1Inch Price Stats

Market Cap: $625,075,987

Circulating Supply: 415,002,580 1INCH

Supply Cap: 1,500,000,000 1INCH

All Time High: $8.65 -82.6%

Oct 27, 2021 (6 months)

All Time Low: $0.767785 95.6%

Dec 29, 2020 (over 1 year)

Brief Description of 1INCH

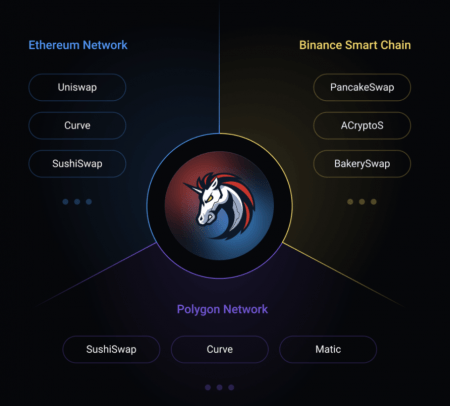

1inch (1INCH) is an Ethereum token that powers 1inch, a decentralized exchange that aims to offer the “best rates by discovering the most efficient swapping routes across all leading DEXes

The journey of 1inch began in 2019 when Sergej Kunz and Anton Bukov, two blockchain enthusiasts, initiated a hackathon project aimed at addressing the issue of high slippage in DEX trades. Their brainchild, 1inch, gained swift recognition for its ingenious algorithmic approach to enhancing trading efficiency.

The project’s exceptional growth led to a successful funding round in September 2020, raising $2.8 million from prominent investors. Bolstered by this support, 1inch continued to evolve. It launched the 1inch Liquidity Protocol, allowing users to provide liquidity and earn rewards.

The team’s commitment to decentralization was exemplified by the 1INCH governance token distribution, empowering users to actively participate in shaping the platform’s future. With rapid integrations, partnerships, and continuous upgrades, 1inch emerged as a cornerstone of the DeFi landscape, providing users with unprecedented control and efficiency in their trading endeavors.

1inch is Ranked #110 on CoinMarketCap While on CoinGecko it is Ranked #138. 1inch Can be Purchased on Tokpie, WOO Network, and GokuMarket.

The 1inch Network was founded by Sergej Kunz and Anton Bukov over the course of the ETHGlobal New York hackathon in May 2019. The two had earlier met during a live stream of Kunz’s YouTube channel (CryptoManiacs) and began entering hackathons together, winning a prize at a hackathon in Singapore, as well as two major awards from the ETHGlobal.

Prior to 1inch, Sergej Kunz worked as a senior developer at product price aggregator Commerce Connector, coded at communication agency Herzog, led projects at Mimacom consultancy, and then worked full time at Porsche in both DevOps and cybersecurity.

Anton Bukov had worked in software development since 2002 and in decentralized finance (DeFi) since 2017. Among other projects, his resume features gDAI.io and NEAR Protocol.

Advantages of 1INCH

- 1Inch, as a DEX aggregator, ensures that users have high liquidity on trades

- The 1Inch user interface is clear and easy to navigate

- 1Inch has a good reputation and track record with no security breaches or hacking incidents

- The CHI Gas tokens are beneficial to users who want further cost reductions

Disadvantages of 1INCH

- Beginner traders can find the platform challenging

- Some traders may find the lack of fiat deposits discouraging

- 1Inch cannot be used by users who do not already possess cryptocurrencies

Use Cases of 1INCH

- Smart Trade Execution:

1inch is the virtual ally for traders, especially in the decentralized world. It scouts various decentralized exchanges, intelligently cherry-picking the best prices and trade paths. By doing so, it safeguards traders from price slippage and ensures that every trade is a well-calculated move. - Efficient Asset Swaps:

Imagine exchanging your digital assets without being weighed down by hefty fees. 1inch makes this a reality by identifying the most economical paths for swapping one cryptocurrency for another. This ensures users get the most out of their trades, without unnecessary costs eating into their gains. - Yield Farming and Liquidity Provision:

1inch Liquidity Protocol offers a golden opportunity for users to dive into yield farming. By providing liquidity to DEX pools, users can earn rewards, multiplying their crypto holdings over time. 1inch effectively becomes a tool for growing your assets passively. - Seizing Arbitrage Moments:

Arbitrageurs find a true companion in 1inch. It spots price differences between various DEXs and acts as a bridge for quick, profitable trades. This ability to exploit fleeting price variations can lead to significant gains. - Decentralized Governance in Action:

1inch governance token (1INCH) holders aren’t just token holders; they’re decision-makers. With the power to vote and influence the platform’s evolution, they actively steer the course of 1inch’s journey, making it a true democratized space. - Crafting Tactical Trading Strategies:

For the strategic minds, 1inch offers a playground for crafting intricate trading strategies. By splitting trades across multiple DEXs, traders can avoid market disruption and optimize outcomes, pushing the boundaries of their trading finesse. - Unveiling Uncommon Tokens:

Ever sought a unique token? 1inch might just lead you to it. Its aggregated approach increases the odds of discovering and trading tokens that might not be readily available on a single exchange. - Holistic Yield Maximization:

1inch isn’t just about farming yield; it’s about farming it smartly. Yield optimizers can capitalize on its insights to unearth the most rewarding opportunities across diverse DEXs and liquidity pools, growing their profits exponentially. - Educational Insights and Research:

Think of 1inch as an enlightening guide through the labyrinth of DeFi. By observing its optimal trade suggestions, users gain a deeper understanding of how decentralized exchanges interact, paving the way for informed decision-making. - Personalized DeFi Exploration:

Ultimately, 1inch offers a personalized DeFi adventure. Whether you’re a trader, yield seeker, or governance enthusiast, it tailors its features to your needs, making your crypto journey more efficient, rewarding, and enlightening.

Summary

1inch isn’t merely a tool; it’s a paradigm shift in the DeFi arena. Its algorithmic wizardry and community-driven ethos have redefined the concept of trading optimization, democratizing access to the best possible trading outcomes. As the crypto landscape continues to evolve, 1inch stands tall as a testament to human ingenuity in harnessing technology for the benefit of all.