protocol’s parameters are set to optimize risk management. In times of market drops, the risk model also considers liquidity, preventing significant losses.

- Adaptation to Market Changes: The cryptocurrency market is known for its rapid changes. MELD’s risk model is designed to be robust and adaptable to changing market conditions with minimal human intervention. This adaptability is crucial in responding to unforeseen market fluctuations and ensuring the protocol’s resilience.

- User Engagement and Support: Maintaining open communication with protocol users is essential. MELD addresses this by providing direct access to administrators for answering questions, resolving issues, and delivering updates. Through active involvement in platforms like Telegram, Discord, and other social media channels, MELD keeps the community engaged and informed. This proactive approach helps address user concerns promptly.

- Smart Contract Security: Ensuring the security of smart contracts is paramount in DeFi. MELD takes a multi-pronged approach to this challenge. They thoroughly test smart contracts before deployment, using testnets and private blockchains for validation. Additionally, they collaborate with reputable blockchain-related companies, such as Tweag, to conduct smart contract audits. This rigorous auditing process helps identify vulnerabilities and strengthens the security of their contracts.

- Real-time Monitoring and Data Analysis: After deployment, MELD continues to monitor smart contracts in real-time to understand user interactions and contract performance. They also collect and analyze historic data, backtesting their strategies and algorithms. This data-driven approach allows them to fine-tune their risk management and security measures. Moreover, it informs their decision-making processes, including user onboarding and the introduction of innovative features.

- MELD has implemented a comprehensive risk management strategy that combines automated risk assessment, user engagement, rigorous auditing, and data-driven decision-making. This approach is designed to address the inherent risks and challenges in DeFi, ensuring the security and sustainability of the MELD protocol in a dynamic market environment.

Conclusion

In summary, MELD is a revolutionary platform that seamlessly merges traditional finance with decentralized finance (DeFi). Through its extensive range of services, such as lending, borrowing, staking, and cross-chain functionality, MELD provides users with a distinctive and user-centric financial solution.

MELD’s ecosystem is built upon four key pillars: the MELD Foundation, MELD Neobank, MELD X, and MELD Digital. They collaborate to create a secure, transparent, and efficient environment where users can effectively manage their assets in the ever-changing world of digital finance. At the heart of the MELD protocol is the MELD token, serving as the protocol’s backbone, enabling governance, incentivization, and protocol insurance.

MELD’s ultimate mission is to empower individuals globally, transcending gender, age, nationality, and religion, by providing a universally accessible platform with no barriers to entry. To prioritize security, MELD employs robust risk management practices and undergoes smart contract audits to safeguard user assets and ensure the platform’s reliability.

As MELD continues to innovate and progress, it remains a trailblazer in reshaping the future of decentralized finance.