Introduction

Arkham leverages cutting-edge AI algorithms to analyze the vast landscape of blockchain and on-chain data, shedding light on previously veiled activities.

Through algorithms and data analysis, Arkham attempts to identify patterns and connections between blockchain addresses, wallets, and exchanges. They claim to link these to individuals, businesses, and other entities.

Overview

Arkham leverages sophisticated algorithms to analyze transaction data directly on the blockchain, extracting patterns and insights without relying on external information. The platform utilizes proprietary AI models, named “Ultra,” to link blockchain addresses to real-world individuals, businesses, and organizations. This is achieved by matching transaction patterns with publicly available data like social media profiles, domain registrations, and known financial entities.

Arkham provides users with interactive dashboards and network maps to visualize transaction flows, identify connections between entities, and track suspicious activity.

The platform features a unique marketplace called the “Intel Exchange,” where users can submit and monetize their on-chain research findings. This incentivizes further investigation and analysis, fostering a collaborative environment for uncovering hidden information within the blockchain.

Arkham operates chain-agnostically, meaning it can analyze transactions on various blockchains like Ethereum, Bitcoin, Binance Smart Chain, and others. This allows for a comprehensive view of crypto activity across different ecosystems.

Arkham democratizes blockchain intelligence. Here, using the native ARKM token, anyone can trade valuable insights—be it through targeted bounties or open auctions. This fosters a thriving community of “on-chain sleuths,” ensuring a constant flow of crucial information for all market participants.

Background

Spearheading Arkham Intelligence, Miguel Morel leverages his entrepreneurial expertise in strategic planning, management, recruitment, and fundraising, honed during his stint as co-founder of Reserve Protocol, a prominent stablecoin network. His business acumen extends beyond borders, with international market successes in East Asia, South America, West Africa, and the Middle East.

Arkham Intelligence launched in 2020 under the leadership of founder Miguel Morel. However, its ascent in the crypto sphere took a surprising turn in summer 2023 with the unveiling of the Intel Exchange. This token-powered platform attracted controversy by incentivizing users with cryptocurrency to unveil data and identify specific crypto wallets, essentially functioning as an anonymous marketplace for wallet-related information via smart contracts. Critics swiftly dubbed it a “snitch-to-earn” or “dox-to-earn” model, mirroring monetization methods seen in some Web3 games. Concerns swirled around potential misuse, including targeted attacks, inadvertent doxxing of innocent individuals, and a broader threat to privacy within the crypto industry. The platform’s significant fundraising of over $12 million further fueled speculation, especially with investors like Peter Thiel and Sam Altman involved, both known for their connections to data companies collaborating with the U.S. government. These associations gave rise to theories about the Intel Exchange being a potential CIA project.

Some of the historical milestones of Arkham Intelligence are:

– Launching the Arkham Codex, a blockchain data model that organizes and links addresses, entities, and assets on the blockchain

– Launching the Arkham Platform, a web-based interface that allows users to search, filter, and analyze on-chain data using the Arkham Codex

– Launching the Arkham API, a RESTful API that enables developers to access and integrate Arkham data into their own applications

– Launching the Arkham Intel Exchange, a marketplace for buying and selling on-chain data using the Arkham token (ARKM)

Tokenomics

ARKM, the native token of Arkham Intelligence, performs three functions:

Fueling the Intel Exchange: It serves as the primary currency for transactions on the platform, allowing users to buy and sell valuable intelligence reports.

Driving Adoption: Through a system of rewards and discounts, ARKM incentivizes user participation and platform growth, building a thriving ecosystem.

Shaping the Future: In the future, ARKM will empower its holders with voting rights, enabling them to actively influence the direction of the Arkham Intel Exchange.

This multi-faceted utility fosters a dynamic token economy. ARKM enters circulation through rewards for valuable contributions and platform purchases, while simultaneously being taken out through exchange fees and other designated uses. This continuous cycle ensures a healthy and stable network in the long run..

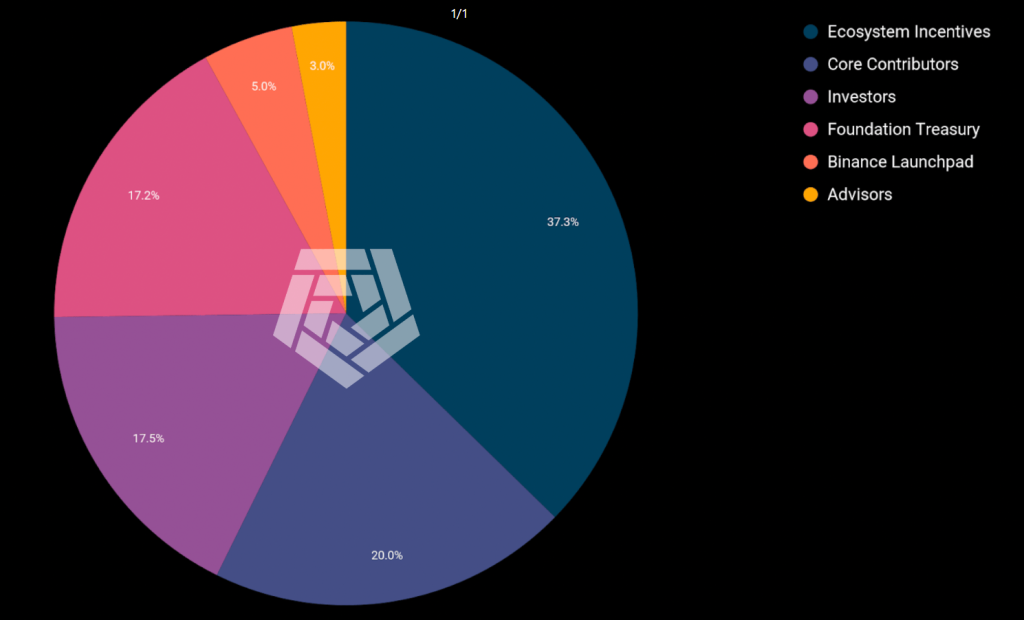

Initial Token Allocation:

Arkham’s 1 billion ARKM tokens were initially distributed according to the following breakdown:

Ecosystem Incentives and grants: 37.3% allocated to ecosystem incentives and grants, designed to foster platform adoption and empower third-party developers.

Core Contributors: 20% reserved for core contributors, acknowledging their critical roles in building Arkham Intelligence.

Investors: 17.5% secured through investor funding, providing crucial resources for platform development and expansion.

Foundation Treasury: 17.2% earmarked for the foundation treasury, ensuring long-term financial stability and supporting future initiatives.

Binance Launchpad: 5% distributed through the Binance Launchpad, boosting initial liquidity and market awareness.

Advisors: 3% set aside for advisors, recognizing their valuable contributions to strategic direction and technical expertise.

Ecosystem Fund Breakdown:

The 37.3% allocated to ecosystem incentives and grants is further divided into four areas:

Community Rewards: 28.7% (10.7% of total supply) directly incentivizes and appreciates platform users.

Contributor Incentive Pool: 26.8% (10.0% of total supply) fosters contributions to the platform’s growth and development.

DON PoS Rewards: 26.8% (10.0% of total supply) incentivizes participation in the platform’s Proof-of-Stake mechanism.

Ecosystem Grants: 17.7% (6.6% of total supply) supports external projects and initiatives contributing to the overall ecosystem.

Gradual Release:

ARKM’s full supply of 1 billion tokens will be unlocked in 7 years after listing. Initially, only 15% of the tokens will be in circulation, ensuring controlled growth and market stability.

Unlocking Schedules:

Investor, Core Contributor, and Advisor Tokens: Locked for 1 year after listing and then released linearly over 3 years.

Ecosystem Fund: Unlocked gradually over 5 years to support ongoing ecosystem development.

Foundation Treasury: Unlocked over 7 years, ensuring long-term sustainability and resource management.

Use cases of ARKM token

Intel-to-Earn:

– Pay to play: Access insightful reports on blockchain data (whale moves, exchange hacks, pump & dumps etc.) with ARKM tokens.

– Become a researcher: Earn ARKM tokens by contributing your own verified investigative reports, adding valuable intel to the ecosystem.

– Bounty hunting: Participate in time-limited challenges on the Intel Exchange, where researchers compete for ARKM rewards by solving specific on-chain mysteries.

Governance:

– Democracy in action: ARKM holders influence the platform’s direction by voting on proposals like changing fees, upgrading features, and allocating funds.

– Voting power proportional to holdings: More ARKM staked, more voting weight to impact decisions shaping Arkham’s future.

– Direct voice for users: Contribute meaningfully to the platform’s evolution and ensure it aligns with community needs.

Access & Discounts:

– Unlock exclusive perks: Premium data sets, advanced analytics tools, and deeper insights only available to ARKM holders.

– Save on transactions: Pay with ARKM and enjoy fee discounts on the Intel Exchange and other ecosystem services.

– VIP treatment: Enhance your Arkham experience with additional benefits like early access to features and limited edition NFTs.

Staking:

– Passive income stream: Earn a steady portion of ARKM tokens by simply depositing and locking your holdings (“staking”).

– Amplified governance voice: Increase your voting power for platform decisions proportionally to the amount staked.

– Support network stability: Staking contributes to the overall security and smooth operation of the Arkham ecosystem.

Features and Functionality

Ultra Engine: Arkham’s proprietary AI-powered algorithm that analyzes on-chain data and identifies patterns to link blockchain addresses to real-world identities. This includes:

- Transaction clustering: Grouping related transactions based on similarities.

- Entity recognition: Identifying entities (individuals, exchanges, wallets) involved in transactions.

- Social media analysis: Linking addresses to social media profiles for further identification.

- Network analysis: Mapping relationships between addresses to uncover groups and activities

Intel Exchange: A marketplace for on-chain intelligence where analysts can share their findings and earn bounties for accurate identifications. This incentivizes community-driven research and promotes transparency.

Customizable Insights: Access a searchable database of crypto users and filter their transactions based on various criteria to gain specific insights and inform investment decisions.

Alerts and Monitoring: Set up real-time alerts for specific addresses, entities, or keywords to track suspicious activity or identify investment opportunities.

Data Visualization:Transform cryptic on-chain data into crystal-clear insights with intuitive dashboards and engaging visualizations. Explore transaction history, entity relationships, and network activity with unprecedented ease.

Advantages of Arkham Intelligence:

- Arkham empowers investors, analysts, and even law enforcement to map complex transaction networks, identify whales and influencers, and expose bad actors like hackers and scammers. This demystifies the blockchain, fostering trust and responsible participation.

- By analyzing historical patterns and linking addresses to entities, Arkham provides invaluable insights into market trends. Imagine anticipating whale movements, detecting pump-and-dump schemes, and uncovering investment opportunities before the herd. This empowers informed decision-making and mitigates risk for traders and institutions alike.

- DeFi protocols are prone to exploits and rug pulls. Arkham’s real-time risk assessment tools can flag suspicious activity, identify potential vulnerabilities, and alert users before disaster strikes. This bolsters DeFi’s resilience and fosters a safer environment for innovation.

- Imagine automated compliance for DeFi protocols, ensuring adherence to regulations and mitigating the risk of regulatory crackdowns. Arkham’s data-driven tools can facilitate transparent governance, fair distribution of rewards, and equitable access to financial opportunities within the DeFi landscape.

- The Arkham Intel Exchange incentivizes on-chain research by allowing users to monetize their insights. This crowdsources valuable intelligence, fosters collaboration among blockchain enthusiasts, and accelerates the pace of discovery within the cryptosphere.

- Arkham’s data and analytics can inform traditional institutions about the risks and opportunities within DeFi, paving the way for collaboration, product innovation, and wider adoption of blockchain technology.

Risks and Challenges

- Privacy Concerns:

- De-anonymization: Arkham’s ability to link crypto addresses to real-world identities raises serious privacy concerns. This could lead to targeted harassment, discrimination, and even physical harm for users.

- Data Misuse: The centralized nature of Arkham’s data raises concerns about potential misuse by governments, law enforcement, or even malicious actors. This could stifle innovation and hinder wider adoption of blockchain technology.

- Surveillance State: Extensive on-chain analysis could contribute to a panoptic surveillance state, where every financial transaction is tracked and analyzed. This could undermine fundamental privacy rights and individual autonomy.

- Technical Challenges:

- Heuristics vs. Accuracy: Linking addresses to entities relies heavily on heuristics and probabilistic methods. This can lead to false positives and inaccurate attributions, causing damage to reputations and potentially hindering legitimate activities.

- Evolving Techniques: Malicious actors are constantly developing new techniques to obfuscate their activities on the blockchain. Arkham needs to continuously adapt and update its algorithms to stay ahead of these evolving threats.

- Scaling: As the volume of blockchain transactions increases, it becomes increasingly difficult to analyze and track all activity effectively.

- Economic and Ecosystem:

- Centralization: Despite its decentralized aspirations, Arkham currently acts as a central point of control for on-chain intelligence. This creates a single point of failure and reduces the overall resilience of the ecosystem.

- Market Manipulation: Access to Arkham’s data could be used by sophisticated actors to manipulate markets through front-running, insider trading, and other illicit activities. This could undermine trust and fairness in the crypto market.

- Regulatory Uncertainty: The legal implications of de-anonymizing blockchain transactions remain unclear. Arkham needs to navigate complex regulatory landscapes while complying with existing laws and preventing illegal activities.

How Arkham Intelligence Addresses Challenges:

- Risk Identification and Assessment:

- Proactive Threat Modeling: Arkham proactively identifies potential threats and vulnerabilities throughout the AI development lifecycle. This includes analyzing the AI’s purpose, capabilities, data interactions, and potential misuse scenarios.

- Algorithmic Bias Detection: Techniques like fairness audits and counterfactual analysis are used to detect and mitigate algorithmic biases that could lead to discriminatory or unfair outcomes.

- Security Vulnerability Assessments: Regular penetration testing and security audits identify vulnerabilities in the AI systems and surrounding infrastructure to prevent unauthorized access or manipulation.

- Mitigation and Control Mechanisms:

- Explainable AI (XAI): Arkham emphasizes developing AI systems that are transparent and interpretable, allowing humans to understand how the AI arrives at its decisions. This helps identify potential errors or biases and enables human oversight.

- Safety Guards and Fail-Safes: Robust safety protocols are implemented to prevent harm or unintended consequences. These may include emergency shutdown mechanisms, data access controls, and human-in-the-loop decision-making for critical tasks.

- Continuous Monitoring and Auditing: AI systems are continuously monitored for anomalies, performance deviations, and potential misuse. Regular audits assess the effectiveness of existing protocols and identify areas for improvement.

- Adaptability and Continuous Improvement:

- Learning from Incidents: Arkham continuously learns from incidents and near misses to improve their risk management practices and protocols. This iterative approach ensures adaptation to evolving threats and challenges.

- Research and Development: Ongoing research and development efforts focus on advancing risk assessment methodologies, developing safer AI architectures, and improving explainability and transparency.

- Collaboration and Knowledge Sharing: Collaboration with other AI researchers, developers, and policymakers is essential for sharing best practices and collectively addressing the challenges of safe and responsible AI development.

How Arkham Network is Secured

It is secured with the help of the Proof-of-Stake Mechanism.

Arkham Intelligence harnesses the power of artificial intelligence to strengthen its defenses against cyber threats. AI models proactively detect and prevent malware, phishing attacks, and data breaches, constantly evolving to stay ahead of emerging threats.

A network of independent nodes powered by the ARKM token, aptly named the Decentralized Oracle Network (DON), verifies the accuracy and reliability of the data gathered by bounty hunters. By outsourcing data verification to the DON, Arkham Intelligence eliminates the risk of bias or manipulation that can plague centralized systems.

Conclusion

Arkham Intelligence is a blockchain analytics platform focused on de-anonymizing transactions and linking them to real-world identities and entities. Their core mission is to bring transparency to the often opaque world of crypto, exposing bad actors and enabling informed decision-making for investors and financial institutions.

Arkham Intelligence stands as a double-edged sword in the crypto world. Its advanced blockchain analytics undeniably enhance transparency and combat illicit activity, yet its methods spark concerns about user privacy and potential for abuse. Ultimately, the responsibility lies with both Arkham to ensure responsible application and with users to weigh the benefits against the potential drawbacks. Whether Arkham Intelligence ultimately paves the way for a more secure and transparent crypto future or becomes a tool for mass surveillance remains to be seen. Only time will tell if the light it sheds on the blockchain shadows will illuminate a safer path or cast a deeper darkness.

Sources

https://www.arkhamintelligence.com

https://www.coingecko.com/en/coins/arkham

https://iq.wiki/wiki/miguel-morel

https://codex.arkhamintelligence.com/tokenomics

https://codex.arkhamintelligence.com