The Bitcoin Mining Process

To mine bitcoin, specialized computer hardware known as ASICs (Application-Specific Integrated Circuits) are required to perform the calculations necessary. The cost of these miners varies depending on the model and capabilities. Entry-level ASIC miners can cost as little as $100, while high-end models can cost several thousand dollars. For instance, the Bitmain Antminer S19 Pro, one of the most powerful Bitcoin miners, costs around $5,000 to $10,000.

Miners compete to solve these equations, and the first miner to do so is rewarded with a set number of bitcoins, which is the block reward. This process is known as proof-of-work, and it is vital to maintaining the security and integrity of the Bitcoin network.

Currently, bitcoin mining is done by a range of individuals and entities, including large mining companies, smaller mining operations, and individual miners. However, as the difficulty of mining has increased, it has become more challenging for individual miners to compete and earn a profit, so many have joined mining pools to combine their computational power and increase their chances of earning a reward. Some companies have invested significant resources into mining operations, with some of the largest mining companies operating in countries like China, Kazakhstan, and the United States.

Mining Pools

To join a mining pool, miners need to register on the pool’s website and download specialized mining software. Once they have set up their mining software, they connect their personal computers or ASIC miners to the pool’s server and start mining.

The mining pool operator charges a small fee for maintaining the pool, usually between 1% to 2% of the block reward. However, joining a mining pool can increase a miner’s chances of earning a reward significantly. When the pool earns a block reward, the reward is distributed among all members of the pool according to their contribution to the pool’s computing power.

Additionally, there are ongoing expenses associated with Bitcoin mining, such as electricity costs and maintenance fees, which can add up quickly.

Energy Consumption

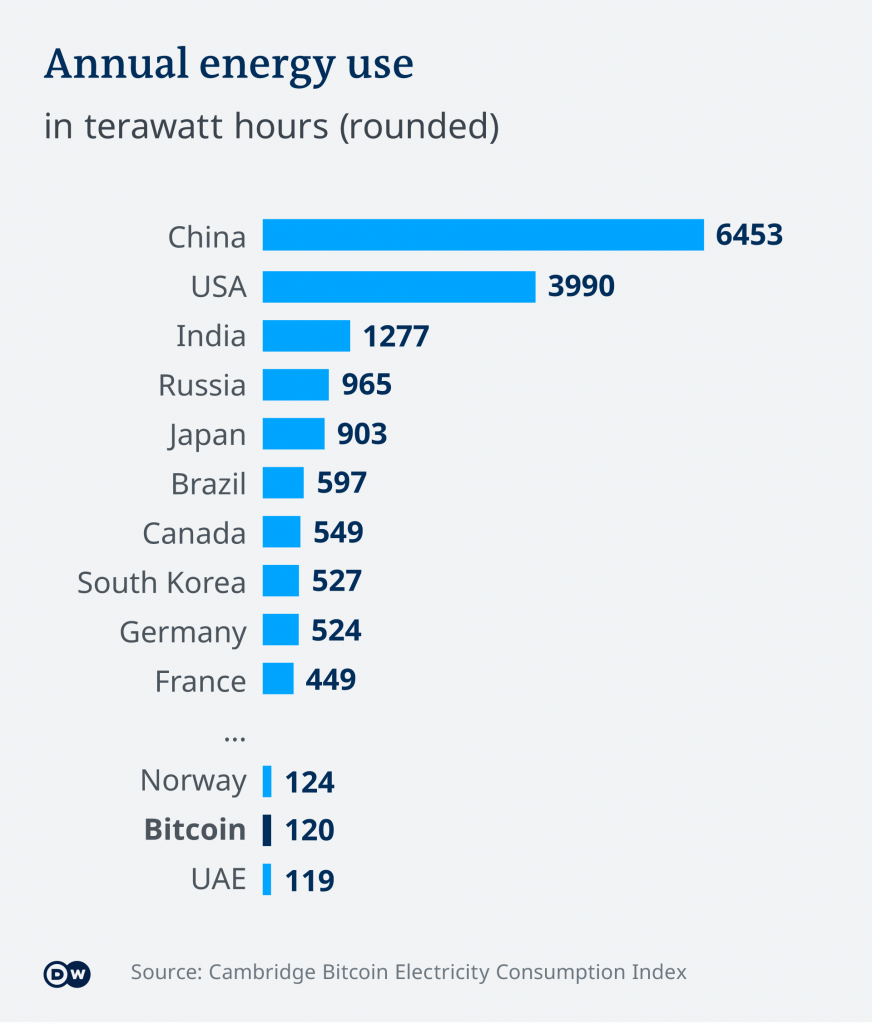

Bitcoin’s energy consumption refers to the amount of energy required to maintain the Bitcoin network and validate transactions through the process of mining. The energy consumption of Bitcoin mining has been a topic of debate, as it requires a significant amount of computational power and electricity to solve complex mathematical problems.

According to the Cambridge Bitcoin Electricity Consumption Index, as of September 2021, the estimated annualized electricity consumption of the Bitcoin network is around 130 terawatt-hours (TWh), which is equivalent to the annual electricity consumption of countries such as Argentina. This energy consumption is mainly due to the use of specialized computer hardware, such as ASIC miners, which are designed to perform the calculations required to mine Bitcoin.

The high energy consumption of Bitcoin mining has raised concerns about its environmental impact, as much of the electricity used to power Bitcoin mining comes from non-renewable sources such as coal or natural gas. There are ongoing efforts to increase the use of renewable energy sources for Bitcoin mining, such as hydropower, wind power, and solar power.

It is important to note that the energy consumption of Bitcoin mining is not a fixed number and can vary depending on several factors, including the difficulty of the mathematical problems, the number of miners on the network, and the price of electricity in different regions.

Positives Of Bitcoin Mining

Bitcoin mining has been criticized for its high energy consumption and potential negative impact on the environment. Here are some potential positives of bitcoin mining on the environment:

Incentivizing

Renewable Energy: The high cost of electricity for Bitcoin mining may incentivize miners to use renewable energy sources such as wind, solar, or

hydropower. This could accelerate the adoption and development of renewable energy sources and decrease the reliance on non-renewable energy sources.

Utilizing Wasted Energy: Bitcoin mining can be done in locations where there is excess energy that would otherwise go to waste. For example, some Bitcoin mining

facilities are located near hydroelectric dams or oil fields where there is excess energy that can be used for mining. In these cases, bitcoin mining can help to utilize wasted energy that would otherwise not be used.

Innovation In Energy-efficient Technology: The high energy consumption of Bitcoin mining has led to innovation in energy-efficient hardware and cooling solutions. As a result, the development of more energy-efficient technology could have broader applications beyond Bitcoin mining and helping reduce energy consumption in other industries.

Economic Benefits: Bitcoin mining can provide economic benefits to regions with cheap electricity and a lack of other economic opportunities. For example, some rural areas in China have seen an influx of Bitcoin mining operations, which has created jobs and increased economic activity.

In conclusion, Bitcoin mining is a crucial process for maintaining the security and integrity of the Bitcoin network. It is also a highly energy-intensive process that has raised concerns about its environmental impact. Despite this, there are potential positive impacts of Bitcoin mining on the environment, including incentivizing renewable energy, utilizing wasted energy, and promoting innovation in energy-efficient technology.

Bitcoin mining can also provide economic benefits to regions with cheap electricity and limited economic opportunities. As the industry continues to evolve, efforts to increase the use of renewable energy sources and develop more energy-efficient technology will be important in reducing its environmental impact.

SOURCES:

“Bitcoin Mining Definition”

https://www.investopedia.com/terms/b/bitcoin-mining.asp

“ASIC Miner Value” https://www.asicminervalue.com/

“Bitcoin Mining Pools”

https://www.bitcoin.com/get-started/what-is-bitcoin-mining/

“Bitcoin Mining Pools: A Cooperative Game Theoretic Analysis”

https://www.avivz.net/pubs/15/fp245-lewenbergA.pdf

Cambridge Bitcoin Electricity Consumption Index: https://cbeci.org/

“A Closer Look at the Environmental Impact of Bitcoin Mining” https://coinshares.com/research/closer-look-environmental-impact-of-bitcoin-mining

“Bitcoin’s Energy Problem is Overblown”

https://www.coindesk.com/layer2/2022/02/16/bitcoins-energy-problem-is-overblown/