SEC Imposes Penalties on Stoner Cats Creator for NFT Offering Violations

In a recent update, the U.S. Securities and Exchange Commission (SEC) has reached a settlement with the brains behind the ‘Stoner Cats’ animated web series concerning an NFT offering that lacked proper registration. To resolve the SEC’s charges, the creators have agreed to a civil fine of $1 million. The scrutiny focused on Stoner Cats 2 LLC, the entity responsible for the animated series, which faced SEC investigation due to its sale of more than 10,000 NFTs in July 2021. These NFTs were sold for approximately $800 each and were swiftly snapped up in just 35 minutes, amassing over $8 million.

The primary issue raised by the SEC was that the NFTs were presented and sold as investment opportunities, rather than just collectibles. The evidence points to Stoner Cats 2 LLC’s marketing campaign highlighting potential resale value in secondary markets. The SEC’s case was further supported by the team’s references to their expertise in both entertainment and crypto fields, as well as the involvement of well-known actors in the series. These factors may have inadvertently led investors to believe they would see profits. It’s important to note that this NFT collection was launched during the bullish period of July 2021. Orchard Farm Productions, led by actress Mila Kunis, was the force behind “Stoner Cats,” and the collection promised an animated series featuring the voices of notable figures like Mila Kunis, Ashton Kutcher, Chris Rock, Ethereum’s Vitalik Buterin, and others.

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, stressed the importance of economic reality over labels. He stated, “Regardless of whether your offering involves beavers, chinchillas, or animal-based NFTs, under federal securities laws, it’s the economic reality of the offering – not the labels used or the underlying objects – that determines whether it’s an investment contract and, consequently, a security.” This statement implies broader implications for other cryptocurrency projects that might unintentionally enter the realm of securities.

Without admitting wrongdoing, Stoner Cats 2 LLC has consented to several actions:

Paying a $1 million civil fine.

Establishing a Fair Fund to compensate affected investors.

Disposing of all NFTs they currently own or control.

Publicizing the order on their website and social media platforms.

The swift response by the SEC serves as a significant reminder for entities in the rapidly evolving cryptocurrency space. As the lines blur between collectibles and “securities,” both creators and investors must be aware of regulatory compliance and the consequences of their offerings. In an expanding world of digital assets, regulatory bodies like the SEC are likely to maintain a vigilant watch.

Bored Ape Yacht Club (BAYC) and BAPE Announce Exciting Streetwear Collaboration

The Bored Ape Yacht Club, known as BAYC, has just surprised everyone with its latest venture, a thrilling collaboration alongside the iconic Japanese streetwear brand BAPE. This exciting announcement came earlier today via the Web3 giant’s official Twitter account, which left the crypto Twitterverse buzzing with anticipation.

In a cryptic tweet from the Bored Ape Yacht Club’s Twitter handle (@boredapeyc), the message simply stated, “Been a fan since way back,” accompanied by an illustrative image featuring an open closet brimming with Hawaiian-themed shirts, and at the center, a white tee bearing the BAPE logo alongside a Bored Ape.

Thomas Hui, BAPE’s Chief Operating Officer, shared his enthusiasm, saying, “As fashion and Web3 increasingly intertwine, we are thrilled to introduce this groundbreaking collaboration with Yuga Labs.”

The collaboration will feature an extremely limited collection available exclusively to the community. The launch is set for November 4 in Hong Kong at ApeFest, a global event hosted by BAYC. Initially, access will be token-gated for the BAYC community, followed by exclusive access for BAPETAVERSE members. In December, the general public will have the opportunity to purchase items from the collection through BAPE’s official store and website.

Bored Ape Yacht Club’s signature ape NFTs have captivated both art collectors and cryptocurrency enthusiasts. Teaming up with BAPE, a renowned streetwear brand known for its distinctive ape motif, promises to create an exciting fusion.

BAPE, established in 1993, has been a pivotal player in streetwear for decades. Founded by fashion designer Nigo, the brand made its US footwear debut in 2005 and is famous for its iconic camouflage print and ape head logo, which continue to define its identity and design philosophy.

Michael Ghory, Yuga Labs’ Vice President of Apparel and Lifestyle, emphasized the authentic nature of this collaboration, saying, “This partnership is built on genuine mutual respect and a commitment to our communities. We’re excited to offer exclusive early access to our BAYC members and the BAPE® Heads and later introduce it globally.”

The announcement has already ignited tremendous excitement within the Bored Ape Yacht Club community and among streetwear aficionados. Within hours, the tweet received thousands of likes and retweets, with fans eagerly speculating about what the capsule collection might include. The official BAPE X account also shared the news, declaring, “Apes Together Strong.”

Greg Solano, Co-Founder of Yuga Labs, expressed the natural fit of this collaboration, stating, “It’s no surprise that we’re fans, and we know many members of the Bored Ape Yacht Club are too. BAYC teaming up with BAPE® for a limited physical collection feels like the most organic step forward.”

In August, BAPE celebrated its 30th anniversary with the release of a limited-edition sneaker, the Forum 84 BAPE Low Triple-White, in collaboration with adidas Originals. These sneakers were auctioned as NFTs, marking the brand’s first foray into the world of digital assets.

Nakamigos Introduce ‘CLOAKS’ NFTs, Stirring Up Community Controversy

The peculiar NFT venture known as Nakamigos made an intriguing revelation on September 13, introducing its latest NFT project, CLOAKS. This development seems to align with the ongoing trend of derivative NFT projects that often lack originality, relying heavily on aggressive marketing and hype. The Web3 community, at times, appears to overlook the crucial task of asking pertinent questions and scrutinizing the innovative purpose behind such projects and their founders.

Nakamigos made its debut in March under the umbrella of HiFo Labs, a rather unexpected company that claims to have been involved in NFT and digital projects for the past five years. Its original collection strongly resembles CryptoPunks, featuring 24 x 24-pixel characters referred to as the “friends of Satoshi Nakamoto.”

In a remarkably short span, Nakamigos managed to outperform the Bored Ape Yacht Club (BAYC) in terms of lifetime trades, with trading volume on the secondary market surging to nearly $13 million in just four days after its launch, as reported by nft now. This figure subsequently skyrocketed to approximately $39 million in the following month, according to CoinDesk.

Speculation began to circulate regarding the connections between HiFo Labs and other entities, with Crypto Twitter hinting at a possible link between HiFo and Larva Labs, the parent company of CryptoPunks, which was acquired by Yuga Labs in 2022. However, Nakamigos took to Twitter in late March to firmly deny any association with Larva or Yuga.

Nakamigos announced its Early Access (free) Mint, scheduled for September 21, running from 12:00pm to 3:00pm ET on the Nakamigos website. Eligible wallets holding a Nakamigos NFT as of the snapshot taken on September 19 at 11:59pm ET would be able to participate. The Public Mint was slated to begin on September 21 at 4:00 p.m. ET, with a minting price of 0.05 ETH.

While specific details about CLOAKS remain scarce, it is known that the NFT collection comprises 20,000 Nakamigos characters, encompassing both “human-like characters and wolves.” Initially, the project announced a minting price of 0.05 ETH for all participants. However, in response to community backlash, they revised this to offer a free mint for Nakamigos holders.

Despite this adjustment in pricing, community members continue to express reservations regarding the overall value and utility of the project. They argue that the introduction of yet another NFT collection could dilute the project’s supply, akin to what occurred with Azuki and its recent collection, Elementals. Some community members draw parallels with DeGods Season III, which initially proposed a “collection upgrade” but later changed their plans due to negative feedback. Opinions vary, with some speculating that these alterations are deliberate, while others see them as reactive measures without a clear strategic intent.

Regardless of the differing perspectives on recent changes, there seems to be a prevailing consensus within the community that projects should prioritize offering additional benefits to their existing holders rather than continuously launching new collections.

There are a number of factors that likely contributed to the decline in the NFT market in September, including:

The ongoing bear market in cryptocurrencies, which has led to a decline in investment in all types of crypto assets, including NFTs.

Rising interest rates, which have made it more expensive to borrow money to invest in NFTs.

The overall economic slowdown, which has led to a decrease in consumer spending on all types of goods and services, including NFTs.

Regulatory concerns, as the US Securities and Exchange Commission (SEC) has initiated a number of lawsuits against NFT companies, alleging that they have violated securities laws.

Challenges Facing the NFT Market

The NFT market is still relatively new, and it has not yet been able to attract a large number of new adopters. This is likely due to a number of factors, including:

The complexity of the NFT ecosystem, which can be difficult for new users to understand.

The lack of understanding about NFTs among the general public.

The difficulty of buying and selling NFTs, especially for less popular collections.

The regulatory uncertainty surrounding NFTs.

SEC Lawsuits Impacting the NFT Market

The SEC lawsuits against companies and individuals involved in the NFT market are likely having a ripple effect on the market. These lawsuits have created uncertainty in the market and have led some investors to withdraw their funds. Additionally, the SEC lawsuits have given rise to concerns about the regulatory landscape for NFTs. This uncertainty and regulatory risks are likely discouraging some new investors from entering the market.

The overall trend is still downwards, and it remains to be seen when the NFT market will recover.

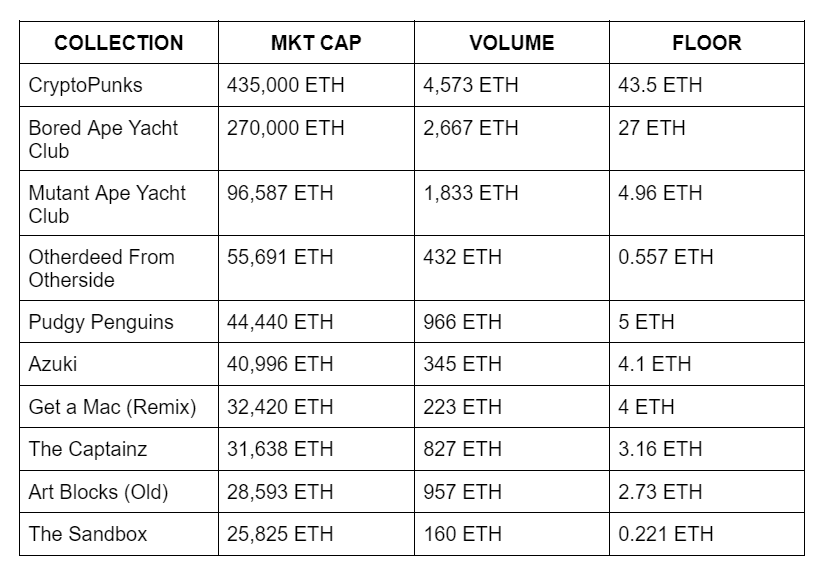

Top NFT Bluechips

Trending NFT Collections (Sales)

Upcoming NFT Projects

This is a list of upcoming projects that appear to have potential. Please note that this is NOT FINANCIAL ADVICE.

The list is based on a variety of factors, including the project’s team, technology, and use case. However, it is important to do your own research before investing in any project.

JIO- @JIOVERSE

DFA- @DigiFineArt

Today- @todaythegame

FEAC- @WE_ARE_FEAC

SOMO- @playsomo

Kentaro- @KentaroClub

Akogare- @AkogareOfficial

Castile- @Castileofficial

Jungle- @jungle_xyz

L3E7- @L3E7_Official

Idenifty- @idenifty

Pioneer Legends- @pioneerlegendio

$KING- @KINGcoinsol

Hunters.Bet@HuntersBetSol

Majin- @0xmajin_

Duel Labs- @Duel_Labs

Metame@metamenft

D3fenders- @d3fenders

Kromes- @Kromes_io

The Keepers- @TheKeepersNFT

Bankmen Finance- @BankmenFinance

Summary

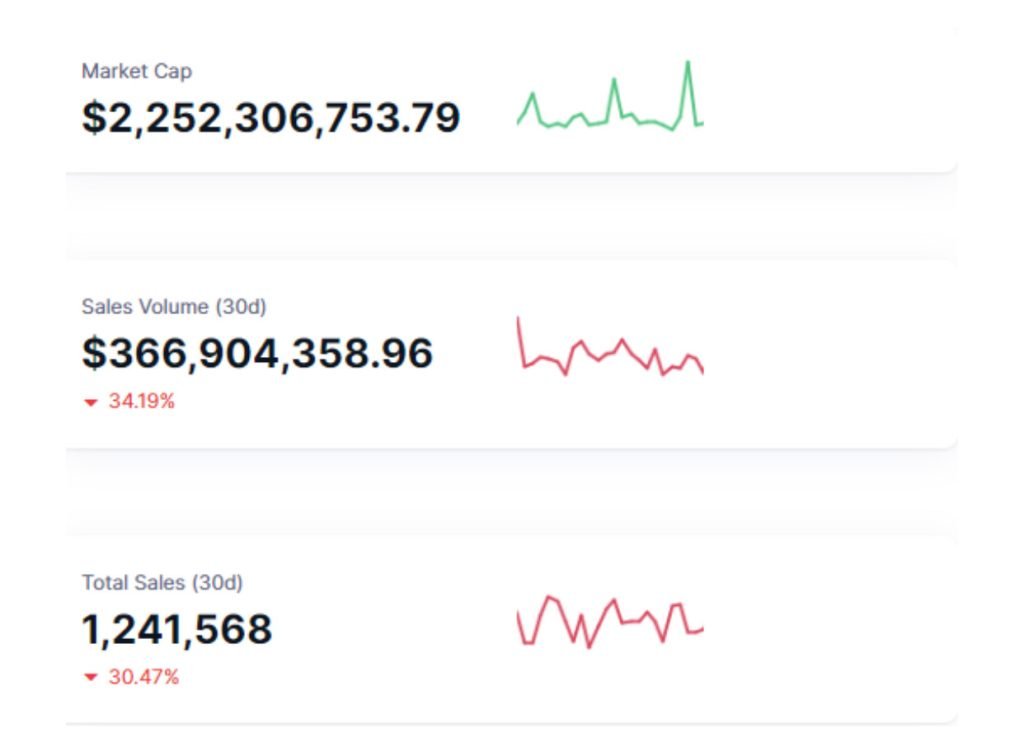

The NFT market continued to decline in September 2023, with both market cap and sales volume falling by double-digit percentages. However, the total number of NFT sales actually increased slightly, suggesting that there is still some interest in the market.

Despite the overall decline in the NFT market, there are still some bright spots. For example, the gaming and metaverse segments are still seeing strong growth. This is likely due to the increasing popularity of online gaming and the growing interest in the metaverse.

In conclusion, the NFT market is still in its early stages of development, and it is facing a number of challenges. However, there are also some bright spots, such as the growth of the gaming projects. It remains to be seen whether the NFT market will be able to overcome these challenges and achieve its full potential.