Introduction

Creditcoin is a foundational L1 blockchain designed to match and record credit transactions, creating a public ledger of credit history and loan performance and paving the way for a new generation of interoperable cross chain credit markets, and connecting capital from Web3 to real world credit investment opportunities.

Overview

Creditcoin is a network that enables cross blockchain credit transaction and credit history building. Creditcoin uses blockchain technology to ensure the objectivity of its credit transaction history: each transaction on the network is distributed and verified by the network.

Background

Creditcoin was jointly founded in 2017 by two companies, Gluwa and Aella with Gluwa as the technology provider of Creditcoin and Aella as the initial distributor.

Gluwa is a global team of industry experts with experience in areas such as blockchain technology, cryptocurrency trading, financial services, computer science, traffic systems, and clinical psychology among others.

The founding team includes Tae Oh, Founder, and CEO of Gluwa, Scott Hasbrouck – VP of Engineering, Sung Choi – VP of investment, Vladimir Kouznetsov – Lead Blockchain Architect, David Lebee, and others.

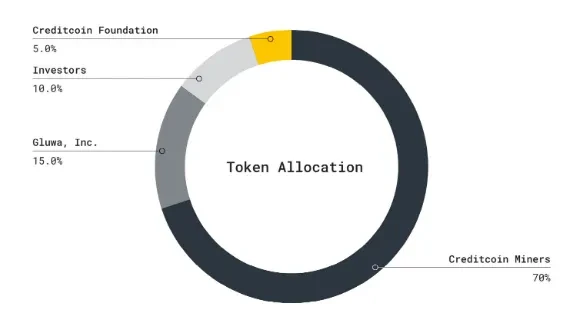

Tokenomics

- The total Creditcoin token supply is set at 2 billion tokens. The token sale is capped at 200 million tokens (10% of the total supply).

- The network conducted a private token sale for 200 million tokens with a soft cap of $10 million and a hard cap of $30 million on 1st September, 2017. All the available tokens were bought during the sale and were subsequently introduced into the market.

- Creditcoin allows users to operate its network with two separate tokens – $CTC and $G-CRE. As the mainnet token, $CTC is used for paying transaction fees and rewarding miners for securing the network.

- $G-CRE is an ERC20 token based on the Ethereum Network which is primarily used for vesting and trading purposes. It cannot be directly used on the Creditcoin mainnet. However, users can use a one- way (1:1) hook and exchange it for $CTC.

Total Supply and Distribution

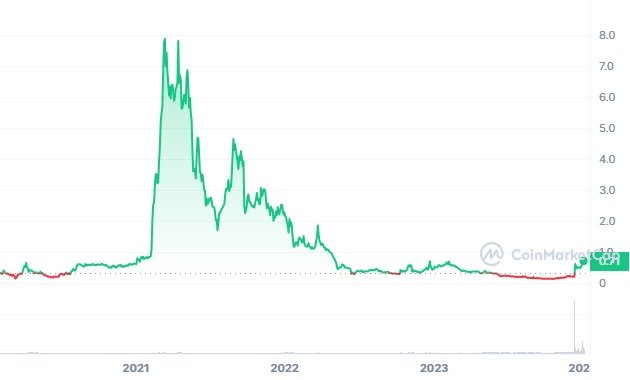

Creditcoin has a current supply of 599,999,997 with 214,464,279 in circulation. The last known price of Creditcoin is 0.37623449 USD and is up 5.27 over the last 24 hours. It is currently trading on 21 active market(s) with $12,704,352.09 traded over the last 24 hours.

Use cases:

One of the primary use cases for CreditCoin is as a secure and transparent platform for peer to peer lending and borrowing. The platform’s smart contract functionality and decentralized nature make it easy for individuals and businesses to take out loans or invest their funds without the need for intermediaries.

Where and how to Buy Creditcoin

You can purchase Creditcoin on KuCoin, Buying Creditcoin on the KuCoin Spot Market is fast and easy. To buy on KuCoin, you can transfer assets to your KuCoin account, then trade those assets for CTC. Alternatively, you can buy USDT using KuCoin Fast Trade, then trade your USDT for Creditcoin (CTC) on the Spot Market.

Example of using Creditcoin

Person A asks to borrow $100 from Creditcoin, saying he/she will pay $150 back.

Person B checks the Creditcoin history of Person A and accepts the transaction.

Then, Person A borrows $100 from Person B.

Person B sells and transfers the loan to Person C.

Persons A and C agree to write off $40 of the debt.

Person A pays Person C $ 110, and C accepts it.

You can store CTC in an exchange wallet. However, most exchange wallets are hot wallets that are vulnerable to various security risks. Alternatively, you can use MetaMask, a web3 wallet that allows you custody over your funds.

Features and Functionality

Some of the main features of Creditcoin include instantaneous settlement of lending and borrowing. The decentralized solution of Creditcoin allows seamless creation of lending markets by offering fast closing of bid spreads.

Its primary function is covering transaction fees and mining rewards. Additionally, CTC operates through a unique token usage mechanism, which is utilized to settle transaction fees for every communication or update issued by the CreditCoin network.

Advantages

-Allows blockchain based loan transactions.

-Investors can lend any cryptocurrency that is supported by Creditcoin.

-Its provision and fundraising system is established on the Creditcoin blockchain.

Risks and Challenges

- It has high value rate

- Currently only supports Bitcoin and Ethereum as a loan medium.

- The CTC currency with no utility outside the Creditcoin ecosystem.

Conclusion

Creditcoin is a decentralized cryptocurrency that operates on blockchain technology. It was created with the goal of providing a secure, fast, and efficient way for people to make financial transactions without the need for intermediaries such as banks. Unlike other cryptocurrencies, CreditCoin has a unique focus on the lending and borrowing market, making it an ideal choice for individuals and businesses looking to take out loans or invest their funds.

Sources

https://www.crypto-rating.com/ico-rating/cointoken/

https://www.okx.com/cs/help/creditcoin-ctc

https://revain.org/projects/creditcoin

https://www.google.com/amp/s/creditcoin.org/blog/creditcoin-roadmap/amp/