Introduction

In the bustling world of digital finance, Curve DAO shines as a smooth operator for swapping stablecoins. Curve is controlled by its users, like a digital democracy on the Ethereum blockchain. This means everyone decides the rules, keeping things fair with tiny fees and barely any price changes when you swap coins.

Overview

Curve DAO is a decentralized exchange (DEX) built for stablecoins. Think of it as a marketplace where you can trade different types of stablecoins (cryptocurrencies pegged to real-world assets like the US dollar) easily and efficiently. Unlike traditional exchanges, Curve DAO operates without a central authority, giving users more control over their funds and potentially lower fees.

Curve DAO leverages the Aragon framework, a robust infrastructure for constructing and managing DAOs.

However, Curve DAO’s significance extends beyond mere governance and yield generation. It represents a paradigm shift in financial control, empowering users to actively participate in shaping the future of stablecoin exchange and DeFi as a whole.

Deep within the vibrant landscape of DeFi, Curve.fi DAO emerges as a beacon of innovation. This decentralized exchange, meticulously crafted for frictionless stablecoin swaps, thrives on the power vested in its CRV token-holding community. Unlike its conventional counterparts, Curve leverages a symphony of specialized algorithms, orchestrating minimal slippage and fees – a dream realized for every stablecoin trader. Yet, Curve transcends mere transactions; it embodies a DAO, where CRV holders ascend to the conductor’s podium, wielding their votes to shape everything from liquidity pools to the platform’s very destiny. With an ever-expanding ecosystem and an unwavering commitment to progress, Curve.fi DAO continues to rewrite the DeFi narrative, one optimized swap and community-driven decision at a time.

Background

Egorov saw an opportunity. In 2017, he unveiled his brainchild: a protocol specifically designed for stablecoin swaps. The key innovation lay in Curve’s unique bonding curves, mathematical formulas that dynamically adjust exchange rates based on the pool’s liquidity. This ingenious mechanism ensured minimal slippage and optimal pricing, attracting both traders and liquidity providers in droves.

But Curve wasn’t just about technology. Egorov, a firm believer in decentralization, envisioned a community-driven protocol. He established Curve DAO, a decentralized autonomous organization where token holders governed the protocol’s future through proposals and voting. This democratic approach fostered a sense of ownership and responsibility among users, further solidifying Curve’s unique position in the DeFi ecosystem.

Over the years, Curve has evolved into a DeFi behemoth. Its total value locked (TVL) regularly soars above $10 billion, attracting some of the biggest names in the space. Its AMM (Automated Market Maker) model has become the gold standard for stablecoin swaps, inspiring countless forks and copycats. More importantly, Curve has retained its core values: a relentless pursuit of efficiency, a commitment to decentralization, and a thriving community of passionate believers.

Early Days: January 2020 – A Curve Emerges

It all began in 2020, when a lone coder named Michael Egorov, armed with his programming prowess and a vision for seamless stablecoin exchange, launched Curve.fi. Curve employed an ingenious innovation: liquidity pools powered by smart contracts. These pools eliminated order book friction, offering users razor-sharp swap rates and minimal slippage.

August 2020: Birth of the DAO, Power to the People

Recognizing the community’s crucial role in Curve’s success, Egorov introduced the Curve DAO in August 2020. This decentralized autonomous organization empowered users not just as traders, but as governors. Holding the CRV token, the lifeblood of the DAO, granted voting rights to influence platform upgrades, fee structures, and even new pool creations.

From Niche to Mainstream:

Curve’s unique approach resonated with the DeFi community. Its focus on stablecoins, the bedrock of DeFi, coupled with its superior swap efficiency, propelled it to the forefront. Soon, leading protocols like Yearn Finance and Convex Finance integrated with Curve, further solidifying its dominance.

Tokenomics

At the heart of Curve Finance, a decentralized exchange known for its efficient stablecoin and asset swaps with minimal slippage, lies its governance token, Curve DAO (CRV). The tokenomics driving CRV have a two-pronged approach:

- Incentivize Liquidity Providers:

• Pool Rewards: A portion of trading fees are distributed proportionally to users who provide liquidity to Curve pools. This encourages deeper liquidity across the platform, leading to smoother swaps and lower slippage.

• veCRV Boosting: By “vote-locking” your CRV (creating veCRV), you receive boosted rewards from specific pools. This incentivizes long-term commitment and alignment with the protocol’s direction. - Facilitate Governance:

• Voting Power: Holding CRV grants voting rights on proposals regarding protocol parameters, fee structures, and new pool deployments. This ensures community ownership and control over Curve’s future.

• Gauge System: Specific gauges direct a portion of CRV emissions towards pools deemed strategically important by the community. This allows for flexible incentivization and promotes desired liquidity distribution.

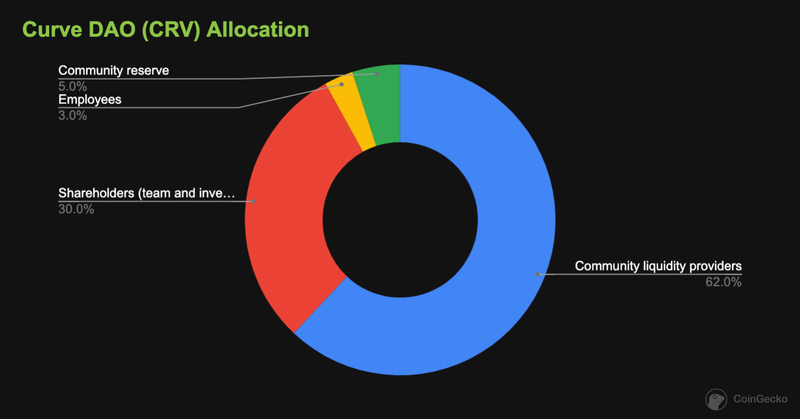

Key Token Distribution:

- 62%: Community Liquidity Providers (LPs) – Rewarded for supplying liquidity to the platform.

- 30%: Shareholders (Team & Investors) – Vested over 2-4 years, ensuring ongoing commitment.

- 3%: Employees – Vested over 2 years.

- 5%: Community Reserve – Used for development initiatives and ecosystem growth.

Use Cases of CRV Token

- Fueling Liquidity:

Taking CRV as the engine powering Curve’s liquidity pools. By depositing assets into these pools, users earn CRV alongside trading fees, incentivizing them to become liquidity providers. This abundant liquidity fuels Curve’s signature low-slippage swaps and efficient exchanges.

- Shaping the Future:

CRV grants you a voice in Curve’s Decentralized Autonomous Organization (DAO). Locking your CRV earns you “vote-escrowed CRV” (veCRV), which empowers you to participate in crucial decisions shaping the protocol’s future. From new pool additions to fee adjustments, your vote counts in Curve’s evolution.

- Amplifying Rewards:

Staking your CRV unlocks additional CRV rewards and a share of the platform’s trading fees. The deeper you dive, the better it gets – longer lock-up periods for your CRV translate to amplified voting power and boosted staking rewards.

- Beyond the Curve:

CRV’s reach extends beyond its own ecosystem. Its integration with DeFi powerhouses like Yearn Finance, Compound, and Aave paves the way for sophisticated yield optimization strategies, allowing you to squeeze the most out of your crypto assets.

- Speculation’s Playground:

CRV isn’t immune to the market’s whispers. Its presence on major cryptocurrency exchanges opens doors for speculation and trading based on its perceived future value.

Features and Functionality

- Shaping the Curve: CRV isn’t just a token, it’s a voting card. Holders wield power in the Curve DAO, deciding on crucial aspects like adding new crypto pairs, tweaking fees, and steering the platform’s evolution. It’s like having a say in building a custom-designed financial highway for digital assets.

- Rewarding the Road Crew: Curve thrives on liquidity, and CRV incentivizes users to become its pit crew. By supplying assets to the platform’s pools, they earn CRV as a thank-you, ensuring smooth, efficient crypto exchanges for everyone.

- Sharing the Spoils: As fees roll in from swaps and transactions, CRV holders get a slice of the pie.

- Locking In for Growth: Staking your tokens locks them in for a set period, earning you extra CRV, stablecoins, or other crypto goodies – a win-win for you and the Curve ecosystem.

- A Scarcity Symphony: Unlike some tokens with ever-inflating supplies, CRV has a set limit of 3.03 billion. This controlled release creates a sense of scarcity, potentially pushing the token’s value up if demand remains strong.

Advantages of Curve

Precision for Swappers:

- Minimal Slippage: Unlike traditional AMMs, Curve’s pools are optimized for specific asset classes like stablecoins or similar ERC-20 tokens. This minimizes price impact, ensuring you get the best bang for your swap buck.

- Frictionless Trading: Curve aggregates liquidity from various DeFi protocols, presenting you with the most efficient path for your trade in a single platform.

- Amplified Capital Efficiency: Curve’s smart contracts are elegantly crafted, reducing gas costs compared to other DEXs. This translates to lower fees and more profit in your pocket.

Paradise for Liquidity Providers:

- Double-Dip Rewards: Earn trading fees from swaps and additional CRV tokens as an incentive for providing liquidity.

- Granular Pool Selection: Curve offers a diverse menu of liquidity pools catering to various risk appetites.

- Governance with a Bite: CRV holders wield the power to vote on protocol upgrades and fee structures. This active participation ensures the platform evolves based on the community’s desires

Built for the Future:

- Constant Innovation: Curve’s team continuously develops new features and optimizing existing ones. This dedication to progress keeps the protocol at the forefront of DeFi.

- Security First: Curve’s codebase has been extensively audited and battle-tested, making it a fortress for your hard-earned crypto.

- Community Matters: Curve fosters a vibrant and engaged community, providing ample resources and support for users of all levels. This collaborative spirit paves the way for a stronger and more sustainable ecosystem.

Risks and Challenges

- Smart Contract Vulnerabilities: As with any blockchain-based project, Curve’s code could contain vulnerabilities that attackers could exploit to steal funds or manipulate the protocol. While the team conducts thorough audits, the ever-evolving nature of code and attack strategies necessitates constant vigilance.

- Governance Risks: Curve is governed by its token holders, who vote on proposals affecting the protocol. This opens the door to issues like:

- Low voter participation: Apathy or lack of understanding can lead to proposals passing without proper scrutiny.

- Collusion or manipulation: Large token holders or organized groups might sway votes for their own benefit.

- Short-term vs. long-term considerations: Voters might prioritize immediate gains over long-term sustainability.

- Competition: Built within the metropolis of DeFi, Curve navigates a labyrinth of rivals, each brandishing their own alluring features. DEX titans like Uniswap, with its user-friendly interface, and Balancer, boasting customizable pools, cast long shadows, challenging Curve’s grip on the stablecoin liquidity crown.

- Regulatory Uncertainty: Curve’s intricate web of stablecoin liquidity pools thrives on regulatory clarity. However, the nebulous regulatory landscape surrounding crypto could cast a shadow over its cross-border swaps and potentially restrict its global reach.

- Dependence on Stablecoins: Curve’s primary function revolves around stablecoins, and its success is intrinsically linked to their stability. Issues like depeg events or regulatory crackdowns on stablecoins could negatively impact Curve’s liquidity and overall performance.

How Curve Addresses Those Challenges

- Rigorous Security Audits: Curve doesn’t leave its digital gates unguarded. Renowned security firms regularly comb through its smart contracts, and the team, ever watchful, scans the protocol for suspicious activity, ensuring user funds sleep soundly.

- Decentralized Governance: Curve encourages active participation in its governance process through various initiatives like education, outreach, and community-driven proposals. Additionally, the introduction of vote delegation allows token holders who may not understand technical details to trust others to vote on their behalf.

- Continuous Innovation: The Curve team constantly works on improving the protocol’s features and efficiency. They actively develop new liquidity pools, integrate with other DeFi protocols, and explore innovative solutions to maintain their competitive edge.

- Community Engagement: Curve fosters a strong and engaged community around the protocol. This open communication allows for collective problem-solving, faster deployment of updates, and adaptation to changing market conditions.

- Focus on Transparency: Curve throws open its financial kimono, baring its operations, finances, and roadmap to public scrutiny. This radical transparency isn’t just a passive disclosure; it’s an invitation to users to peer under the hood, fostering trust and collaboration.

How Curve Dao is Secured

Nestled within the Ethereum blockchain’s robust embrace, Curve DAO, the decentralized architect of the Curve.fi DeFi exchange, meticulously cultivates a multi-layered fortress of security. At its core, meticulously audited and formally verified smart contracts stand steadfast, their functionalities scrutinized by renowned firms and community eyes alike. But the lines of defense extend further. Algorithmic economics, woven into the very fabric of its stablecoin pools and efficient swaps, incentivize virtuous participants and deter malevolent shadows. Transparency reigns supreme, as all transactions dance in the dappled sunlight of public view, their secrets revealed on the blockchain’s immutable ledger. And should unforeseen storms brew, a vigilant Emergency DAO stands guard, a multi-signature shield prepared to act. Moreover, Ethereum’s recent shift to a Proof-of-Stake consensus mechanism bolsters the foundations, its validators diligently forging a path of enhanced security and decentralization. This intricate tapestry of safeguards, meticulously woven from technology, governance, and community, grants Curve DAO its formidable resilience within the ever-evolving landscape of DeFi.

Conclusion

Curve DAO reigns supreme as a decentralized exchange (DEX) built for efficient stablecoin and ERC-20 token swaps. It boasts low fees, minimal slippage, and deep liquidity pools, making it a go-to for crypto traders seeking optimal exchange rates. But Curve DAO is more than just a fancy swapping machine. Community governance fueled by the CRV token empowers users to shape the platform’s future, directing protocol fees and tweaking pool parameters. This democratic spirit gives Curve an edge, fostering a loyal user base and driving continuous innovation.

Sources:

https://dao.curve.fi/

https://coinmarketcap.com/currencies/curve-dao-token/

https://101blockchains.com/curve-dao-token-crv/

https://www.nicehash.com/blog/post/curve-dao-is-now-listed-on-the-nicehash-exchange

https://curve.readthedocs.io/

https://resources.curve.fi/

https://www.coingecko.com/en/coins/curve-dao-token/