Introduction

In the ever-evolving landscape of decentralized finance (DeFi), THORChain has emerged as a prominent project, making significant waves. It stands as a pioneering decentralized cross-chain liquidity protocol, promising to redefine the movement of assets across different blockchain networks. In this article, we will delve deep into THORChain, exploring its background, technology, tokenomics, security, real-world applications, and more

Overview

THORChain stands as a decentralized cross-chain liquidity protocol meticulously crafted to enable the smooth exchange of native assets across numerous blockchain networks. Functioning autonomously as a Layer 1 cross-chain decentralized exchange (DEX) built upon the Cosmos SDK, THORChain offers users a decentralized avenue to swap assets, free from the reliance on centralized intermediaries or the need for wrapped or pegged assets.

This decentralized liquidity protocol, THORChain, empowers users to effortlessly engage in cryptocurrency trading across a wide array of networks while retaining full control over their assets. THORChain facilitates the seamless exchange of one cryptocurrency for another without the reliance on conventional order books for liquidity. Instead, market prices are determined through the relative asset proportions held within liquidity pools, adhering to the principles of an automated market maker.

At the heart of the THORChain ecosystem lies its native utility token, RUNE. RUNE serves as the foundational currency within the THORChain framework, playing a pivotal role in governance and security measures.

Background

THORChain was founded in 2018 by a group of pseudonymous core contributors, including key member Chad Barraford. Since its inception, THORChain has continuously evolved, with historical milestones such as the introduction of continuous liquidity pools and asynchronous network upgrades. Today, the project is led by Nine Realms, with Gavin McDermott at the helm.

At its core, THORChain is built on the Cosmos SDK, a highly adaptable framework for building blockchain applications. It utilizes the Tendermint consensus engine, ensuring secure and efficient network operation. Unlike some DeFi platforms, THORChain does not focus on complex smart contracts; instead, its primary focus is on liquidity and asset swaps.

Tokenomics

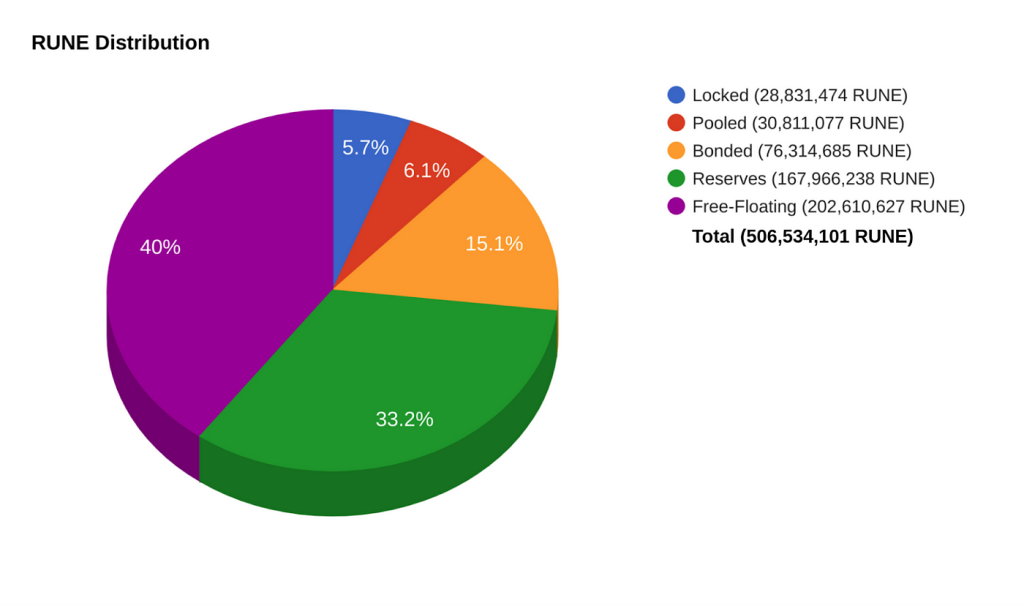

The native token of THORChain is called “RUNE.” With a total supply of approximately 330 million RUNE tokens and a maximum limit of 500 million, the project carefully manages token scarcity. RUNE serves a multitude of roles within the THORChain ecosystem, from facilitating settlements to enhancing network security, participating in governance, and incentivizing liquidity providers.

THORChain had its initial launch through an Initial DEX Offering (IDO) on the Binance DEX back in July 2019. During this IDO, a total of 20 million RUNE tokens were made available and sold to investors. Prior to this milestone, an additional 130 million RUNE tokens had already been distributed through earlier funding rounds.

As per the official Binance DEX proposal, 10% of the entire token supply, equating to 50 million tokens, was set aside for the team. These tokens were initially locked and only started unlocking at a rate of 20% per month upon the mainnet’s launch. A substantial portion of this allocation was subsequently sold to raise additional funds for the protocol. It’s important to note that the team’s ownership of RUNE remains minimal, comprising less than 1% of the total RUNE supply.

You can obtain Native RUNE directly on the THORChain platform or through exchanges like Binance. Additionally, a range of wallets and exchanges support RUNE, ensuring ease of use. the top cryptocurrency exchanges for trading in THORChain stock are currently Binance, Bybit, BItrue, ZOOMEX, and Bitget.

$RUNE market stats

Max supply: 500,000,000 RUNE

Circulating supply: 336,033,257 RUNE

Market Cap: $573,555,526

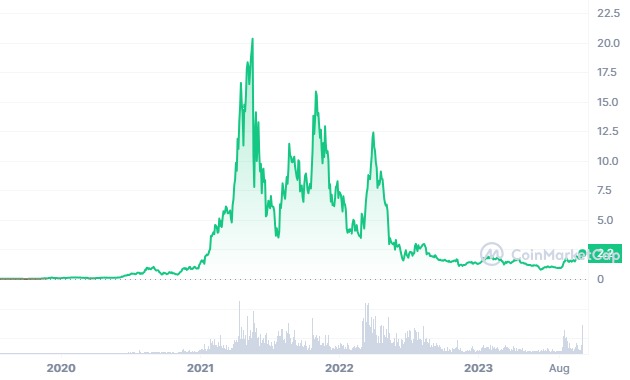

All-time high: $21.26 May 18, 2021

All-time low: $0.007939 Sep 27, 2019

Features and Functionality

THORChain’s core features are designed to empower users in a decentralized, non-custodial manner:

Native Asset Swaps: Users can swap native assets across multiple blockchain networks without relying on intermediaries or wrapped tokens.

Transparent and Fair Prices: THORChain ensures transparent and fair asset prices without the need for centralized third-party price feeds.

Innovative Mechanisms: The project implements innovative mechanisms like swap queues and liquidity synths to enhance efficiency and resist attacks.

Economic Security: THORChain’s economic security model relies on node operators bonding RUNE tokens, creating a robust security framework.

Use Cases and Applications

THORChain’s applications extend across various industries and sectors, with a focus on:

Real-World Use Cases: THORChain allows for native asset swaps between prominent blockchain networks like Bitcoin, Ethereum, and BNB Chain, making cross-chain transactions a reality.

DeFi and Traditional Finance: The protocol has promising applications in DeFi, traditional finance, and any sector requiring cross-chain liquidity.

Growing Community: While THORChain is decentralized, it has garnered support from a growing community of developers and users, further expanding its use cases.

Risks and Challenges

Like any DeFi project, THORChain is not without potential risks, with impermanent loss being a notable concern for liquidity providers. Ensuring network security is of utmost importance to prevent attacks. Nevertheless, THORChain tackles these challenges with a robust economic security model and continuous development efforts.

Security holds a central role within the DeFi space, and THORChain prioritizes it diligently. The project incorporates a range of security measures, such as bonded node operators and economic security models. Although it has encountered difficulties in the past, these incidents have served as valuable learning experiences, driving ongoing enhancements in security protocols. Routine security audits further bolster the network’s resilience.

THORChain is constructed using the Cosmos SDK and operates on the Tendermint consensus mechanism, fortifying the network against potential attacks through an innovative BFT proof-of-stake (PoS) system where a large number of validators collaborate to propose and finalize transaction blocks.

In addition to these safeguards, THORChain’s smart contracts have undergone thorough scrutiny by multiple third-party security firms, including a comprehensive audit by Certik, which found no vulnerabilities.

Conclusion

In summary, THORChain is a groundbreaking cross-chain liquidity protocol, with RUNE at its core, offering transparency, security, and efficiency. Its innovative approach to cross-chain liquidity sets it apart in the DeFi space, and its ongoing development efforts indicate a promising future.

As the DeFi landscape continues to evolve, THORChain stands as a beacon of innovation, enabling users to seamlessly transact assets across blockchain networks.

Summary

https://thorchain.org/

https://erikvoorhees.medium.com/an-introduction-to-thorchain-for-bitcoiners-3f621bf0028e

https://docs.thorchain.org/

https://coinmarketcap.com/currencies/thorchain/#About