Game Theory Explained

Game theory is an applied mathematics branch that studies human behavior and rational decision-making. Game theory, which was originally developed to investigate the behavior of businesses, markets, and consumers is now widely used in a variety of fields of study. It entails creating interactive environments or “games” in which players respond rationally to rules and the influence of other players.

Game theory is an essential tool in blockchain research and development. It focuses on understanding the relationship between an economic system and an individual’s behavior, especially when the costs and benefits are variable and not fixed ahead of time. Politics, philosophy, and psychology can all benefit from game theory.

The well-known “Prisoner’s Dilemma” is a classic example of Game theory in action. It is a game theory model that depicts a scenario in which two prisoners are interrogated in separate rooms. Both prisoners are persuaded to betray the other, resulting in a much lower charge for themselves. The best case scenario is for both prisoners to remain silent, resulting in a slightly reduced sentence for both. However, the rewards for betraying the other, as well as the fear of being betrayed first, would make it difficult for them to select the best option.

The game theory is an important tool in many fields, including blockchain technology, for understanding how rational decision-making affects human behavior.

Bitcoin Game Theory

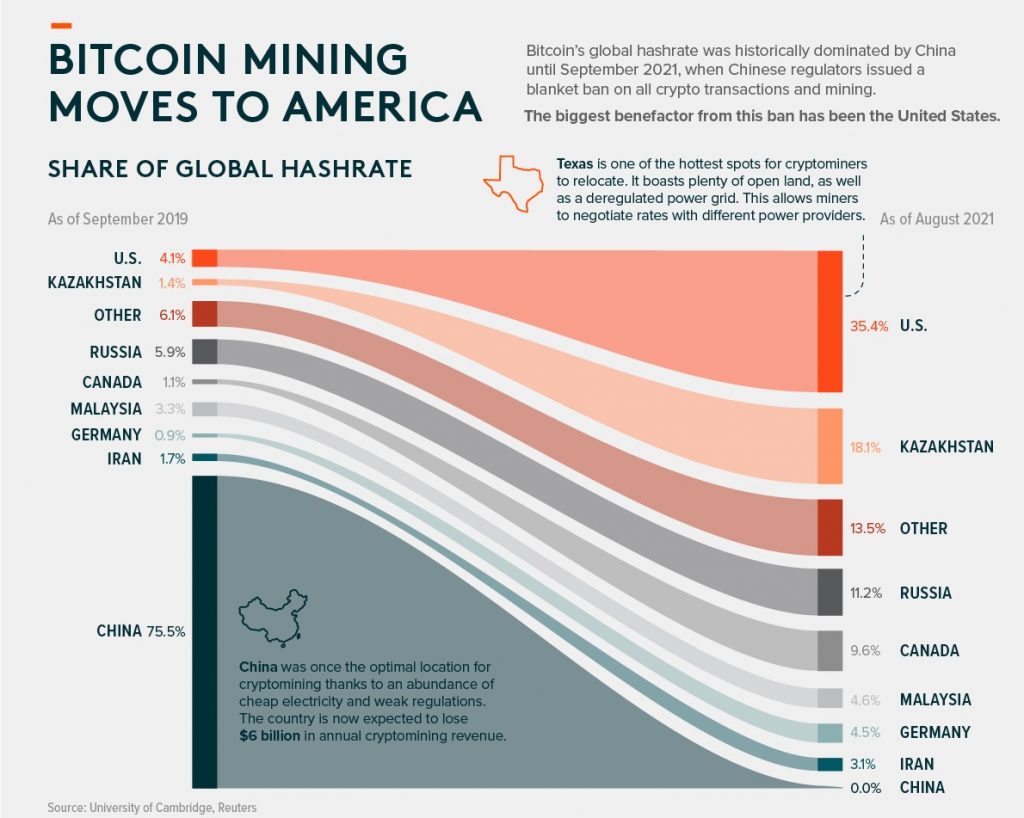

Game theory models are critical in the development of a secure and trustworthy economic system for cryptocurrencies such as Bitcoin. Cryptocurrencies have always been subtly opposed by various ‘players’ such as banks, governments, and some special interest groups, who have made a number of strategic moves against bitcoin. One of these was the Chinese government’s ban on bitcoin mining, which drove miners to other bitcoin-friendly countries.

In the context of cryptocurrencies, the fusion of cryptography and game theory gave rise to the concept of crypto-economics. The study of the economics of blockchain protocols, taking into account the potential consequences of participant behavior and the design of these protocols, is known as crypto-economics. It also takes into account the behavior of external agents who may join the network in order to disrupt it from within. In essence, crypto-economics examines network node behavior in light of the protocol’s incentives and the most rational and likely decisions.

The bitcoin blockchain is inherently decentralized, with nodes distributed across multiple locations. An agreement between these nodes is required for transactions or block validation. This system, however, is vulnerable to malicious activity and disruptions caused by dishonest nodes.

To address this issue, the proof of work (PoW) algorithm was developed to encourage honest behavior among nodes. The PoW algorithm employs cryptographic techniques that make mining more competitive and costly. This provides a strong incentive for miners to act honestly while also discouraging and penalizing malicious behavior. Miners who engage in unethical behavior risk losing their resources and being kicked off the network.

Game theory models are critical for creating secure, decentralized economic systems such as cryptocurrencies. As demonstrated by the Proof of Work algorithm, which was developed using a combination of cryptography and game theory, the Bitcoin blockchain is highly resistant to attacks.

Although other cryptocurrencies may use different methods to validate transactions, they all rely on game theory concepts in some way. The number of network participants is another important factor in blockchain security, with larger networks generally being more reliable than smaller ones.

In summary:

The study of strategic decision-making in the context of the Bitcoin network and its underlying cryptocurrency is known as Bitcoin game theory. It is critical to the development of cryptocurrencies and to the security structure of Bitcoin.

Sources:

https://www.investopedia.com/terms/p/prisoners-dilemma.asp

https://en.wikipedia.org/wiki/Prisoner%27s_dilemma

https://cryptonews.com/exclusives/game-theory-of-bitcoin-adoption-by-nation-states.htm

https://www.youtube.com/watch?v=Zq5XuTaLy4k

https://bitcoinmagazine.com/culture/the-bitcoin-dilemma

https://calebandbrown.com/blog/the-game-theory-of-cryptocurrency/