Landmark Case: OpenSea Ex-Employee Sentenced to Three Months in Prison Over Digital Asset Insider Trading

In a landmark case, Nathan Chastain, a former product manager at OpenSea, has been sentenced to three months in prison and more by the U.S. Department of Justice (DOJ) in what is being hailed as the “first-ever digital asset insider trading scheme.” Chastain’s troubles began when he was forced to resign from his position at OpenSea in September 2021. In 2022, he faced charges from the Manhattan U.S. attorney’s office, alleging that he had exploited his role at OpenSea to select NFTs for the platform’s homepage, which he later profited from.

Prosecutors claimed that Chastain accrued over $50,000 USD by strategically purchasing specific NFTs that he knew would be featured on OpenSea’s website between June and September 2021. He then sold these NFTs at inflated prices, meticulously managing anonymous wallets and OpenSea accounts to conceal his activities. After a trial that began on April 24, Chastain was found guilty of wire fraud and money laundering following three days of jury deliberation. Surprisingly, despite the “insider-trading scheme” label, traditional insider-trading charges were not part of the case. Instead, Chastain was convicted on counts of wire fraud and money laundering.

Chastain’s sentence includes three months of prison, three months of home confinement, three years of supervised release, a $50,000 fine (nullifying his $50,000 NFT profit), and the forfeiture of 15.9 ETH (approximately $26,000 at the time of the verdict). Notably, this sentence was lighter than the two-year term initially sought by federal prosecutors, with U.S. District Judge Jesse M. Furman opting for a punishment more in line with Chastain’s ill-gotten gains. This case underscores the DOJ’s resolve to crack down on misappropriation of confidential information and insider trading in the realm of NFTs and cryptocurrency, even as regulatory authorities like the SEC and the CFTC navigate jurisdictional disputes in the evolving digital asset landscape.

“Nathanial Chastain exploited his advanced knowledge of which NFTs would be featured on OpenSea’s website to make profitable trades for himself,” U.S. Attorney Damian Williams told Reuters in May.

Sotheby’s Enters the Legal Fray: Named Defendant in Expanding BAYC Class-Action Suit

In December 2022, a significant class-action lawsuit sent shockwaves through the crypto and NFT world, implicating over 40 defendants in alleged price manipulation of Bored Ape Yacht Club (BAYC) NFTs. The lawsuit contended that these individuals artificially inflated BAYC NFT prices through celebrity endorsements, all without adhering to the necessary disclaimers mandated by the anti-touting provision of the Securities Act.

Among the celebrities embroiled in the lawsuit were big names like Justin Bieber, Paris Hilton, Jimmy Fallon, Gwyneth Paltrow, Serena Williams, Madonna, Steph Curry, and more, who had previously endorsed BAYC. This episode of celebrity involvement in crypto projects harkened back to Kim Kardashian’s involvement in promoting EthereumMax (EMAX) in 2021, which led to her settling with the SEC by paying hefty penalties.

The list of celebrities facing scrutiny for endorsing crypto ventures grew, encompassing figures like Ne-Yo, Lindsay Lohan, Justin Sun, Soulja Boy, Floyd Mayweather, Jr., DJ Khaled, and others, with even the now-defunct FTX exchange being implicated. Sotheby’s, implicated in the case, dismissed the allegations as “baseless” and vowed to vigorously defend itself, echoing similar sentiments from Yuga Labs. The lawsuit also called out Max Moore, Sotheby’s Head of Contemporary Art Auctions, for promoting the BAYC auction on social media and during an official Sotheby’s x BAYC Sale Twitter Spaces event, alleging that the auction house claimed to have sold the entire lot of NFTs for $24.4 million to an anonymous buyer, each BAYC NFT with a floor price of $240,000, a $100,000 increase from their original price.

A Pioneering Partnership: nWay, Animoca Brands, and Yuga Labs Unveil the ‘Wreck League’ Gaming Extravaganza

In an exciting announcement, nWay, a prominent developer and publisher of competitive multiplayer games under Animoca Brands, has unveiled its much-anticipated release, Wreck League. This Web3-powered game marks a groundbreaking venture in esports by empowering players to create, possess, and engage in battles with their personalized Mech fighters.

Positioned as the future of esports, Wreck League transcends conventional gaming boundaries by allowing users to construct their Mech fighters, compete with them, and secure on-chain prizes. The debut season of the game will tap into the widely recognized Web3 brand, Yuga Labs. Wreck League boasts a dual-focus design, featuring separate Web2 and Web3 versions. The marketing approach undertaken by nWay is designed to appeal to a broad audience, steering clear of complex blockchain terminology while employing user acquisition strategies from their previous game successes.

The player community comprises creators, owners, and players who can unite for league events. High-performance Mechs are assembled from 10 individual Mech Parts NFTs, offering continuous customization opportunities through disassembly. Top creators with outstanding Mechs are expected to team up with skilled players for high-stakes competitions.

Moreover, a free-to-play (F2P) edition of Wreck League, without the need for NFT ownership, aims to bridge the gap between the Web3 and traditional gaming communities. Mech NFT owners can also generate non-NFT copies of their Mechs for sale in the Web2 game’s store, with proceeds benefiting the original NFT holders.

The Web3 version caters to Mech NFT holders, featuring a two-week leaderboard tournament initiated with Mech minting. Participants engage in scheduled battles, earning or losing points based on victory or defeat. Rankings are determined by accumulated points, with on-chain prizes awarded upon tournament conclusion. These rewards range from exclusive 1of1 NFTs for top performers to various incentives for players, including mech sets, legendary boxes, and mech parts, injecting an element of excitement and competition into the event.

Wreck League introduces an innovative twist to fighting games, allowing players to craft their Mech fighters instead of relying on a predefined roster. This leads to an astonishing 1.5 quadrillion unique battle combinations. For the inaugural season set to launch in September, the game will incorporate four coveted Yuga Labs collections: Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, and Otherside Kodas. The collection of Mech Parts, assembled by players, represents NFTs that can be combined to create complete Mech character NFTs. Notably, rare Yugaverse Mechs will also be accessible, adding an exclusive dimension to in-game achievements.

Spencer Tucker, Chief Gaming Officer of Yuga Labs, expressed excitement about nWay joining The noncanonical Extended Yugaverse, emphasizing the significance of building an interoperable ecosystem in Web3. Wreck League’s incorporation of Yuga’s collections promises to chart a course toward delivering a captivating gaming experience and additional utility for the collection holders. This innovative fusion of gaming and NFTs heralds a new era in esports, inviting players to create, compete, and conquer like never before.

“Wreck League is a hybrid Web3 and Web2 project,” explained Taehoon Kim, CEO of nWay. “Our aim is to unite the communities and players, leveraging the creative potential of the Web3 community to continuously enhance the game’s content.”

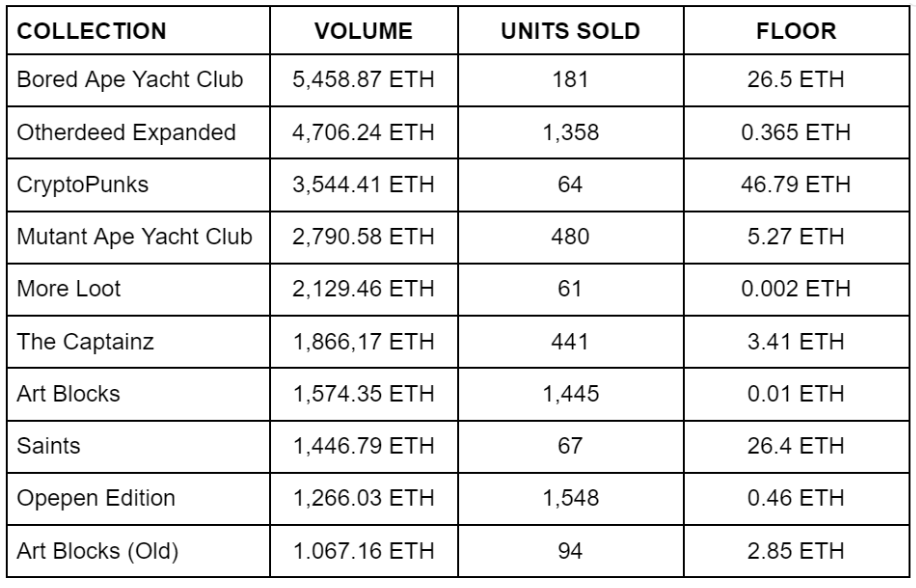

Top Bluechip NFT

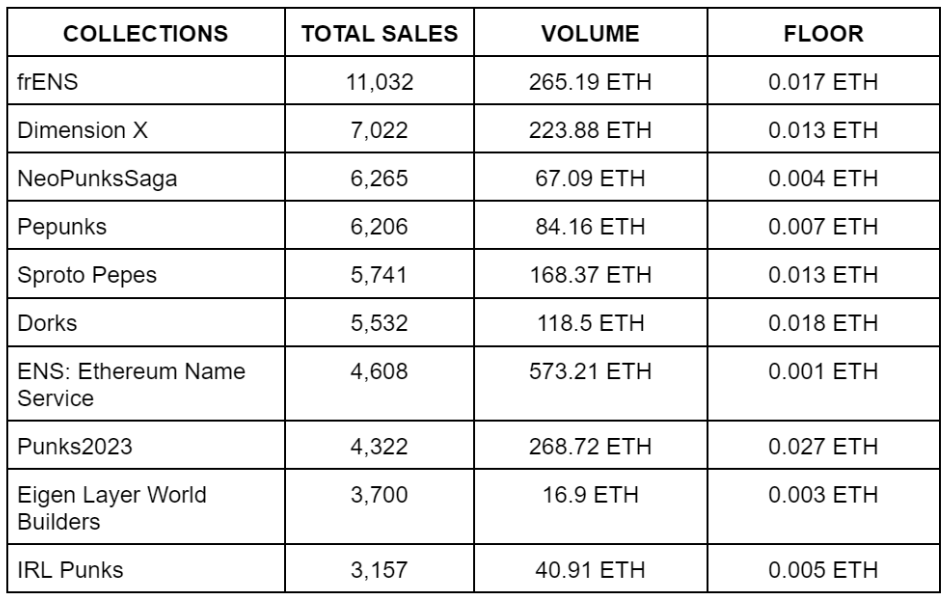

Trending NFT(Sales)

Upcoming Mints

Ethereum:

Sugartown- @visitsugartown

DFA- @DigiFineArt

Akogare- @AkogareOfficial

Castile- @Castileofficial

Codename:Renegades- @Play_Renegades

Story Protocol- @StoryProtocol

Solana:

Moonfrost- @MoonfrostGame

Solana Sensei- @SolanaSensei

Kirin Labs- @KirinLabs_NFT

Reavers- @reaversnft

Phantom Mages- @PhantomMages

Elementals- @Elementals_NFT_

Polygon/Avax:

Dokyo- @dokyoworld