Introduction

Cosmos is a visionary ecosystem of sovereign and compatible blockchains that aspire to create the “Internet of Blockchains”. These blockchains are built with the Cosmos SDK and run by the Tendermint consensus, enabling them to scale and interact with each other flawlessly. In this blog post, we will delve into the main characteristics and advantages of the Cosmos ecosystem, as well as some of the leading projects in terms of market cap, tokenomics, use cases and risks. Some of the projects we will examine over the course of the week are ATOM, the native token of the Cosmos Hub, CRO, the token of the EVM-compatible Cronos chain,among others. Keep reading for more insights into this fascinating and innovative ecosystem.

Overview

Cosmos is a visionary ecosystem of sovereign and compatible blockchains, called zones, each running by classical Byzantine fault-tolerant (BFT) consensus protocols like Tendermint (already employed by platforms like ErisDB). Some zones act as hubs with respect to other zones, allowing many zones to interoperate through a shared hub.

The architecture is a more general application of the Bitcoin sidechains concept, using classic BFT and Proof-of-Stake algorithms, instead of Proof-of-Work.Cosmos can interoperate with multiple other applications and cryptocurrencies, something other blockchains can’t do well. By creating a new zone, you can plug any blockchain system into the Cosmos hub and pass tokens back and forth between those zones, without the need for an intermediary.

While the Cosmos Hub is a multi-asset distributed ledger, there is a special native token called the atom. Atoms have three use cases: as a spam-prevention mechanism, as staking tokens, and as a voting mechanism in governance. As a spam prevention mechanism, Atoms are used to pay fees. The fee may be proportional to the amount of computation required by the transaction, similar to Ethereum’s concept of “gas”. Fee distribution is done in-protocol and a protocol specification is described here.

As staking tokens, Atoms can be “bonded” in order to earn block rewards. The economic security of the Cosmos Hub is a function of the amount of Atoms staked. The more Atoms that are collateralized, the more “skin” there is at stake and the higher the cost of attacking the network. Thus, the more Atoms there are bonded, the greater the economic security of the network. Atom holders may govern the Cosmos Hub by voting on proposals with their staked Atoms.

Background

Cosmos was founded by Jae Kwon and Ethan Buchman, who are also the co-founders and leaders of Tendermint Inc., the company that developed the core technology of Cosmos. They are both software engineers and entrepreneurs who have been actively involved in the cryptocurrency and blockchain communities for many years. They are joined by a team of developers, researchers, designers, and community managers who work on various aspects of the Cosmos project. The development of Cosmos is also coordinated by the Interchain Foundation (ICF), a Swiss non-profit organization that funds and supports the research and development of the Cosmos network and its ecosystem.

Cosmos was conceived in 2016, when Kwon and Buchman published the Cosmos whitepaper, which outlined the vision and architecture of the Cosmos network. In 2017, Cosmos raised almost $18 million across three token sales, and its mainnet went live in early 2019. Since then, Cosmos has achieved several milestones, such as launching the Inter-Blockchain Communication (IBC) protocol, which enables cross-chain communication and asset transfers, in March 2021; launching the Gravity DEX, a decentralized exchange that allows users to swap tokens across different blockchains, in May 2021; and launching the Emeris platform, a one-stop portal for accessing DeFi applications on the Cosmos network, in August 2021. Cosmos also hosts a variety of blockchains that cater to different use cases and sectors, such as Terra, Crypto.com, Binance Chain, Akash, and more.

Tokenomics

The Cosmos ecosystem has a native token called ATOM. It is used for different purposes on the network, such as securing, governing, and paying fees. It has the following tokenomics:

Supply: The total supply of ATOM is 268,020,000 tokens as of November 12, 2023. The supply can change over time depending on the inflation rate and the fees burned on the network.

Inflation: The inflation rate of ATOM is dynamic and adjusts according to the total staking ratio of the network. The higher the staking ratio, the lower the inflation rate, and vice versa. The inflation rate also affects the rewards for the validators and the delegators who stake their tokens to secure the network. The inflation rate ranges from 7% to 20% per year, with a target of 10% staking ratio.

Fees: ATOM is used to pay for the fees on the network, which are determined by the validators who set a minimum fee for their services. The fees are paid in the native tokens of each blockchain, or in any other tokens that are supported by the network. The fees are burned to reduce the token supply and create a deflationary pressure on the token.

Staking: ATOM holders can stake their tokens to contribute to the security and governance of the Cosmos Hub. They can delegate their tokens to validators, who run nodes and process transactions on the network. The validators and the delegators earn rewards in ATOM proportional to the amount of tokens staked and the inflation rate. The staking rewards are subject to a 21-day unbonding period, during which the tokens are locked and cannot be transferred or traded. The staked tokens are also subject to a slashing mechanism, which penalizes the validators and the delegators for malicious or faulty behavior, such as double-signing, downtime, or censorship.

Governance: ATOM holders can participate in the governance of the Cosmos Hub, by voting on proposals and changes that affect the network. The proposals can be related to the parameters, features, upgrades, or funding of the network. The voting power of each ATOM holder is proportional to the amount of tokens staked. The proposals require a quorum of 40% of the total voting power, a majority of 50% of the votes, and a veto threshold of 33.4% of the votes to pass.

ATOM is available across a number of major exchanges popularly Binance, Coinbase and OKEx and has a DEX score of 99.

Market Cap: $8,221,445,009

Circulating Supply: 292,304,426

Supply Cap: NIL

All Time High: $44.45 -36.5% Jan 17, 2022 (3 months)

All Time Low: $1.16 2333.8% Mar 13, 2020 (about 2 years)

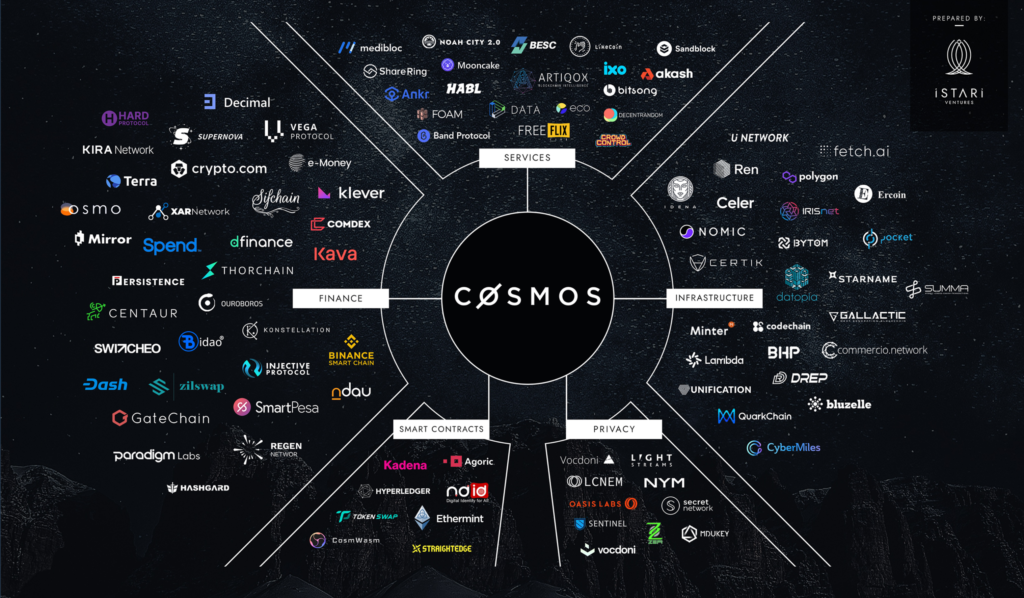

Ecosystem

The Cosmos ecosystem is a network of independent and interoperable blockchains that aim to create the “Internet of Blockchains”. It offers several benefits for both developers and users of blockchain applications, such as scalability, sovereignty, interoperability and innovation. The Cosmos ecosystem hosts a variety of blockchains that cater to different use cases and sectors, such as DeFi, NFTs, memes, and more. Here are some of the top performers in each sector, along with the top performing tokens in the ecosystem:

Decentralized finance (DeFi) is one of the most popular and promising sectors in the blockchain space, as it enables various financial services and applications without intermediaries or centralized control. Some of the popular DeFi platforms in the Cosmos ecosystem are:

Kava: Kava is a cross-chain DeFi platform that offers lending, borrowing, stablecoins, and yield farming services. It is powered by the KAVA token, which is used for staking, governance, and paying fees on the network. Kava has a market cap of $706.3 million and a price of $0.77 as of November 12, 2023.

Anchor: Anchor is a savings protocol that aims to provide a stable and attractive interest rate for deposits of Terra stablecoins. It is powered by the ANC token, which is used for staking, governance, and paying fees on the network. Anchor has a market cap of $45.7 million and a price of $0.01 as of November 12, 2023.

Osmosis: Osmosis is a decentralized exchange (DEX) that allows users to swap tokens across different blockchains using the IBC protocol. It is powered by the OSMO token, which is used for staking, governance, and paying fees on the network. Osmosis has a market cap of $331.9 million and a price of $0.53 as of November 12, 2023.

Non-fungible tokens (NFTs) are unique digital assets that can represent anything from art, music, games, collectibles, and more. They are verifiable, scarce, and tradable on the blockchain. Some of the popular NFT platforms in the Cosmos ecosystem are:

Crypto.com NFT: Crypto.com NFT is a platform that showcases exclusive content and collaborations from artists, celebrities, athletes, and brands. It is powered by the CRO token, which is also the native token of the Crypto.com ecosystem. Crypto.com NFT has a market cap of $2.37 billion and a price of $0.08 as of November 12, 2023.

Persistence: Persistence is a platform that enables the creation and exchange of NFTs that represent real-world assets, such as commodities, invoices, art, and more. It is powered by the XPRT token, which is used for staking, governance, and paying fees on the network. Persistence has a market cap of $50 million and a price of $0.27 as of November 12, 2023.

Juno: Juno is a platform that enables the creation and deployment of smart contracts and NFTs on the Cosmos network. It is powered by the JUNO token, which is used for staking, governance, and paying fees on the network. Juno has a market cap of $42.4 million and a price of $0.53 as of November 12, 2023.

Memes are humorous or ironic images, videos, or texts that are shared online for entertainment or social commentary. They are often used to express opinions, emotions, or trends. Some of the popular meme platforms in the Cosmos ecosystem are:

Chihuahua: Chihuahua is the first interoperable meme coin with a POS blockchain, making it one of the most utilized chains in the Cosmos ecosystem. It is powered by the HUAHUA token, which is used for staking, governance, and paying fees on the network. Chihuahua has a market cap of $79.6 million and a price of $0.00 as of November 12, 2023.

Kujira: Kujira is a meme coin that aims to provide liquidity and yield farming opportunities for the Cosmos ecosystem. It is powered by the KUJI token, which is used for staking, governance, and paying fees on the network. Kujira has a market cap of $400.2 million and a price of $3.41 as of November 12, 2023.

Terra Luna Classic: Terra Luna Classic is a meme coin that is a fork of the Terra blockchain, which collapsed in May 2021 due to a severe bug in its oracle system. It is powered by the LUNC token, which is used for staking, governance, and paying fees on the network. Terra Luna Classic has a market cap of $409.4 million and a price of $0.00 as of November 12, 2023.

The top four performing tokens in the Cosmos ecosystem by market cap are:

Cosmos Hub (ATOM): ATOM is the native token of the Cosmos Hub, the central blockchain that connects all the other blockchains in the network. It is used for staking, governance, and paying fees on the network. ATOM has a market cap of $3.44 billion and a price of $8.80 as of November 12, 2023.

Cronos (CRO): CRO is the token of the Cronos chain, a scalable and EVM-compatible blockchain that is connected to the Crypto.com ecosystem. It is used for staking, governance, and paying fees on the network. CRO has a market cap of $2.15 billion and a price of $0.08 as of November 12, 2023.

Injective (INJ): INJ is the token of the Injective chain, a fully decentralized and permissionless layer-2 DEX that supports trading of any asset, including derivatives, NFTs, and synthetic assets. It is used for staking, governance, and paying fees on the network. INJ has a market cap of $1.51 billion and a price of $17.89 as of November 12, 2023.

THORChain (RUNE): RUNE is the token of the THORChain, a cross-chain liquidity protocol that enables users to swap assets across different blockchains without intermediaries or custodians. It is used for staking, governance, and paying fees on the network. RUNE has a market cap of $1.1 billion and a price of $3.65 as of November 12, 2023.

Features and Functionality

- Scalability: The Cosmos ecosystem enables each blockchain to process its own transactions without affecting the performance of the other blockchains. This lowers the congestion and the fees on the network, and allows for fast and efficient applications.

- Sovereignty: The Cosmos ecosystem allows each blockchain to have its own governance, economics and applications. This gives the developers and the users more control and customization over their blockchains according to their needs and preferences.

- Interoperability: The Cosmos ecosystem enables the blockchains to communicate and transfer assets with each other and with other blockchain networks. This creates a network effect and a larger market for the blockchain applications and services.

- Innovation: The Cosmos ecosystem enables the developers to use the existing modules and tools from the Cosmos SDK or create their own to build their blockchains. This fosters innovation and experimentation in the blockchain space.

Risks and Challenges

The Cosmos ecosystem is a network of independent and interoperable blockchains that aim to create the “Internet of Blockchains”. It offers several benefits for both developers and users of blockchain applications, such as scalability, sovereignty, interoperability and innovation. However, it also faces some risks and challenges, such as:

Validator centralization: The Cosmos ecosystem relies on a limited number of validators to secure the network and process the transactions. This creates a risk of validator centralization, where a few validators control a large portion of the network’s stake and power. This could lead to censorship, collusion, corruption or attacks on the network. To mitigate this risk, the Cosmos ecosystem encourages decentralization and diversity of validators, by allowing anyone to run a validator node, providing incentives for delegators to choose smaller validators, and implementing a slashing mechanism to penalize malicious or faulty behavior.

Governance disputes: The Cosmos ecosystem allows for each blockchain to have its own governance system, where the token holders can vote on proposals and changes that affect the network. This creates a risk of governance disputes, where different blockchains or stakeholders may have conflicting interests or opinions on the network’s direction and development. This could lead to forks, splits, stagnation or fragmentation of the network. To mitigate this risk, the Cosmos ecosystem fosters collaboration and coordination among blockchains, by providing a common framework for governance, enabling cross-chain communication and voting, and supporting community-driven initiatives and projects.

Interoperability challenges: The Cosmos ecosystem enables cross-chain communication and asset transfers, where the blockchains can exchange data and value with each other and with other blockchain networks. This creates a risk of interoperability challenges, where different blockchains or networks may have incompatible or inconsistent standards, protocols, formats or rules. This could lead to errors, delays, losses or frauds on the network. To mitigate this risk, the Cosmos ecosystem adopts a standardized and secure protocol for interoperability, called the Inter-Blockchain Communication (IBC) protocol, which ensures the validity and finality of the data and assets transferred across blockchains.

Conclusion

In conclusion, the Cosmos ecosystem is a network of independent and interoperable blockchains that aim to create the “Internet of Blockchains”.

It offers several features and advantages for both developers and users of blockchain applications, such as scalability, sovereignty, interoperability and innovation. It also hosts a variety of blockchains that cater to different use cases and sectors, such as ATOM, CRO and LUNA. However, it also faces some risks and challenges, such as validator centralization, governance disputes and interoperability challenges. The Cosmos ecosystem is still evolving and growing, and it has the potential to become one of the most influential and impactful projects in the blockchain space.

Sources

https://cosmos.network/https://www.okx.com/learn/what-is-cosmos

https://medium.com/functionx/what-is-the-cosmos-ecosystem-6f0c76412223

https://cosmos.network/ecosystem/apps/

https://www.coindesk.com/business/2020/08/10/cosmos-founding-team-broke-up-early-this-year-the-project-didnt/

https://cosmos.network/intro/https://beincrypto.com/learn/cosmos-crypto-guide/

https://medium.com/@beehive.validator/list-of-nft-projects-in-the-cosmos-ecosystem-d7a7438b7e15

https://www.coingecko.com/en/categories/cosmos-ecosystem

https://www.cryptoeq.io/corereports/cosmos-abridged

https://www.fxstreet.com/cryptocurrencies/news/circle-to-launch-usdc-stablecoin-on-cosmos-via-noble-network-202303282337

https://cryptodaily.co.uk/2022/10/critical-vulnerability-puts-entire-cosmos-ecosystem-at-risk