What Is Bitcoin Halving?

The bitcoin halving is an event that happens approximately every four years. It halves the reward for mining a block to ensure that the total number of bitcoins in circulation does not exceed 21 million, thus making bitcoin resistant to inflationary pressures.

Why Does Bitcoin Halving Occur?

The exact reasoning behind Satoshi Nakamoto’s decision to implement the bitcoin halving is not known, as the identity of Satoshi Nakamoto is still anonymous. However, the bitcoin halving is widely believed to have been designed as a key component of bitcoin’s monetary policy to create scarcity and prevent inflation. In the original bitcoin whitepaper, Satoshi Nakamoto stated that the total supply of bitcoin would be limited to 21 million coins. By gradually reducing the rate at which new coins are created through the halving process, the total supply of bitcoin is gradually approaching this limit, creating a low inflationary asset with a finite supply.

The gradual reduction in the rate of new bitcoin creation through the halving process is designed to mimic the process of mining for precious metals like gold, where the supply of new gold gradually dwindles over time. By creating scarcity and a finite supply, bitcoin is designed to be resistant to the inflationary pressures that can affect traditional fiat currencies.

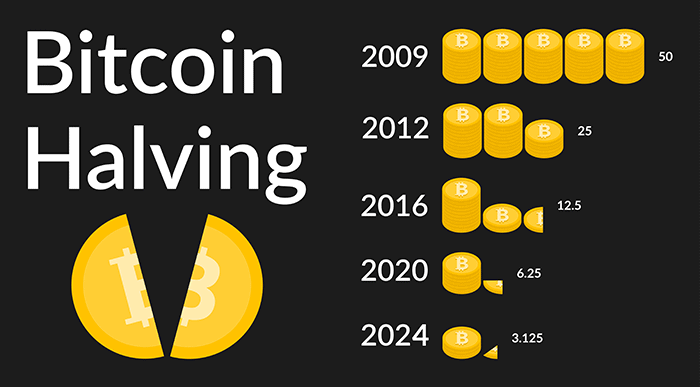

Past & Future Halvings

The most recent halving occurred on May 11, 2020. It reduced the block reward from 12.5 bitcoins to 6.25 bitcoins. Many people are anxiously awaiting the next halving in 2024, when the reward will be reduced from 6.25 to 3.125 bitcoins.

This process will continue until all 21 million bitcoins have been mined, which is expected to happen in the year 2140.

What Does The Halving Mean For Miners?

The bitcoin halving events have significant impacts on bitcoin miners. As the block reward is reduced in half, it becomes increasingly difficult for miners to earn the same amount of bitcoin they did before. This means that they need to increase their computing power and efficiency to stay profitable, or they risk being forced out of the market. The reduction in block rewards also means that miners must rely more heavily on transaction fees to make up for the decrease in revenue from block rewards.

The halving events can also lead to changes in the mining landscape. As smaller and less efficient miners are squeezed out of the market, larger and more professional mining operations may take their place. This can lead to further centralization of the mining industry, as smaller players may struggle to compete with larger and more well-funded operations.

Despite these challenges, many miners continue to see bitcoin mining as a lucrative investment opportunity, especially in the long term. As the supply of new bitcoins decreases due to the halving events, the price of bitcoin may increase, making mining a potentially profitable venture. Miners must be prepared to adapt to the changing market conditions and invest in the latest technology to remain competitive.

What Does The Halving Mean For The Bitcoin Price?

After fourteen years in existence, it is a well known fact that the halving has minted many new millionaires and billionaires. In their study of the relationship between halving events and the price of bitcoin, Michail G. Palaiothodoros and Apostolos-Paul N. Refenes (2021) state that “the bitcoin halving events have historically had a positive impact on the price of bitcoin, as they create a supply shock that leads to a decrease in the rate of new coins entering the market. This can drive up demand and create a scarcity-driven price increase, although other factors such as market sentiment, adoption, and regulation can also influence the price of bitcoin.” [1]

Richard Knight in his article “Bitcoin Halving Cycle – Making Millionaires,” said that “approximately a year before the halving the price of bitcoin starts to appreciate. Approximately a year after the halving, peak price is reached. The trend reverses, and the downtrend can last up to two years (until the cycle repeats).” [2]

The most recent bitcoin halving on May 11, 2020, is a good example of this. During that bull run, bitcoin rose to an all-time high of $63,789 on April 13, 2021. This occurred eleven months after the halving, which coincides with previous bull markets. Many traders and investors project that the bitcoin price will multiply by a factor of six to seven times from the 2022 low of $15,600.00.

It is important to note that past performance is not indicative of future results. It is well advised that investors should always conduct their own research and make informed decisions before investing in any asset.

Does The Halving Help Make Bitcoin An Alternative To Fiat Currencies?

As the block reward for miners is cut in half during each halving event, the creation of new bitcoins slows down, making it a deflationary asset with a finite supply. “This unique characteristic of bitcoin makes it an attractive alternative to traditional fiat currencies,” says Caitlin Long, founder of Custodia Bank. [3]

According to Long, the halving helps to control inflation which, means that the supply of bitcoin grows at a slower pace than fiat currencies. This helps to prevent the devaluation of bitcoin over time.

The transparency of the bitcoin halving can be seen as another positive attribute for those who value transparency and predictability in a monetary system. The pre-determined schedule of the halving and the fact that its information is publicly available provides greater transparency and assurance for investors and users of the currency. In contrast, traditional fiat currencies are subject to the discretion of central banks and governments, which can create uncertainty and unpredictability for investors and users. A good case of central bank unpredictability is the Federal Reserve Bank rapidly raising the fed funds rate by nearly five percentage points from 2022 to 2023.

The transparency and predictability of the bitcoin halving can be seen as a potential advantage for those who are looking to grow wealthy and want an alternative to fiat currencies.

To conclude, the halving is an important part of bitcoin’s monetary policy because it ensures that the supply of new bitcoins entering the market is gradually reduced over time. This helps to maintain the scarcity of bitcoin, which is one of the factors that contribute to its value. Additionally, the halving serves as an important signal to the market, reminding participants that the supply of bitcoin is limited and that its value is likely to increase over time as demand grows.

FOOTNOTES:

[1]Palaiothodoros, M. G., & Refenes, A. P. N. (2021). The impact of Bitcoin halving events on price formation: An ARDL approach. Finance Research Letters, 38, 101681.

[2]https://medium.datadriveninvestor.com/bitcoin-halving-cycle-making-millionaires-b0d64f6b665d

[3]https://www.youtube.com/watch?v=BtgMbqCZxzk”

SOURCES:

Bitcoin Wiki. (2021). Controlled supply. https://en.bitcoin.it/wiki/Controlled_supply

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. https://bitcoin.org/bitcoin.pdf

Yeh, M. (2021, May 11). Bitcoin halving 2020: Everything you need to know. Cointelegraph. https://cointelegraph.com/bitcoin-halving-2020

Taylor, C. (2021, January 13). What Is Bitcoin Halving? CoinJournal. https://coinjournal.net/what-is-bitcoin-halving/