Algorand Price Stats

-

Market Cap: $2,291,925,560

-

Circulating Supply: 6,948,828,192 ALGO

-

Supply Cap: 10,000,000,000 ALGO

-

All-Time High: $3.56 on June 20, 2019.

-

All-Time Low: $0.105336 on March 13, 2020

A Brief History of Algorand

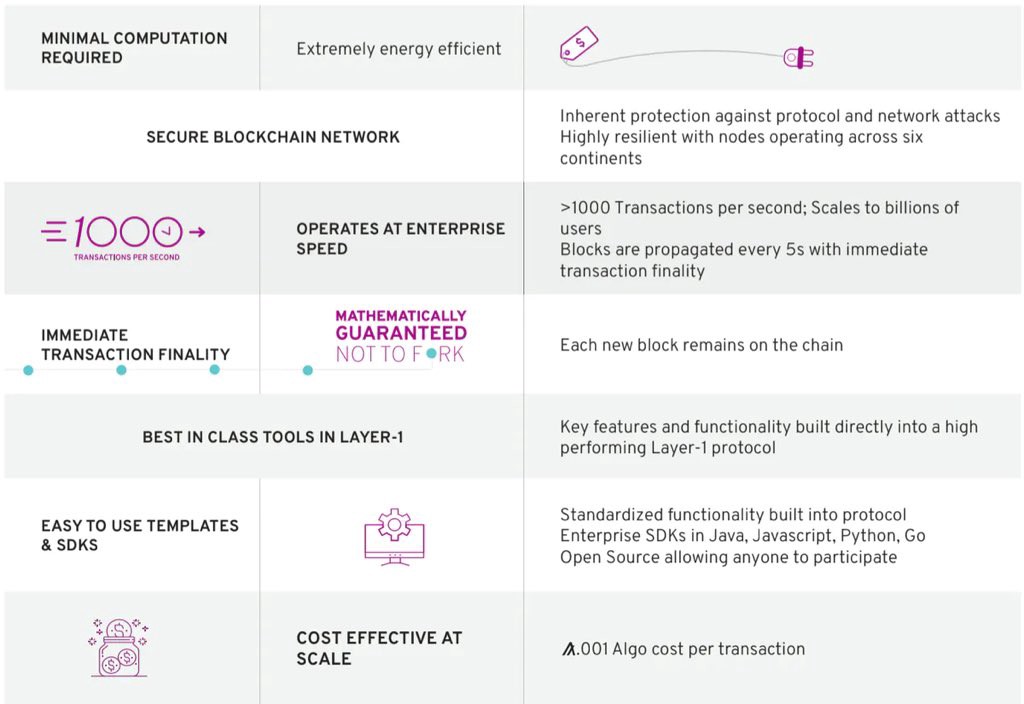

Algorand is an autonomous, decentralized blockchain-based network that can be used for a variety of purposes. These systems are secure, scalable, and efficient, which are all necessary for effective real-world applications. To create new forms of trust, Algorand will support computations that require reliable performance guarantees. The Algorand mainnet went live in June 2019 and can handle nearly 1 million transactions per day by December 2020. The transaction metrics for Algorand can be found here. The Algorand initial coin offering (ICO) took place in June 2019, with a token price of $2.4. Algorand was founded in 2017 by Italian computer scientist Silvio Micali, who proposed pure proof-of-stake as a solution to blockchain’s scalability problem. In June 2019, Algorand launched its mainnet and raised $60 million in its first ALGO token sale. Union Square Ventures and Pillar Venture Capital have also made investments in Algorand. Six Clovers, a fintech infrastructure provider, launched a cross-border payment system on Algorand in June 2021, and Arrington Capital launched a $100 million fund that same month, betting on the platform. Algorand Is Ranked #30 on Coinmarketcap while on Coingecko it is Ranked #32 and it can currently be purchased on Binance, OKX, Bybit, BingX, and FTX.

Algorand Team

Professor Silvio Micali is the founder of Algorand and he is a computer Scientist at the Massachusetts Institute of Technology. He received the Turing Award in 2012 in recognition of his fundamental contributions to the theory and practice of secure two-party computation, electronic cash, cryptocurrencies, and blockchain protocols. This places him among the world’s foremost crypto creators. The team also consists of other experienced professionals across all fields.

Advantages of Algorand

- There are strong partnerships involved

- Algorand has improved the blockchain landscape through various technological developments.

- It has an incredible speed of development and minimal bugs and errors.

- Algorand is technically and commercially positioned for success.

Disadvantages of Algorand

- A lot of competition with other blockchains focused on flexible smart contracts.

- Liquidity is not much for ALGO on exchanges.

Use Cases of Algorand

- Gold Trading – transforming physical gold into a digital asset on algorand

- Digital Identities Management – using algorand’s platform to build digital identities for millions in Africa.

- Insurance and accounting – professional grade accounting integrated available to algorand users and also enabling digital media validation across the ecosystem.

- Air Quality Monitoring – global air quality monitoring initiative launches on algorand

- Digital Assets Management.

Summary

Algorand is one of a number of newer projects attempting to broaden the possible applications for cryptocurrency by increasing transaction speeds and decreasing the time it takes for transactions to be deemed final on its network.

Sources:

https://www.algorand.com/https://www.algorand.foundation/

https://www.coinbase.com/price/algorand

https://www.algorand.com/about/our-team

https://coinmarketcap.com/currencies/algorand/

https://www.coindesk.com/price/algorand/

Beneficial Use Cases of Algorand In Various Industries