Introduction

The Solana ecosystem is a network of projects that use the power and speed of the Solana blockchain, which is built on a Layer-1 blockchain that combines the advantages of Cosmos and Ethereum. The Solana ecosystem also supports cross-chain interoperability and has a rich developer community. Some of the projects that are part of the Solana ecosystem are Raydium, Star Atlas, Audius, Render, and Orca. These projects cover different categories and use cases, such as finance, gaming, art, infrastructure, and more. The Solana ecosystem is a vibrant and growing network that is paving the way for the future of decentralized applications and NFTs. In this article we’ll cover the various use cases, tokenomics of solana among others.

Overview

Solana is a blockchain platform that aims to provide fast, low-cost, and scalable transactions for decentralized applications and NFTs. It is powered by a novel consensus mechanism called Proof of History (PoH), which uses a high-frequency verifiable delay function (VDF) to create a cryptographic timestamp for each transaction. This allows Solana to process transactions in parallel and achieve high throughput and low latency

The Solana ecosystem consists of various projects that use the Solana blockchain as their underlying infrastructure. These projects cover different domains and use cases, such as finance, gaming, art, infrastructure, and more. Some of the most popular and innovative projects in the Solana ecosystem are:

Raydium: A decentralized exchange (DEX) that leverages Solana’s high throughput and low latency to provide fast and efficient trading. Raydium also supports liquidity pools, yield farming, and cross-chain swaps.

Star Atlas: A grand strategy game of space exploration, territorial conquest, and political domination. Star Atlas features stunning graphics, immersive gameplay, and a rich economy powered by NFTs and crypto.

Audius: A decentralized music streaming platform that empowers artists and fans. Audius lets artists upload, share, and monetize their music without intermediaries, and lets fans discover, stream, and support their favorite artists.

Render: A decentralized network that leverages idle GPU power to render 3D graphics and animations. Render also enables creators to mint and sell their digital artworks as NFTs on the blockchain.

Orca: A user-friendly and feature-rich DEX that aims to make DeFi accessible to everyone. Orca offers a sleek interface, low fees, high liquidity, and a variety of trading options, such as limit orders, margin trading, and options.

Background

Solana is a blockchain platform that was launched in 2017 by the Solana Foundation, a non-profit organization based in Geneva, Switzerland. The founder and leader of Solana is Anatoly Yakovenko, a former software engineer at Qualcomm, who developed the idea of Proof of History, a novel consensus mechanism that enables fast and scalable transactions on the blockchain. Yakovenko was joined by other former Qualcomm colleagues, such as Greg Fitzgerald, Raj Gokal, Eric Williams, and Stephen Akridge, who co-founded Solana Labs, the company that develops and maintains the Solana network123.

Some of the major milestones and achievements of Solana are:

In March 2020, Solana launched its mainnet beta, which marked the first public release of the Solana network.

In June 2020, Solana partnered with Serum, a decentralized exchange built on Solana, to create the first end-to-end decentralized trading platform on the blockchain.

In July 2020, Solana raised $20 million in a Series A funding round led by Multicoin Capital, with participation from Blocktower Capital, Foundation Capital, and others.

In August 2020, Solana conducted a token sale on CoinList, selling 8 million SOL tokens for $0.22 each, raising $1.76 million.

In September 2020, Solana was listed on Binance, the world’s largest cryptocurrency exchange, and saw a significant increase in its trading volume and price.

In November 2020, Solana launched Wormhole, a cross-chain bridge that connects Solana with Ethereum, allowing users to transfer tokens and data between the two networks.

In January 2021, Solana announced the launch of Breakpoint, a global conference for developers, investors, and enthusiasts of Solana, which was held in Lisbon, Portugal, in November 2021.

In March 2021, Solana integrated with Chainlink, a leading decentralized oracle network, to provide reliable and secure data feeds for smart contracts on Solana.

In April 2021, Solana reached a new milestone of processing over 1 billion transactions on its network, demonstrating its high performance and scalability.

In May 2021, Solana launched Metaplex, a platform for creating and selling NFTs on Solana, which attracted many artists and collectors to the Solana ecosystem.

In June 2021, Solana raised $314 million in a private token sale led by Andreessen Horowitz and Polychain Capital, with participation from Alameda Research, Blockchange Ventures, and others.

In July 2021, Solana was listed on Coinbase, the largest cryptocurrency exchange in the US, and saw another surge in its trading volume and price.

In August 2021, Solana launched Ignition, a hackathon and accelerator program for developers and entrepreneurs to build innovative projects on Solana, which offered over $5 million in prizes and grants.

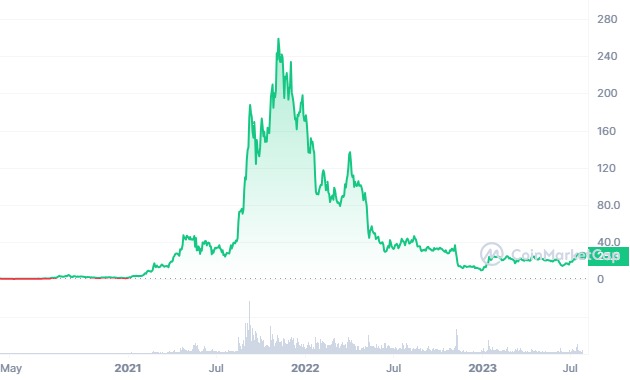

In September 2021, Solana reached a new all-time high of over $200 per SOL token, making it one of the top 10 cryptocurrencies by market capitalization.

In October 2021, Solana hosted Breakpoint, the first global conference for Solana, which featured over 150 speakers, 100 sponsors, and 10,000 attendees from around the world.

In November 2021, Solana experienced a network outage that lasted for over 17 hours, due to a large influx of transactions that overwhelmed the network’s capacity. The Solana team and community worked together to resolve the issue and restore the network’s functionality.

Tokenomics

Solana is a high-performance blockchain platform that aims to provide scalability, security, and decentralization for various applications. Solana has its own native cryptocurrency called SOL, which is used for paying transaction fees, staking, and running smart contracts. SOL has a DEX score of 99 and is ranked #6 on coinmarketcap. Here are some key aspects of Solana’s tokenomics:

Supply: Solana has a total supply of 562,465,547 SOL, of which 422,397,048 SOL (75.1%) are circulating and 140,068,498 SOL (24.9%) are non-circulating. The non-circulating supply consists of SOL that is locked in stake accounts until certain dates, or owned by Solana Labs or the Solana Foundation1. Solana has an uncapped maximum supply, with a unique dis-inflationary emission rate that decreases by 15% every year.

Inflation: Solana’s current annual inflation rate is 5.689%, which will decrease by 15% every epoch-year (about 180 epochs) until it reaches a final inflation rate of 1.5%. Solana’s inflation is designed to reward stakers for securing the network, while offsetting the effect of transaction fees, which are partially burned and partially distributed to validators.

Staking: Solana has a high staking ratio, with 399,194,404.6 SOL (71% of total supply) staked as of July 18, 2022. Staking SOL requires activating and delegating it to a validator, which can take up to 2-3 days to complete. Stakers earn rewards based on the current inflation rate, network performance, and validator performance. Staking also helps to increase the security and decentralization of the network, as validators need to have a minimum stake to participate in consensus.

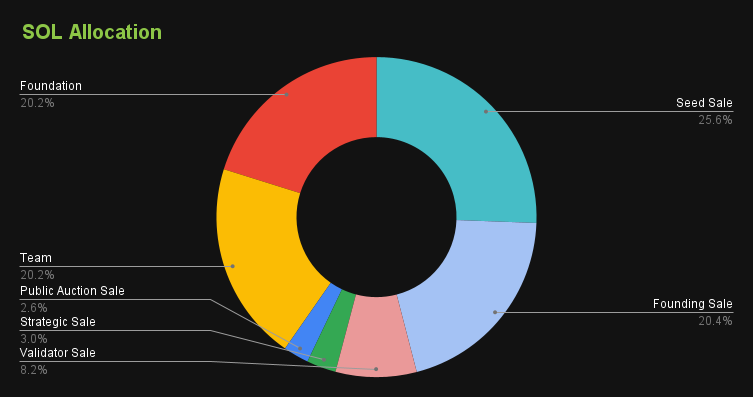

Funding: Solana raised a total of $25.6 million in various funding rounds, including a seed sale, a founding sale, a validator sale, a strategic sale, and a public auction. The average price of SOL in these rounds ranged from $0.04 to $0.25. The investors and founders who participated in these rounds received SOL tokens that are locked in stake accounts until certain dates, with some arrangements vesting regularly over time.

Solana is a blockchain platform that has its own native token, called SOL. The total supply of SOL is 562,465,547, of which 422,397,048 (75.1%) are circulating and 140,068,498 (24.9%) are non-circulating. The non-circulating supply consists of locked SOL that are subject to vesting schedules or owned by Solana Labs or the Solana Foundation. The token distribution of SOL is as follows:

Seed Sale: 15.86%

Founding Sale: 12.63%

Validator Sale: 5.07%

Strategic Sale: 1.84%

Public Auction Sale: 1.60%

Team: 12.50%

Foundation: 12.50%

Community Reserve: 38.00%

The use cases of SOL are:

Security: SOL is used to secure the network by staking it to validators who process transactions and produce blocks. Stakers earn rewards based on the inflation rate and transaction fees.

Governance: SOL is used to participate in the governance of the network by voting on proposals and upgrades. Governance is currently centralized by the Solana Foundation, but will transition to a more decentralized model in the future.

Incentives: SOL is used to incentivize developers, validators, and users to contribute to the growth and innovation of the Solana ecosystem. The Solana Foundation offers grants, hackathons, and other programs to support the community.

Utility: SOL is used to pay for transaction fees and rent on the network. Transaction fees are proportional to the size and complexity of the transaction, and rent is charged for storing data on the network.

SOL can be bought and stored on various platforms, such as:

Exchanges: SOL can be traded on major cryptocurrency exchanges, such as Binance, Coinbase, FTX, and Kraken. Users can buy SOL with fiat or other cryptocurrencies, depending on the exchange.

Wallets: SOL can be stored on various wallets, such as Phantom, Sollet, Solflare, and Ledger. Users can choose between web, mobile, or hardware wallets, depending on their preference and security needs.

DEXes: SOL can be swapped on decentralized exchanges, such as Serum, Raydium, and Orca. Users can exchange SOL for other tokens on Solana or other blockchains, using cross-chain bridges like Wormhole.

Market Cap: $23,698,884,139

Circulating Supply: 422,990,338 SOL

Supply Cap: 562,983,611 SOL

All Time High: $259.96 -78.4% Nov 06, 2021 (5 months)

All Time Low: $0.500801 10985.8% May 11, 2020 (almost 2 years)

Features and Functionality

Solana is a blockchain platform that aims to provide a fast, scalable, and secure solution for various applications. Solana claims to be the fastest blockchain in the world, with a throughput of over 50,000 transactions per second and a sub-second finality. Solana also boasts a low-cost transaction fee of $0.00025 per transaction. Solana achieves these impressive performance metrics by using a novel consensus mechanism called Proof of History (PoH), which allows the network to synchronize and validate transactions without relying on a leader or a committee. Solana also leverages other innovations such as Proof of Stake (PoS), Turbine, Sealevel, Pipelining, Cloudbreak, Archivers, and Gulf Stream to optimize its security, scalability, and efficiency.

Solana supports smart contracts, which enable developers to create and deploy decentralized applications (DApps) on the platform. DApps can have various use cases, such as finance, gaming, social media, art, and more. Some of the popular DApps that run on Solana are:

Audius: A decentralized music streaming platform that allows artists to upload and monetize their music, and listeners to discover and stream music from over 100,000 artists.

Serum: A decentralized exchange (DEX) that allows users to trade crypto assets with low fees, high speed, and cross-chain compatibility.

Raydium: A liquidity provider and automated market maker (AMM) that offers fast and cheap swaps, yield farming, and staking opportunities.

Star Atlas: A massively multiplayer online game (MMO) that combines space exploration, combat, and strategy in a virtual metaverse.

Solana Art: A marketplace for non-fungible tokens (NFTs) that showcases digital art, collectibles, and gaming assets created on Solana.

Solana’s unique selling points and advantages are its high performance, low cost, and rich ecosystem. Solana can handle thousands of times more transactions than other blockchains, such as Ethereum and Bitcoin, while maintaining a high level of security and decentralization. Solana also offers a low barrier to entry for developers and users, as they can enjoy low fees and fast transactions. Solana also has a vibrant and growing community of developers, investors, and enthusiasts who support and contribute to the platform’s growth and innovation.

Risks, Challenges and Steps Taken to Mitigate Them

Solana is a promising blockchain platform that offers fast, scalable, and low-cost transactions for various applications. However, like any other technology, Solana also faces some risks and challenges that may affect its growth and adoption. Here are some of the main ones:

Network stability: Solana has experienced several network outages and congestion issues in the past, which have disrupted its normal operations and caused losses for some users. For example, in September 2021, Solana went offline for 17 hours due to a flood of transactions that crashed many validators. In January 2022, Solana suffered from high levels of network congestion due to duplicate transactions that affected its performance. These incidents have raised concerns about Solana’s reliability and security, especially for mission-critical applications that require high availability and consistency. Solana has been working to improve its network stability by implementing various measures, such as increasing the number of validators, upgrading its software, and enhancing its monitoring and alerting systems.

Competition: Solana is not the only blockchain platform that aims to provide high scalability and performance for decentralized applications. There are many other competitors in the market, such as Ethereum, Binance Smart Chain, Avalanche, Polygon, and Cardano, that offer similar or better features and functionalities. Some of these platforms have larger and more established user bases, developer communities, and ecosystems than Solana, which gives them an edge in terms of network effects and adoption. Solana will have to compete with these platforms for market share and user attention, and prove its value proposition and differentiation. Solana has been trying to gain a competitive advantage by focusing on its core strengths, such as its innovative Proof-of-History consensus mechanism, its low transaction fees, and its rich ecosystem of projects and partners.

Regulation: Solana operates in a highly uncertain and dynamic regulatory environment, where the rules and norms for cryptocurrencies and blockchain technologies are constantly evolving and changing. Solana may face legal and regulatory challenges from various jurisdictions, such as the US, China, India, and the EU, that may impose restrictions, bans, or taxes on its activities and operations. Solana may also face compliance and governance issues, such as anti-money laundering, consumer protection, and data privacy, that may affect its reputation and legitimacy. Solana will have to adapt to the changing regulatory landscape and comply with the relevant laws and regulations in each market it operates in. Solana will also have to engage with regulators and policymakers to educate them about its technology and benefits, and advocate for a favorable and supportive regulatory framework.

Conclusion

Solana is a groundbreaking blockchain platform that is redefining the landscape of decentralized finance. Its innovative hybrid consensus model, speed, and scalability make it stand out among its competitors. With a market capitalization of over $66 billion and a continuous focus on improving the blockchain ecosystem, Solana has firmly established itself as a major player in the crypto world.

https://docs.solana.com/history

https://deepstash.com/idea/101348/who-are-the-founders-of-solana

https://www.coingecko.com/en/coins/solana/tokenomics

https://originstamp.com/blog/what-is-solana-and-what-are-its-use-cases/

https://blockchain.oodles.io/blog/top-solana-blockchain-use-cases/

https://www.rain.com/learn/solana-use-cases-a-look-at-the-ethereum-killers-ecosystem-and-uses

https://www.fool.com/investing/2022/01/26/the-biggest-challenge-solana-faces-in-2022/

https://beststocks.com/challenges-and-concerns-surrounding-solanas-n/