Introduction

The purpose of this article is to introduce optimism, a layer 2 solution for scaling Ethereum. Optimism aims to improve the speed, cost, and usability of Ethereum by using optimistic rollups, a technique that allows transactions to be executed off-chain and verified later on-chain. Optimism is one of the most anticipated projects in the Ethereum ecosystem, as it promises to enable faster and cheaper transactions for users and developers, while preserving the security and decentralization of Ethereum.

Overview

Optimism is a project that leverages optimistic rollups, a layer 2 scaling solution for Ethereum. Optimistic rollups are a form of rollups, which are bundles of transactions that are executed off-chain and periodically submitted to the main chain as a single transaction. Rollups reduce the load on the main chain, as they only require the main chain to verify the validity of the rollup, not the individual transactions within it.

Optimistic rollups are a specific type of rollups that use a technique called optimistic execution. Optimistic execution means that transactions are assumed to be valid by default, and only challenged if someone provides a proof of fraud. This allows transactions to be executed instantly and cheaply off-chain, without waiting for confirmation from the main chain. However, this also introduces a risk of invalid transactions being included in the rollup, which can be exploited by malicious actors. To prevent this, optimistic rollups use a system of incentives and penalties, where honest users are rewarded for verifying and challenging invalid transactions, and dishonest users are punished for submitting or executing them.

Optimism uses the Ethereum Virtual Machine (EVM) as its execution environment, which means that it is compatible with existing Ethereum smart contracts and tools. Optimism also uses the Optimistic Virtual Machine (OVM), which is a modified version of the EVM that supports optimistic execution. The OVM allows developers to deploy and run their smart contracts on optimism, without requiring any code changes. Optimism also provides a bridge that allows users to transfer their assets between Ethereum and optimism, enabling interoperability and liquidity.

Background

Optimism was founded by Jinglan Wang, Karl Floersch, and Ben Jones, who are former researchers and developers at the Ethereum Foundation and Plasma Group. Plasma Group was a non-profit organization that focused on developing plasma, another layer 2 scaling solution for Ethereum. However, plasma faced some technical and usability challenges, such as data availability and mass exit problems, which led the Plasma Group team to pivot to optimistic rollups.

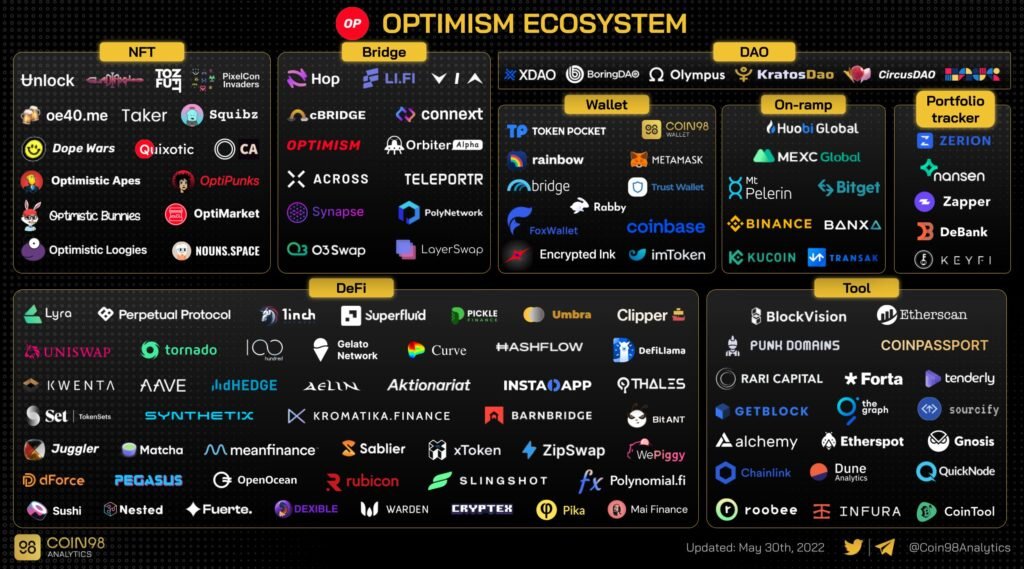

Optimism was officially announced in January 2020, as a rebranding of Plasma Group. The project received funding from prominent investors and organizations, such as Paradigm, a16z, Coinbase Ventures, and the Ethereum Foundation. Optimism also partnered with leading projects and platforms in the Ethereum ecosystem, such as Uniswap, Synthetix, Chainlink, and MakerDAO, to integrate and test their solutions on optimism.

Optimism launched its testnet in September 2020, and its mainnet in March 2021. However, the mainnet is currently in a limited mode, where only whitelisted projects and users can access it. Optimism plans to open its mainnet to the public in the near future, after ensuring the stability and security of its network.

Tokenomics

Optimism does not have a native token, as it is not a separate blockchain, but a layer 2 solution for Ethereum. However, optimism uses ETH as its gas fee for transactions, similar to Ethereum. Optimism also uses ETH as a collateral for its fraud proof system, where users have to stake ETH to submit or challenge transactions on the network. Optimism also allows users to transfer and use other ERC-20 tokens on its network, such as DAI, USDC, SNX, and UNI, through its bridge.

Optimism does not have a fixed supply of ETH, as it is dependent on the supply of ETH on Ethereum. However, optimism aims to reduce the demand and consumption of ETH on its network, by lowering the gas fees and increasing the throughput of transactions. Optimism claims that it can reduce the gas fees by up to 100x, and increase the throughput by up to 1000x, compared to Ethereum.

Optimism does not have a token distribution, as it does not have a native token. However, optimism has a team and investor distribution, where the founders and early backers of the project own a share of the company. Optimism has not disclosed the exact details of its team and investor distribution, but it has stated that it is committed to transparency and fairness, and that it will use its funds to support the development and growth of its network.

Optimism does not have a specific use case for its token, as it does not have a native token. However, optimism has a general use case for its network, which is to provide a scalable and user-friendly layer 2 solution for Ethereum. Optimism enables users and developers to access faster and cheaper transactions, while maintaining the security and decentralization of Ethereum. Optimism also enables users and developers to interact with various applications and protocols on its network, such as decentralized exchanges, synthetic assets, oracle services, and stablecoins.

Optimism does not have a specific place to buy, store, and trade its token, as it does not have a native token. However, optimism has a general place to buy, store, and trade ETH and other ERC-20 tokens on its network, which is its bridge. Optimism’s bridge allows users to transfer their assets between Ethereum and optimism, using a simple and secure interface. Users can also use various wallets and exchanges that support optimism, such as Metamask, Argent, Coinbase, and Binance, to access and manage their assets on the network.

Features and Functionality

Optimism has several core features and use cases that make it a unique and valuable layer 2 solution for Ethereum. Some of these features and use cases are:

– Optimistic execution: Optimism uses optimistic execution, which allows transactions to be executed instantly and cheaply off-chain, without waiting for confirmation from the main chain. This improves the speed, cost, and usability of transactions, and enhances the user experience and satisfaction.

– Fraud proof system: Optimism uses a fraud proof system, which ensures the security and validity of transactions, and prevents malicious actors from exploiting the network. The fraud proof system uses a system of incentives and penalties, where honest users are rewarded for verifying and challenging invalid transactions, and dishonest users are punished for submitting or executing them.

– EVM and OVM compatibility: Optimism uses the EVM and the OVM as its execution environments, which means that it is compatible with existing Ethereum smart contracts and tools. The EVM and the OVM allow developers to deploy and run their smart contracts on optimism, without requiring any code changes. This reduces the friction and complexity of developing and migrating applications to optimism, and increases the adoption and innovation of the network.

– Bridge: Optimism uses a bridge, which allows users to transfer their assets between Ethereum and optimism, enabling interoperability and liquidity. The bridge provides a simple and secure interface for users to move their assets across the networks, and supports various ERC-20 tokens, such as DAI, USDC, SNX, and UNI. The bridge also allows users to access various applications and protocols on both networks, such as Uniswap, Synthetix, Chainlink, and MakerDAO.

Optimism has several unique selling points and advantages that make it stand out from other layer 2 solutions for Ethereum. Some of these advantages are:

– Scalability: Optimism claims that it can scale Ethereum by up to 1000x, by increasing the throughput of transactions from 15 TPS to 15,000 TPS. This means that optimism can handle more transactions and users, and support more applications and use cases, without compromising the performance and quality of the network.

– Cost-efficiency: Optimism claims that it can reduce the gas fees of transactions by up to 100x, by lowering the demand and consumption of ETH on the network. This means that optimism can make transactions more affordable and accessible, and reduce the barriers and challenges for users and developers, especially in times of high network congestion and volatility.

– User-friendliness: Optimism claims that it can improve the user-friendliness of transactions, by providing instant and cheap transactions, and by maintaining the compatibility and familiarity of the EVM and the OVM. This means that optimism can enhance the user experience and satisfaction, and attract more users and developers to the network, especially those who are new or unfamiliar with Ethereum and web3.

Risks and Challenges

Optimism faces some potential risks and challenges that could affect its development and adoption. Some of these are:

– Technical complexity: Optimism involves a high level of technical complexity, as it requires the coordination and synchronization of multiple components and layers, such as the EVM, the OVM, the bridge, the fraud proof system, and the main chain. This could pose some difficulties and uncertainties for the development and maintenance of the network, and could also introduce some bugs and vulnerabilities that could compromise the security and functionality of the network.

– User education: Optimism requires a certain level of user education, as it introduces some new concepts and mechanisms, such as optimistic execution, fraud proofs, delegate tokens, and the bridge. Users need to understand how these concepts and mechanisms work, and what are the benefits and risks involved, in order to use optimism effectively and safely. Users also need to be aware of the differences and trade-offs between optimism and other layer 2 solutions and the main chain, and how to choose the best option for their needs and preferences.

– Competition: Optimism faces some competition from other layer 2 solutions and scaling technologies, such as zk-rollups, Polygon, Arbitrum, and StarkWare. These solutions also offer scalability, cost-efficiency, and user-friendliness, and some of them have already launched their mainnets and gained significant adoption and traction. Optimism needs to differentiate itself from these solutions, and demonstrate its value proposition and competitive edge, in order to attract and retain users and developers, and to establish its position and reputation in the layer 2 ecosystem.

Conclusion

Optimism is a layer 2 solution for scaling Ethereum, that uses optimistic rollups, a technique that allows transactions to be executed off-chain and verified later on-chain. Optimism aims to improve the speed, cost, and usability of Ethereum, by providing instant and cheap transactions, while preserving the security and decentralization of Ethereum. Optimism also aims to support and enable various applications and use cases on its network, such as decentralized finance, gaming, social media, and art.

Sources:

https://optimism.io/

https://medium.com/ethereum-optimism

https://twitter.com/optimismPBC

https://docs.optimism.io/

https://blog.synthetix.io/optimistic-ethereum-launch/

https://uniswap.org/blog/uni-optimism-downtime-retro/

https://blog.chain.link/chainlink-optimism-mainnet/

https://makerdao.com/en/blog/optimism-dai-bridge-officially-launched/