Introduction

Canto is a blockchain built for DeFi liberation. Imagine open finance without gas fees, rent-seeking tokenomics, or centralized control. Canto offers a unique take on DeFi, prioritizing freedom, accessibility, and innovation through its zero-fee infrastructure, public good ethos, and focus on open-source development.

Overview

In the vibrant landscape of DeFi, Canto carves its own path. It fosters inclusivity through open infrastructure and prioritizes groundbreaking design principles that push the boundaries of what’s possible. Ditching the tired fork-and-paste approach, By leveraging the familiar bedrock of the Ethereum Virtual Machine as a launchpad, Canto propels itself further, injecting its own unique architectural choices that fundamentally redefine the potential of DeFi, fostering an environment where inclusivity reigns and revolutionary design principles push the very boundaries of what’s possible. Unlike the staid and imitative landscape often encountered, Canto is a vibrant laboratory where experimentation flourishes and the promise of a truly democratized financial future takes concrete form.

Canto carves a unique path in the DeFi landscape, prioritizing open access and user empowerment through a trio of core tools: a fully decentralized exchange, a community-driven lending market, and a stablecoin designed for stability and security. This grassroots project shuns traditional fundraising mechanisms and vested interests, instead fostering an environment where experimentation is paramount nd users wield the reins of their financial future.

Canto’s DEX disrupts the traditional model, offering a vibrant marketplace for trading any ERC20 or Cosmos token without permission or hidden fees. Powered by an AMM with constant product curves, it empowers traders and liquidity providers alike. Meanwhile, the Canto lending market unlocks a dynamic ecosystem of borrowing, lending, and stablecoin minting. Users can capitalize on diverse asset options under variable interest rates, even harnessing collateralized debt positions to forge the US dollar-anchored NOTE, an oasis of stability within the market’s ebb and flow.

Background

In July 2022, a new melody emerged in the blockchain landscape: the Canto Protocol. This DeFi-focused blockchain aimed to harmonize two often discordant notes – scalability and decentralization – under the baton of a dedicated group of founders. Leading the charge were:

Scott Lewis: Co-founder of DeFi Pulse, a prominent DeFi data aggregator, Lewis brought his deep understanding of the DeFi ecosystem and commitment to community-driven projects to Canto.

The founders of Slingshot Crypto and Plex: This team contributed their expertise in decentralized exchange technology and infrastructure development, laying the groundwork for Canto’s efficient transaction processing and user-friendly interface.

The B-Harvest team: Renowned for their contributions to the Cosmos ecosystem, this team provided valuable guidance on building a modular and interoperable blockchain architecture for Canto.

Unlike many projects reliant on venture capital or pre-sales, Canto took a grassroots approach, initially relying on community support and organic growth.

Humble Beginnings and Early Challenges:

The early days were not without difficulties. Resource limitations challenged the team, requiring them to prioritize essential infrastructure development while building community trust in a competitive DeFi landscape. However, Canto’s unique architecture, employing the Tendermint BFT consensus algorithm with innovative optimizations, resonated with early adopters attracted to its strong decentralized ethos.

Rapid Growth and Ecosystem Flourishing:

As months passed, Canto’s Total Value Locked (TVL), a measure of DeFi activity, steadily climbed, surpassing 66 million USD within its first two months. This impressive growth was fueled by the flourishing ecosystem of dApps built on Canto, offering lending, borrowing, stablecoin swapping, and other DeFi functionalities.

A Strategic Boost and Onward Evolution:

In late 2022, a strategic investment from Variant, a reputable crypto venture fund, provided Canto with a significant boost. This influx of capital further propelled TVL upwards, exceeding 180 million USD, solidifying Canto’s position among the leading DeFi chains.

Committed to maintaining its decentralized core, Canto implemented on-chain governance in early 2023, empowering token holders to directly shape the protocol’s future through voting on key decisions. This move reinforces Canto’s dedication to community-driven development.

Looking Ahead: Building a Decentralized DeFi Future:

Canto’s future roadmap focuses on several key areas:

– Cross-chain interoperability: Connecting with other blockchains to expand the ecosystem and facilitate seamless asset movement.

– Advanced DeFi features: Implementing innovative mechanisms like on-chain derivatives and margin trading to enhance the DeFi experience.

– Community-driven development: Fostering active community participation in protocol development and governance, ensuring Canto remains a truly decentralized platform.

Tokenomics

Canto is a DeFi-focused Layer 1 blockchain built on the Cosmos SDK and Tendermint consensus. Its native token, CANTO, plays a crucial role in the network’s functionality. Here’s a detailed breakdown of Canto’s tokenomics:

Token Supply and Distribution:

Canto boasts a total supply of 1 billion CANTO, with over 559 million currently in circulation.

Distribution:

45% (450 million CANTO): Long-term liquidity mining, distributed over 5-10 years.

35% (350 million CANTO): Medium-term liquidity mining, distributed over months/years.

13% (130 million CANTO): Team and contributors.

5% (50 million CANTO): Future public goods grants.

2% (20 million CANTO): “Settlers of Canto” (governance contributors).

Below is the graphical representation of the Token allocation

As the lifeblood of Canto, CANTO acts as the currency for gas fees, a staking asset for network security and rewards, a voting tool for governance, and the key to unlocking liquidity options within Canto’s DeFi protocols.

To fuel participation and ecosystem growth, Canto employs an inflationary emission schedule, initially pegged at 19.84% APR but subject to periodic reductions, with inflationary tokens proportionally distributed to incentivize long-term staking. Future emission rates, however, remain open to community-driven adjustments through on-chain governance.

Use cases of Canto Token

– Network Governance: $CANTO empowers its holders through participation in the Canto Decentralized Autonomous Organization (DAO). By staking their tokens, users gain voting rights on crucial decisions shaping the network’s future, from protocol upgrades to fee structures. This fosters a sense of ownership and community involvement, driving the network’s long-term growth.

– Transaction Fees: Similar to other blockchains, $CANTO is the native currency used for paying transaction fees on the Canto network. These fees compensate validators for securing the network and incentivize them to maintain its smooth operation. However, Canto takes a unique approach by offering several fee-free options for specific DeFi activities, promoting wider adoption and user engagement.

– Staking & Validator Rewards: Staking $CANTO plays a vital role in securing the Canto network. Users can delegate their tokens to validators who run the blockchain infrastructure and verify transactions. In return, stakers earn validator rewards.

– Liquidity Incentives: Canto heavily incentivizes liquidity provision on its native decentralized exchange (DEX). Users who supply liquidity pairs with $CANTO earn trading fees and additional $CANTO rewards, attracting capital and ensuring smooth trade execution. This fosters a vibrant DeFi ecosystem on Canto, benefiting both traders and liquidity providers.

– Access to Canto Lending Market (CLM): $CANTO serves as the key to unlocking the Canto Lending Market (CLM), a permissionless lending and borrowing protocol. Users can deposit their $CANTO or other supported assets as collateral to borrow various cryptocurrencies. Similarly, lenders can earn interest on their deposited assets, creating a dynamic lending and borrowing ecosystem within the Canto network.

– Integration with Futute dApps: With Canto’s ecosystem steadily expanding, one can anticipate an ever-widening range of use cases for $CANTO beyond its current functionalities. The network’s strategic alignment with the Ethereum Virtual Machine (EVM) fosters a conducive environment for developer adoption, paving the way for a vibrant dApp landscape. Future dApps built on Canto may leverage $CANTO for diverse purposes, including powering in-app economies, empowering dApp governance, and unlocking participation in the next generation of DeFi protocols.

Features and Functionality

Utility Token:

- Liquidity Incentives: CANTO rewards incentivize users to provide liquidity to various DeFi protocols on Canto, including the native DEX and Canto Lending Market.

- Governance: CANTO holders can participate in on-chain governance by voting on proposals related to protocol upgrades, fee structures, and other key decisions.

- Collateral: CANTO can be used as collateral to borrow the Canto-native stablecoin NOTE and other supported assets.

Economic Model:

- Inflationary: CANTO has a variable inflation rate adjusted dynamically based on network activity and protocol needs.

- Token Burn: A portion of transaction fees generated on the Canto network are burned, reducing the overall supply of CANTO and potentially creating deflationary pressure.

- Fee Capture: Canto does not have native transaction fees, but protocols built on top can set their own fees and potentially distribute a portion of them to CANTO holders.

Unique Aspects:

- Free Public Infrastructure: Canto prioritizes building core DeFi primitives like AMMs and lending protocols as free public goods, aiming to avoid rent extraction and user capture.

- EVM Compatibility: Canto’s EVM integration allows developers to easily deploy existing Ethereum-based DeFi projects on Canto, fostering cross-chain liquidity and innovation.

- Focus on Innovation: Canto aims to become a hub for original DeFi development, encouraging builders to experiment and create novel financial applications.

Advantages

- Speed and Scalability: Canto utilizes a unique hybrid consensus mechanism called Tendermint BFT, which combines the Byzantine Fault Tolerance (BFT) protocol with Proof-of-Stake (PoS) validation. This combination aims to maintain security while enabling greater scalability compared to solely PoS-based chains.

Interoperability:

- IBC integration: Canto integrates with the Inter-Blockchain Communication (IBC) protocol, allowing seamless communication and asset transfers between Canto and other IBC-enabled blockchains. This opens up a wider range of DeFi opportunities and fosters a more interconnected blockchain ecosystem.

- EVM compatibility: Canto features a custom-designed smart contract execution environment compatible with the Ethereum Virtual Machine (EVM). This facilitates easier porting of existing DeFi applications and tools from Ethereum to Canto, attracting developers and users familiar with the Ethereum ecosystem.

Developer Friendliness:

- Modular architecture: Canto adopts a modular architecture, allowing developers to easily integrate various DeFi building blocks into their applications. This modularity enables faster development and customization of new DeFi functionalities.

- Cosmos SDK integration: Canto leverages the Cosmos SDK, a popular framework for building blockchain applications. This provides developers with familiar tools and simplifies the development process.

Sustainability:

- Dynamic Fee Structure: Canto employs a dynamic fee system that adapts to network congestion, aiming to optimize both affordability and network stability. This ensures accessible transactions while maintaining a healthy ecosystem.

- Energy Efficiency: Compared to energy-intensive Proof-of-Work blockchains like Bitcoin, Canto’s Proof-of-Stake consensus mechanism operates at a fraction of the energy cost, aligning with the rising demand for sustainable blockchain solutions.

Risk and Challenges

Security Risks:

- New and Untested Platform: Canto is a relatively young protocol compared to established DeFi platforms. This raises concerns about potential security vulnerabilities that may remain undiscovered.

- Smart Contract Risks: Bugs or exploits within the Canto smart contracts could lead to losses for users.

- Economic Attacks: The Canto protocol’s reliance on free infrastructure could make it susceptible to economic attacks such as flash loan manipulation or denial-of-service attacks.

Sustainability and Tokenomics:

- Maintaning free Infrastructure: One major question surrounding Canto is its free infrastructure model’s viability over time. The protocol needs to strike a delicate balance between generating income and keeping its promise of free usage.

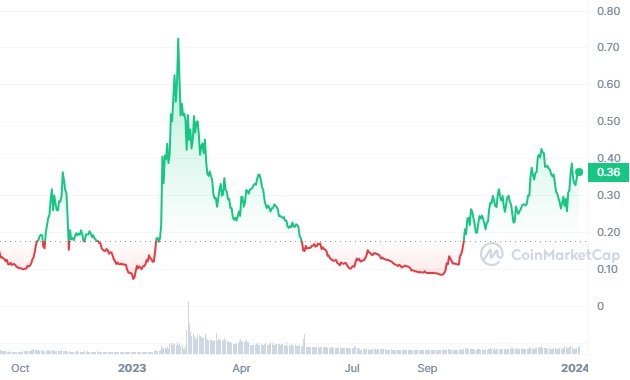

- Token Value Volatility: The price of Canto’s native token ($CANTO) could experience significant volatility due to its young age and the evolving DeFi landscape. This volatility could impact the overall stability of the ecosystem.

- Distribution and Governance: The initial distribution of $CANTO tokens and the power dynamics within the Canto governance system could lead to centralization concerns.

Adoption and Competition:

- Attracting Users and Developers: Competing with established DeFi platforms for users and developers can be challenging for a new protocol like Canto.

- Building a Diverse Ecosystem: Building a rich and diverse ecosystem of DeFi applications is essential for Canto’s long-term success.

- Regulatory Uncertainty: The evolving regulatory landscape around DeFi poses a challenge for all protocols, including Canto.

How Canto Addresses The Challenges

Addressing Security Risks:

- Audits: Regular security audits by reputable firms are conducted to identify and address potential security concerns.

- Bug Bounties: To actively bolster security, Canto implements a generous bug bounty program, attracting skilled researchers to uncover and report potential vulnerabilities before they can be exploited.

- Formal Verification: Taking security seriously, Canto leverages cutting-edge formal verification techniques to rigorously analyze their smart contracts, leaving little room for hidden security flaws.

Addressing the fears of unsustainability:

- Transaction Fees: While transaction fees for LPs are currently zero, the Canto team is exploring alternative fee structures for future implementation to ensure network sustainability.

- Reserve Funds: Canto maintains reserve funds that can be used to cover unexpected expenses or stabilize the protocol during times of stress.

- Community Governance: The Canto community plays a crucial role in shaping the protocol’s economic model and token distribution through active participation in governance proposals.

Addressing Unacceptance and Competition:

- Incentivizing Developers: Canto offers grants and other incentives to attract developers and encourage the creation of innovative DeFi applications on the platform.

- Partnerships and Integrations: Building partnerships and integrations with other DeFi protocols and applications can increase Canto’s user base and ecosystem reach.

- Community Driven Growth: The Canto community plays a vital role in promoting the protocol and attracting new users through organic outreach and marketing efforts.

How Canto is Secured

At the heart of Canto’s security lies its Tendermint consensus mechanism, boasting Byzantine Fault Tolerance (BFT). This translates to near-impenetrable protection against both malicious actors and network failures.

Building upon EVM compatibility, Canto leverages the proven security of the Ethereum Virtual Machine, a battle-tested foundation for smart contracts. Additionally, Canto prioritizes continuous improvement through regular security audits by renowned firms, meticulously identifying and addressing potential vulnerabilities. Finally, the innovative CSR Model incentivizes responsible development by sharing fees with developers who craft secure smart contracts, fostering a virtuous cycle of safety.

Conclusion

Canto is a permissionless Layer-1 blockchain built on the Cosmos SDK and Tendermint Core, designed as a free public infrastructure for DeFi with EVM compatibility. While its free DeFi vision and rapid growth are impressive, long-term sustainability and governance remain key questions. Success will depend on navigating these challenges and attracting a thriving developer and user community.

Sources:

https://www.canto.io

https://docs.canto.io

https://www.coingecko.com/en/coins/canto

https://www.coincarp.com/currencies/canto/project-info/

https://coinmarketcap.com/currencies/canto/