Introduction

Serum is a decentralized exchange software built on Solana where cryptocurrencies can be bought and sold by traders. If you’re unfamiliar, Solana is a blockchain platform that aims to increase user scalability through faster transaction settlement times. By being deployed on Solana, Serum can fully benefit from the speed and cost effectiveness of transactions settled on its blockchain.

Overview

Serum is a protocol and ecosystem that brings speed and low transaction costs to decentralized finance. It is built on Solana and is completely permissionless. Ecosystem partners can compose with Serum’s on chain central limit orderbook to share liquidity and power markets-based features for institutional and retail users.

More specifically, Serum’s on chain central limit order book and matching engine provides liquidity and price time priority matching to traders and composing projects. Users benefit from this exchange model through the ability to choose the price, size and direction of their trades. Composing projects benefit from Serum’s existing architecture, bootstrapped liquidity, and matching service.

As a cryptocurrency, the Serum token runs natively on the Solana blockchain, which means Serum transactions take place very quickly. The token is cross listed as an ERC-20 token on Ethereum. Serum is also available in a 1 Million token denomination, the MegaSerum. Users can convert SRM to MSRM and vice versa.

Background

Serum’s whitepaper was released in July 2020, highlighting the bottlenecks of existing Ethereum based decentralized exchanges and the lack of cross chain support. The Serum project was launched in August 2020 by the Serum Foundation, which included members like FTX, Alameda Research, and the Solana Foundation. The advisory board of Serum is helmed by Compund’s founder Robert Leshner, FTX CEO Sam Bank man Fried, CMS co-founder Dan Matuszewski, etc.

Serum selected the Solana blockchain to launch their DEX as it is faster and cheaper than Ethereum. Solana was also the best fit as it wouldn’t cost a fortune to execute order book based transactions on its network allowing Serum to create a fully on-chain market matching engine.

As Serum supported applications to build on top of its order book, it skyrocketed to become the preferred backend for building DeFi apps on Solana. In November 2021, Serum had $1.5 billion in total value locked, and the project was home to many top Solana-based DeFi projects such as Raydium, Mango Markets, and Atrix.

The brains behind serum include:

FTX, Alameda Research, and the Solana Foundation. The advisory board of Serum is helmed by Compund’s founder Robert Leshner, FTX CEO Sam Bank man Fried, CMS Co founder Dan Matuszewski, etc.

Tokenomics

The native token of Serum is SRM. It has a circulating supply of 263,244,669 SRM coins and a max. supply of 10,161,000,000 SRM coins.

Use cases:

it is used for protocol governance, getting discounts on fees, participating in network activities, earning passive income, and purchasing cryptocurrencies.

Serum is trading on 21 cryptocurrency exchanges across 30 trading pairs. The most popular Serum pair is SRM/BUSD on Binance, where it has a trading volume of $ 0.00. You can trade Serum with many fiat currencies including USD, EUR, TRY, IDR and many stablecoins such as USDT, USDC, BUSD. Other ones include AscendEX, OKX, FTX Spot, and Gate.io.

Wallets where SRM can be stored include:Trust Wallet, MetaMask, Ledger, imToken, Torus.

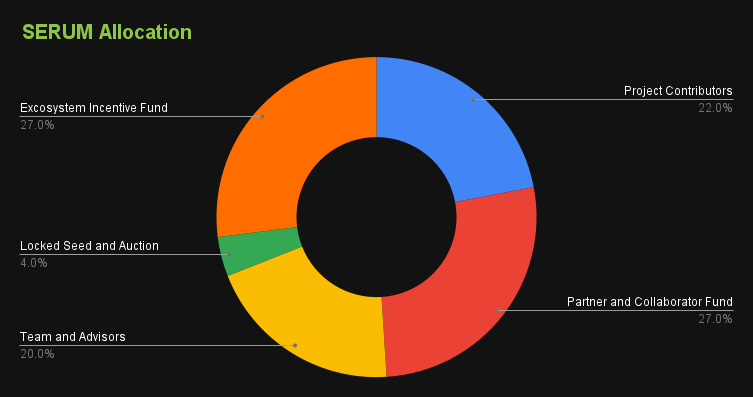

Token allocation

27% – Ecosystem Incentive Fund;

27% – Partner and Collaborator Fund;

22% – Project Contributors;

20% – Core Team;

4% – Locked Seed and Auction.

Features and Functionality

Risks and Challenges

It does not yet have a good user base unlike other DeFi platforms.

SRM can’t create simple returns

The platform is not battle tested

Advantages

It is secured and reliable for blockchain activities.

Transactions are fast.

It allows exchange between different currency pairs.

The KYC process is straightforward and quick, allowing an increase in trading limits.

Roadmap and Future Development

The roadmap for Project Serum appears to be divided into five parts. Parts one and two have already been completed. Part one involved launching the Serum token and the Serum DEX. Part two involved building a cross-chain bridge, opening the door to third party DEX development on Solana, and introducing ecosystem grants for promising projects related to Serum.

Of the remaining three parts, only the third part is currently visible. It is geared towards implementing familiar DeFi goodies such as decentralized lending and borrowing, yield farming, and even the integration of automated market maker smart contracts (this is the technology which underlies current DEX leaders such as Uniswap). It is unclear when the third part will be completed as there are no specific timelines provided by Project Serum.

Conclusion

Serum is a fully decentralized ecosystem based on Solana. Its main focus is interoperability, and the highlight of its ecosystem is decentralibility. Serum offers an easy to use platform from which any crypto token can be exchanged for another without the need to go through any KYC procedures. Serum’s DEX uses the traditional swap system, allowing users to add any trading pairs they like.

Sources

https://www.okx.com/learn/what-is-serum

https://www.kraken.com/learn/what-is-serum-srm

https://kriptomat.io/cryptocurrencies/serum/what-is-serum/